This talk covers all "the usual suspects" for me--the Neoclassical obsession with equilibrium, financial instability, the Loanable Funds myth and the reality of Endogenous Money, and the foolishness of governments trying to run a surplus as if they are households, when the better analogy is that they are banks and should run deficits to create part of the money supply the non-bank private sector needs.[embedded content] Click here to download the Powerpoint file (Minsky files are embedded...

Read More »Lecture 2 in “Becoming an Economist” at Kingston University

Becoming an Economist is the introductory course on economics for undergraduates at Kingston University. This is the second of 11 lectures in the subject; I’ll post the others as I write them over the next few months. This lecture discusses why the Mainstream approach, starting from the fundamental question Walras posed "Can a system of free markets reach a set of prices that ensures that supply equals demand in all markets?" The answer was "No", but that didn't stop the...

Read More »Call for papers for new journal on private debt

The Private Debt Project (this website will become active as of December 2015) invites proposals for articles, papers, and research notes related to the study of private debt and its relationship to economic growth and financial stability. The Project will provide honorarium for all published work. In cases involving papers with original research, it will also consider small research grants to help cover the cost of the research. Commissioned articles, papers, and...

Read More »Fellowship for economic journalism

The Friends Provident Foundation has just established a Fellowship for UK journalism to produce a “a significant work of long form journalism in any medium on the theme of building resilient economies.” I’ve copied the full press release below. For further details, click on this link. The full press release is copied below. Journalist Fellowship 2016 The Foundation’s trustees have created a journalist fellowship to build a better understanding of economics in...

Read More »Lecture 1 in “Becoming an Economist” at Kingston University

Becoming an Economist is the introductory course on economics for undergraduates at Kingston University. This is the first of 11 lectures in the subject; I’ll post the others as I write them over the next few months. This lecture discusses why economists disagree with each other, and draws analogies with astronomy at the time when Galileo discovered craters on the Moon, and moons orbiting Jupiter and Saturn. [embedded content] This is the Powerpoint file for the...

Read More »Talking Interest Rates with Phil Dobbie

One of the people I miss talking with in Australia is radio journalist and tech and internet expert Phil Dobbie. Fortunately there’s Skype, and we regularly now chat matters economic on his internet radio show Balls Radio. Here’s the latest complete program, including our discussion of why interest rates are so low and are not going to move up until the level of private debt falls dramatically–which is unlikely to happen. [embedded content]

Read More »Discussing the UK with Simon Rose on Share Radio

One of the very enjoyable aspects of being in London is speaking regularly with Simon Rose on the business-oriented internet radio Share Radio. I know I can talk under wet cement; I think Simon could manage to talk after it had set solid. We have a great time bantering about topics economics, and I hope it's of interest to the audience as well. Here's the latest installment, with some earlier ones available here. [embedded content] This blog has been verified by Rise:...

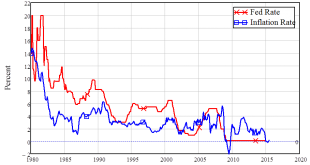

Read More »Should The Fed Raise Rates?

For seven years now, the rate The Fed sets to determine the price banks pay to borrow from it and from each other has been zero, or so close to zero that the difference is immaterial. This is, historically speaking, not normal, and The Fed has a desperate desire to return to what is normal, which is rate a few per cent above the rate of inflation (see Figure 1). Click here to read the rest of this post.

Read More »Critical Realism & Mathematics versus Mythematics in Economics

This is the brief talk I gave at a conference celebrating 25 years of the Critical Realist seminar series at Cambridge University. Critical realists argue against the use of mathematics in economics; I argue here that it's the abuse of mathematics by Neoclassical economists--who practice what I have dubbed "Mythematics" rather than Mathematics--and that some phenomena are uncovered by mathematical logic that can't be discovered by verbal logic alone. I give the example of my own model of...

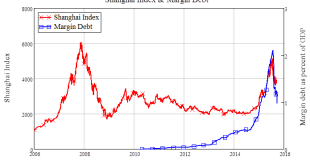

Read More »Why China Had To Crash Part 2

One thing my 28 years as a card-carrying economist have taught me is that conventional economic theory is the best guide to what is likely to happen in the economy. Read whatever it advises or predicts, and then advise or expect the opposite. You (almost) can’t go wrong. Click here to read the rest of this post.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch