Theresa May confirmed yesterday that a whopping £10bn more would be earmarked for Help to Buy. Under this scheme, the government lends buyers of new-build homes a 20% equity loan so that they only need a 75% mortgage and a 5% deposit. May said this huge injection of funding would help the ‘just about managing’. But evidence from the scheme to date suggests that it is more likely to help those on higher incomes than struggling young renters. Here are four reasons why Help to Buy should be scrapped, not extended: 1. Nearly a fifth of those who have used Help to Buy to date are not first-time buyers. 2. In 2015/16, a typical household using Help to Buy had a household income of £44,000, compared to the national average of £25,000. Source: DCLG, HBAI In fact, at

Topics:

neweconomics considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Theresa May confirmed yesterday that a whopping £10bn more would be earmarked for Help to Buy. Under this scheme, the government lends buyers of new-build homes a 20% equity loan so that they only need a 75% mortgage and a 5% deposit. May said this huge injection of funding would help the ‘just about managing’.

But evidence from the scheme to date suggests that it is more likely to help those on higher incomes than struggling young renters. Here are four reasons why Help to Buy should be scrapped, not extended:

1. Nearly a fifth of those who have used Help to Buy to date are not first-time buyers.

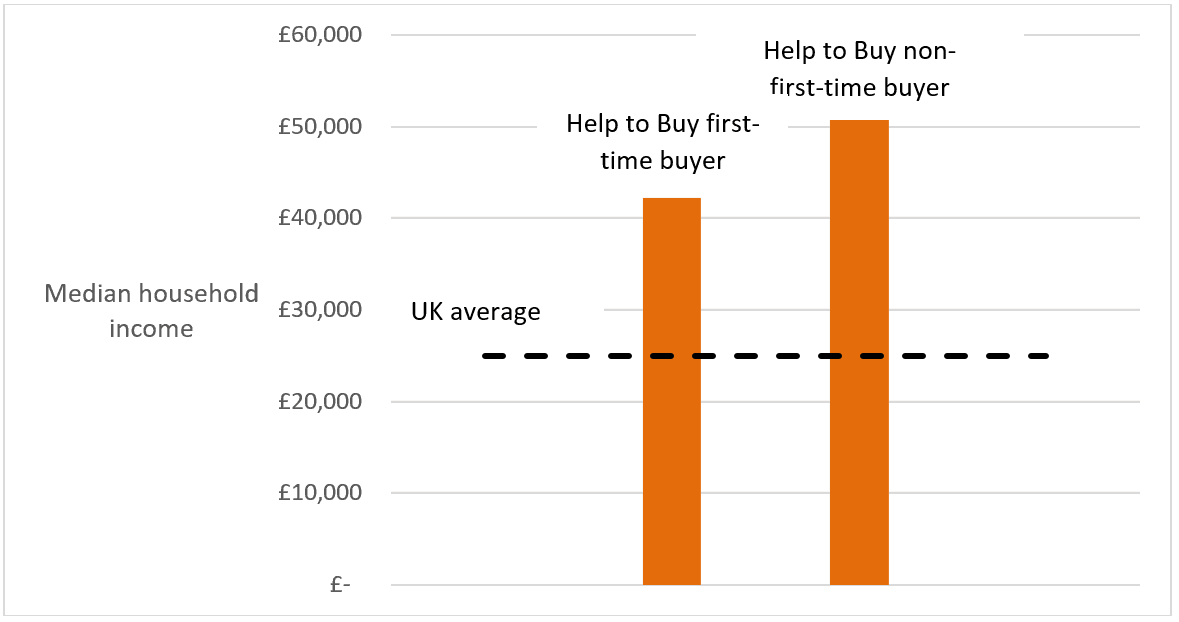

2. In 2015/16, a typical household using Help to Buy had a household income of £44,000, compared to the national average of £25,000.

Source: DCLG, HBAI

In fact, at least 84% of those who have used Help to Buy to date have an above average household income.

3. The government’s own evaluation published last year showed that over half of those who had used Help to Buy could have bought a similar home without it, and 9% could have bought the exact same home they moved into without support.

4. Based on previously announced funding plans an additional £10bn for Help to Buy means 87% of all government financial support for housing will go to propping up the private sector, with only 13% going to affordable housing providers.

This includes £3bn of loans and £4bn of grants for private developers, £12bn of remaining potential guarantees under the (thankfully) finished Help to Buy Mortgage scheme, and £4.2bn spent topping up buyers’ savings through Help to Buy and Lifetime ISAs.

This is not only a potentially unfair use of government funds but bad economics. If Help to Buy is used by people who are likely to be able to afford a home anyway, this simply means more money chasing the same number of homes and higher prices. Developers and their shareholders reap the benefits: the announcement of yet more funds for Help to Buy caused developer shares to jump by 2-4%.

The policy is less a leg-up for young renters and more a bailout for a broken speculative model of housing supply.

The policy is less a leg-up for young renters and more a bailout for a broken speculative model of housing supply. Moreover, Help to Buy-fuelled demand is a highly addictive drug for speculative developers.

Developers bid for land based on what they think they can get for the houses they intend to build on it. Help to Buy by definition allows households to spend more than they otherwise could on buying a home, pumping up demand for new homes and the amount that developers can expect to fetch for each unit. Developers who take a chance on the policy continuing put in higher bids for land, squeezing out others. If the policy stops abruptly, these developments built could become unviable and building could falter.

Propping up speculative development by indefinitely boosting housing demand is a potentially bottomless pit. The government had already earmarked £12.5bn for Help to Buy and loaned out £6.7bn. A much better solution is to stop our overreliance on speculative development by getting land into the hands of those who will build homes that people can actually afford. At NEF we are working with community-led schemes that aim to do that – look out for our new campaign launched later this week.