Share the post "Today in Scary Financial Media: “Apocalypse now”" Here’s something to scare the pants off of you. According to what seems to be a daily article in the financial media about the next financial crisis, it’s “apocalypse now”. Go have a laugh or cry, I mean read. My thoughts: Yes, the next big crash is always right around the corner according to the financial media who is just dying to get your attention and page views however possible….They’ll be right eventually and it...

Read More »Private Sector Saving is Not Saving Net of Investment

Share the post "Private Sector Saving is Not Saving Net of Investment" I’m highly sympathetic to Post-Keynesian economic perspectives. Post Keynesians generally prefer to work from an operational perspective so there is a strong influence on how the economy works at an operational level which includes a fairly thorough understanding of stock flow consistent accounting. As I like to say, accounting is the language of economics so it’s pretty important to get the accounting right if you’re...

Read More »A Bull Market Built on Endless Financial Crisis Fears

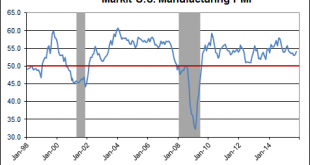

Share the post "A Bull Market Built on Endless Financial Crisis Fears" The seven year bull market in stocks hasn’t been a story about how great things are. Let’s be honest – the economy is still pretty weak. But this bull market in stocks has been more about how wrong the bears have been. The thing is, stocks don’t rise just because the economy is getting better. They often rise just because the economy is getting better relative to expectations. And in the last few months a lot of...

Read More »Natural Nonsense – Why The Natural Rate of Interest is a Distraction

Share the post "Natural Nonsense – Why The Natural Rate of Interest is a Distraction" The “natural rate of interest” is a theoretical concept in economics that describes the interest rate at which the economy operates at full employment with stable inflation. If this price actually exists and economists can calculate it then that would be a pretty important number to know when implementing policy. Of course, it’s a totally vague concept to begin with because there isn’t just one interest...

Read More »Life Lessons From Doing a Full Ironman

Share the post "Life Lessons From Doing a Full Ironman" It’s been a week since I competed in Ironman Cabo and my body and mind are finally feeling back to normal. The Ironman is aptly named as it’s a 2.4 mile swim followed by a 112 mile bike and then a 26.2 mile run. It takes the best competitors in the world about 9 hours to complete while most people finish in 12-15 hours. It took me 16 hours thanks to my lack of endurance athleticism, a set of unfortunate race occurrences and what...

Read More »The Real Tragedy of the Crisis was Congress, not the Federal Reserve

Brad Delong has written a piece in Project Syndicate that I find to be unfairly critical of Ben Bernanke. Specifically, Delong writes: “In 2000, Bernanke had argued that a central bank with sufficient will could “always,” in the medium term at least, restore full prosperity via quantitative easing. If a central bank printed money and bought financial assets on a large-enough scale, people would begin to step up their spending. “ I don’t think this is quite true though. In a 2002 speech,...

Read More »The Fed is Navigating Global Uncertainty Well (So Far)

Today’s FOMC statement left rates unchanged, but the focus is on the removal of the section on global uncertainty. If you recall during the last meeting there was a good deal of focus on emerging markets and global uncertainty. And rightly so. No one, and I mean no one, knew how China’s economic weakness was going to filter through the world. At points it looked like we could be on the verge of a 2008 repeat. The Fed responded in a very prudent manner by keeping rates unchanged and...

Read More »A Different Kind of Mexican Hangover….

Sorry for the radio silence over the last few days, but I spent my weekend competing in the Ironman Cabo event. It was a torture fest in 90 degree weather across 2.4 miles of ocean, 112 miles of biking (oh, with 7500 feet of climbing – that’s about a quarter of Mt Everest for those keeping tabs) and then we ran (well, walked a lot in my case) a marathon. It looks like 35-40% of the field didn’t finish and I only made the cutoff time by an hour or so (16 hours). So let’s just say I’m...

Read More »5 Myths About US Government Debt

Just passing along a very good piece from analysts at JP Morgan on myths about US government debt. These will all sound familiar to regular readers, but it’s important to emphasize given the fears in the mainstream media and the upcoming debt ceiling debate. US government bonds have been tremendous performers over the last 20 years even as many of these myths have grown in popularity. Unfortunately, these myths keep many investors from allocating assets to this important asset class. Go...

Read More »Creating Demand out of “Thin Air”

Michael Pettis has a post about endogenous money in which he challenges the idea that banks and governments can create demand from “thin air”. This is a concept that has grown in great popularity over the years thanks in large part to internet discourse, but it’s also become quite confused at times due to differing views on endogenous money. Pettis does a nice job covering much of that confusion which stems from the way Steve Keen has depicted the ideas over the years. I like Keen and...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism