This is the second in a series of blog posts on financing infrastructure assets.

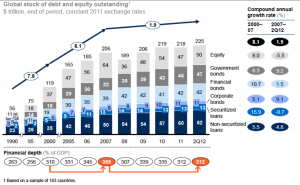

From 1990 to 2012, the stock of global financial assets increased from $56 trillion to $225 trillion. In 2012, it included a $50 trillion stock market, $47 trillion public debt securities market, $42 trillion in financial institution bonds outstanding, $11 trillion in non-financial corporate bonds, and $62 trillion in non-securitized loans and $13 trillion in securitized loans outstanding (Figure 1).

Figure 1. Stock of Global Financial Assets (USD trillion)

Source: Lund et al. 2013, p. 2

From 2007 to 2012, government debt securities increased by 47 percent (Figure 1) while financial depth rose to 355 percent of global GDP in 2007 from 120 percent in 1980 (Lund et al. 2013: 2). In spite of a massive