When you pivot in basketball you have full control of the ball and the future outcomes. A pivot can be an effective tool in changing the course of your controlled direction and helping eventually score. But if you lose the ball you don’t get the opportunity to pivot. You instead have to backpedal and get back on defense to make up for your mistake. Many people these days are talking about a Fed “pivot”. This idea that they will alter their rate of change in interest rates and manage...

Read More »Three Things I Think I Think – Cramer, The Economics of Home Runs & The Bear Market

Here are some things I think I am thinking about: 1) The Jim Cramer ETFs. A firm has launched a set of inverse and long Jim Cramer ETFs. The basic gist of the funds is to be able to piggyback on the view that Jim Cramer is a great investor or a good contrarian indicator. I don’t know what I actually think I think about this. Part of me hates these gimmicky style funds that prey on people’s emotions. And another part of me says that people should be allowed to buy whatever they want...

Read More »Three Things I Think I Think – Some Weekend Reading

Here are some things I am thinking about heading into the weekend. 1) Balancing Intrinsic and Extrinsic goals to achieve happiness. Adam Grant posted this wonderful paper discussing intrinsic and extrinsic goals relative to overall happiness. In short, intrinsic goals are things like relationships, community and health. They’re things that you can measure based on your own subjective views. Extrinsic goals are things like wealth, fame and beauty. They are measured by other people’s...

Read More »Housekeeping: Email Subscription Updates

Just a quick note here in case you noticed the new email subscription feed. Google recently killed Feedburner so we moved everything over to FollowIt. We were informed that the format was ugly and had to alter the format of the emails so hopefully they look a little cleaner going forward. You don’t need to do anything except continue to enjoy our extremely nerdy content. I hope everyone is hanging in there. I know it’s been a brutal year. Stay disciplined! Please follow and like us:...

Read More »Will the Fed Overtighten and Crash the Global Economy?

Is the Federal Reserve tightening policy too far and too fast? In this video we discuss how the monetary policy transmission mechanism works, how it’s impacting the global economy today and whether it might be starting to break things. In this video you’ll learn about how monetary policy can filter through the economy and why the Fed’s interest rate moves are having such a big impact on housing and global currency markets. Some helpful links: 1) Will the surging dollar crash the...

Read More »Three Things I Think I Think – It’s Breaking

Here are some things I think I am thinking about. 1. T-Bills at 4% are a screaming deal. Back in another life when I ran my hedge fund I was unknowingly taking advantage of the overnight equity premium phenomenon. That is, I was never exposed to daytime moves. So I was invested in an event driven equity position overnight and had no directional daytime exposure. The goal was to get pure event exposure. The strategy was magical until correlations went to 1 during the financial crisis,...

Read More »Everything Investors Need to Know About the Federal Reserve

Here’s a good podcast I did earlier this month about Monetary Policy and the Federal Reserve. Jack and Justin are great friends of mine and run an excellent podcast called Excess Returns. Please check it out if you haven’t already. There has been a lot of debate about Federal Reserve policy in the wake of the pandemic. But many of those involved in that debate want to promote a specific position and interpret the facts in a way to accomplish that goal. In this episode, we wanted to...

Read More »Will the Surging Dollar Crash the Global Economy?

Here’s a new 3 Minute Money. In this video I discuss the implications of the surging US Dollar: Why is the USD surging despite rising inflation? What does this signal about the global economy? What does this mean for Federal Reserve policy? I hope you learn something and enjoy the video. [embedded content] About Post Author ...

Read More »Debunking Common Investment Myths

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short and sweet at just over 30 minutes. We covered a lot of ground and Daniel is a great host. Check out his podcast here. Tune in to hear: – What is “all duration investing” and what behavioral upside might this approach have for investors? – How can you better organize a bucketing...

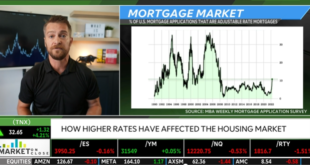

Read More »TD Ameritrade Interview – My Outlook on Housing

I joined Oliver Renick on TD Ameritrade Network last Friday to discuss the housing market and some of my recent comments from the newest Three Minute Money video. In short: Interest rates over 6% creates an unaffordability problem that is likely to put downward pressure on prices as demand dries up and supply increases. This isn’t a 2008 repeat, however, because you won’t have the low quality adjustable rate borrower being forced to panic sell.We’re also unlikely to see a financial...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism