In this post, I want to get a sense of foreign exchange crises since 2008. The data that I am using is taken from the World Bank. It is not perfect. It is a bit spotty and could be improved upon. It is also annual data, so it will not pick up intrayear crises. But it is solid enough that it should give us a good first cut on the dynamics of foreign exchange crises. The first question to ask is simple enough: how many foreign exchange crises were experienced in this time period? For our purposes, we will define a foreign exchange crisis as any time a currency fell by 15% or more in a single year. Here are the number of such crises in every year since 2008. The next feature we want to explore is whether these crises were resolved or not. A foreign exchange crisis is – in

Topics:

Philip Pilkington considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

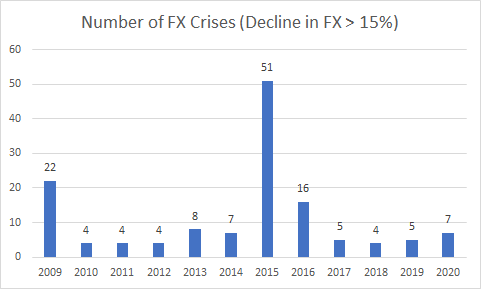

In this post, I want to get a sense of foreign exchange crises since 2008. The data that I am using is taken from the World Bank. It is not perfect. It is a bit spotty and could be improved upon. It is also annual data, so it will not pick up intrayear crises. But it is solid enough that it should give us a good first cut on the dynamics of foreign exchange crises.

The first question to ask is simple enough: how many foreign exchange crises were experienced in this time period? For our purposes, we will define a foreign exchange crisis as any time a currency fell by 15% or more in a single year. Here are the number of such crises in every year since 2008.

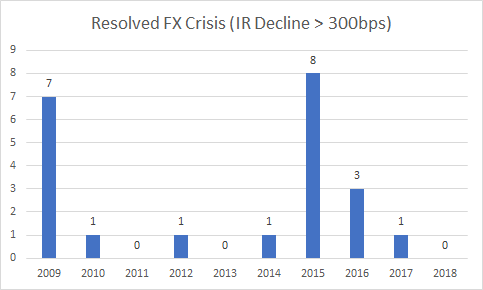

The next feature we want to explore is whether these crises were resolved or not. A foreign exchange crisis is – in developing countries at least – accompanied by a sharp rise in interest rates. Central banks often do this because the foreign exchange collapse triggers inflation. The policy has the additional benefit – although I would say the primary benefit – of attracting foreign capital to prop up the exchange rate.

In a country that gets its foreign exchange crisis under control, this interest hike should be a temporary phenomenon. After a year or two, the currency should stabilise and inflation should fall. The interest rate can then be lowered to allow domestic economic activity to pick back up at the new equilibrium exchange rate.

To detect this we will take each foreign exchange crisis and see by how much interest rates fell two years after this crisis. So, a strong positive reading indicates that the crisis was resolved and interest rates fell over the next two years. While a strong negative reading indicates that the crisis worsened and the country had to keep raising interest rates to get the currency and inflation under control.

We can also plot the number of succesful resolutions by year. We define this as any country that saw interest rates decline by 300bps in the subsequent two year period.

This is a very different looking chart to the overall number of exchange rate crises. Between 2008 and 2018 there were a total of 125 exchange rate crises using our definitions. In this time period only 22 of them were resolved in a resoundingly successful way.