Recently I have been looking at whether inflation might be in the pipeline. The jury is still out on that, but caution would be wise given the current situation. That leads to a rather obvious question: what should investors do during an inflation? First off, if we are to be naive stock investors, how much does inflation impact stock market returns? We can see the impact in the following chart. But this chart simply does not capture the pain investors feel during proper inflations. In order to get a sense of this, let’s zoom in on the ‘decade of hell’ – the inflation period 1972-82. As we can see, basically all of investors’ nominal stock market gains were wiped out during this inflation. Were there alternatives? Many will point to commodities and their derivatives.

Topics:

Philip Pilkington considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Recently I have been looking at whether inflation might be in the pipeline. The jury is still out on that, but caution would be wise given the current situation.

That leads to a rather obvious question: what should investors do during an inflation?

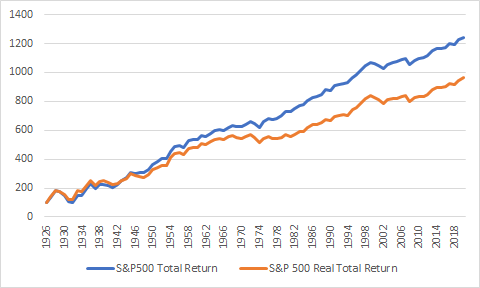

First off, if we are to be naive stock investors, how much does inflation impact stock market returns? We can see the impact in the following chart.

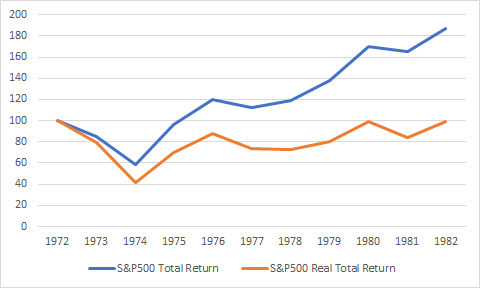

But this chart simply does not capture the pain investors feel during proper inflations. In order to get a sense of this, let’s zoom in on the ‘decade of hell’ – the inflation period 1972-82.

As we can see, basically all of investors’ nominal stock market gains were wiped out during this inflation.

Were there alternatives? Many will point to commodities and their derivatives. I think that this is misleading because, in large part, the 1970s inflation was driven by rising commodities prices. There is no guarantee that inflations will always be accompanied by rising commodities prices.

Okay, so let’s just stick to really basic alternatives. What do they look like? Here are real returns by asset class sorted for various rates of inflation (and including the ‘decade of hell’).

Faced with this, the S&P500 looks like a pretty good bet.

So, if we abstract from alternative asset classes, do we just have to sit content with either low or stagnant stock market returns? Maybe not. There is a chance that we could juice them a little by chasing factors.

The following measures what might be called ‘factor enhancement’. That is, the ratio of the average factor component in a given inflationary regime relative to the total factor average over the whole time series. So, any reading above 1 indicates that the factor is ‘enhanced’ in a given inflationary regime.

Interestingly, even at a first cut, it appears that utilising factors during high inflations may be enough to juice a portfolio. Momentum (Mom) and value stocks (HML) seem to be pretty good bets during inflation; while small caps (SMB) have their day in the sun in very high and moderate inflation.

During the ‘decade of hell’ tilting your portfolio toward the three factors could have substantially eased the pain of low returns.