A new sandpit for long side discussions, conspiracy theories, idees fixes and so on. To be clear, the sandpit is for regular commenters to pursue points that distract from regular discussion, including conspiracy-theoretic takes on the issues at hand. It’s not meant as a forum for visiting conspiracy theorists, or trolls posing as such. Like this:Like Loading...

Read More »Monday Message Board

Back again with another Monday Message Board. Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please. If you would like to receive my (hopefully) regular email news, please sign up using the following link http://eepurl.com/dAv6sX You can also follow me on Twitter @JohnQuiggin, at my Facebook public page and at my Economics in Two Lessons page Like this:Like Loading...

Read More »Quiggin Out MMa Podcast Epi 30 featuring the MMA prediction rapper, Tovaun Anthony!

The Quiggin Out MMA Podcast is here with episode 30 and features a one of kind man , the "MMA Prediction Rapper", Tovaun Anthony! In this episode, Anthony and I discuss his martial arts background, his love for the sport, and how a one-off crazy idea took off and is now making waves inside the MMA community, including having MMA media, like James Lynch, involved in his UFC 259 fight predictions video. For those who don't know, Anthony breaks down fight cards as a full fledged...

Read More »The Economic Consequences of the Great War

A draft of the first chapter of my book, The Economic Consequences of the Pandemic. Comments, criticism and congratulations all welcome. Share this:Like this:Like Loading...

Read More »Fifty miles of wall

That’s the only lasting policy achievement of Trump’s Presidency. But for his brand of grievance politics, losing is winning. Share this:Like this:Like Loading...

Read More »On economics, America has moved left

That’s the headline for my latest piece in Inside Story, covering the Biden rescue package. Share this:Like this:Like Loading...

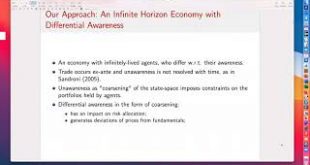

Read More »John Quiggin (UQ) – 03 Mar 2021

Financial Market Equilibrium with Bounded Awareness

Read More »Monday Message Board

Back again with another Monday Message Board. Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please. If you would like to receive my (hopefully) regular email news, please sign up using the following link http://eepurl.com/dAv6sX You can also follow me on Twitter @JohnQuiggin, at my Facebook public page and at my Economics in Two Lessons page Like this:Like Loading...

Read More »Energy return: ratio or net value (revised)

Quite a while back we had a discussion of the idea of Energy Return On Energy Invested (EROEI) as a measure of the viability of solar and wind energy. I did the numbers for solar (including battery backup) and came to the conclusion that EROEI was at least 10 and therefore not a problem. The issue has come up in an email discussion I’ve been having. Thinking about it, I concluded that using a ratio of energy generated to energy invested is incorrect. As a starting point, I assume...

Read More »Too many choices

In the NY Times, Paul Krugman makes the case that too much choice (particularly about retirement investment) can be bad Ani Guerdjikova and I demonstrate this with lots of algebra Share this:Like this:Like Loading...

Read More »