In a recent post, I pointed out that long-term (30 year) real interest rates on safe (AAA) bonds had fallen to zero, and suggested that this meant the end of capitalism, at least in the sense that the term was understood in classical economics. On the other hand, stock markets have been doing very well. So what is going on? This is a complicated story and I’m still working it out,An important starting point is the fact that the most profitable companies, particularly tech companies, don’t have all that much in the way of capital assets compared to their market value. What they have is monopoly power, which has been increasing steadily over time. That benefits those who already own and control these firms, but it does not provide new investment opportunities. I’ll start by looking

Topics:

John Quiggin considers the following as important: Economic Consequences of the Pandemic

This could be interesting, too:

John Quiggin writes The financial sector after the pandemic

John Quiggin writes The Scrooge McDuck theory of the rich

John Quiggin writes Sloppy thinking about vaccine mandates

John Quiggin writes Economic policy after the pandemic

In a recent post, I pointed out that long-term (30 year) real interest rates on safe (AAA) bonds had fallen to zero, and suggested that this meant the end of capitalism, at least in the sense that the term was understood in classical economics. On the other hand, stock markets have been doing very well. So what is going on? This is a complicated story and I’m still working it out,

An important starting point is the fact that the most profitable companies, particularly tech companies, don’t have all that much in the way of capital assets compared to their market value. What they have is monopoly power, which has been increasing steadily over time. That benefits those who already own and control these firms, but it does not provide new investment opportunities.

I’ll start by looking at price-to-book ratios. Alphabet, which owns Google has a market value five times the book value of its assets https://www.macrotrends.net/stocks/charts/GOOG/alphabet/price-book The ratio is 15 for Microsoft and 21 for Apple. By contrast, for General Motors, the classic 20th century corporation, it’s just under 1.

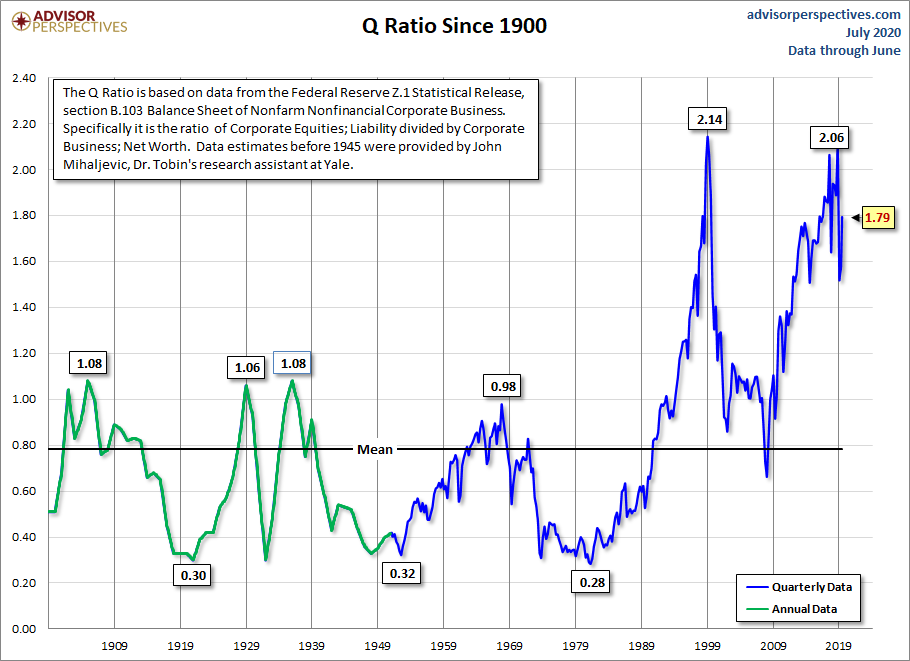

For the corporate sector as a whole, the comparable measure is Tobin’s q ratio, which has been trending upwards since the late 1970s and is now near the all-time high reached during the dotcom bubble.

The value of companies like Apple, Google and Microsoft is made up primarily of “intangibles”. That term can cover all sorts of things, and is often taken to refer to some special aspect of the firm in question, such as accumulated R&D, tacit knowledge or ‘goodwill’ associated with brands.

R&D is at most a small part of the story. The leading tech companies spend $10 – 20 billion a year each on R&D https://spendmenot.com/top-rd-spenders/, a tiny fraction of market valuations of $1 trillion or more. And feelings towards most of these companies are the opposite of goodwill – more like resentful dependence in most cases.

A simpler explanation is that the main intangible asset held by these companies is monopoly power, arising from network effects, intellectual property, control over natural resources and good old-fashioned predatory conduct.

In this context, the crucial point about intangibles isn’t that they aren’t physical, it’s that they can’t be reproduced by anyone else. No one can sell a Windows or Apple operating system, even if they were willing to invest the effort required to reverse-engineer it. While there are competitors for the Google’s search engine (I recommend DuckDuckGo), there are huge barriers to entry, notably including the fact that the product is ‘free’ or rather supported by advertising for which all consumers pay whether they use Google or not.

There’s a complicated relationship here between the rise of monopoly and the development of the information economy in which the top tech firms operate. Information is the ultimate ‘non-rival’ good. Once generated by one person it can be shared with anyone else without diminishing in value. As the cost of communication has fallen, it’s become possible for everyone in the world to gain access to new information at essentially zero cost.

What this means is that there is very little relationship between the value of information and the ability of corporations to capture value from it. The protocols and languages that make the Internet possible are a public good, created by collaborative effort and made freely available. The information on the Internet is generated by households, business and governments using these protocols. Without these public goods, Google would be worthless. But because advertising can be attached to search results, ownership of a search engine is immensely profitable.

In turn, this means that traditional ideas about capital and investment are largely irrelevant in the information economy. More on this soon, I hope.