The 2018 PEF Student Essay Contest is open! The deadline for submitting essays is quickly approaching: April 30, 2018. Please use this submission form (fiche d’inscription concours). You can download a poster (English , Francais) here — please help us out and post one in your department. 2018 PEF ESSAY CONTEST RULES ELIGIBILE ENTRANTS? Open to all Canadian students, studying in Canada and abroad, as well as international students presently studying in Canada. All entrants receive a...

Read More »A Tale of Two Books

Just published is Volume I of an exhaustive – occasionally exhausting – biography of Paul Samuelson. It’s titled Founder of Modern Economics: Paul A Samuelson Vol I: Becoming Samuelson, 1915-1948 and authored by Roger E Backhouse. The two books of my blog title are Foundations of Economic Analysis, published in 1947, a revision of Samuelson’s Harvard doctoral dissertation, in which he unearthed the mathematical scaffolding of economic theory, and Economics: An Introductory Analysis, the...

Read More »Five things to know about the 2018 Alberta budget

On March 22, the NDP government of Rachel Notley tabled the 2018 Alberta budget. I’ve written a blog post discussing some of the major ‘take aways’ from the standpoint of Calgary’s homeless-serving sector (where I work). Points made in the blog post include the following: this was very much a status quo budget; Alberta remains the lowest-taxed province in Canada (and still the only province without a sales tax); Alberta still has (by far) the lowest net debt-to-GDP ratio of any province;...

Read More »Ten proposals from the 2018 Alberta Alternative Budget

Posted by Nick Falvo under aboriginal peoples, Alberta, budgets, Child Care, education, fiscal policy, homeless, housing, HST, income, income support, income tax, Indigenous people, inequality, labour market, macroeconomics, NDP, poverty, progressive economic strategies, public infrastructure, public sector procurement, public services, seniors, small business, social policy, student debt, taxation, user fees, women, workplace benefits. March 21st, 2018Comments: none The...

Read More »Media release: Alberta needs a provincial sales tax

(March 20, 2018-Edmonton) Today, a coalition of researchers, economists, and members of civil society released an alternative budget to boost Alberta’s economic growth while reducing income inequality. “Alberta is on the road to recovery after a deep recession,” said economist Nick Falvo, “now is not the time to reverse the course.” The document, High Stakes, Clear Choices, sets a progressive vision encouraging public investment to stabilize tough economic times, reduce poverty, support our...

Read More »Inequality-redistribution in Canada update

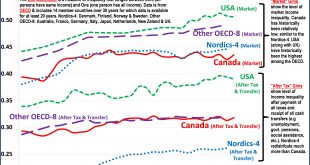

Two years ago I posted my first guest blog focused on income inequality, specifically how changes in Canada’s redistribution over the last three decades have increased after-tax income inequality, and how these changes compared to OECD trends. The figures and analysis in this post update the earlier blog, based on the most recent OECD data to 2015. I also look at the market inequality-redistribution relationship and find that Canada is the only country that combines low market inequality...

Read More »Homelessness and employment: The case of Calgary

I’ve just written a blog post about homelessness and employment, with a focus on Calgary (where I live and work). Points raised in the blog post include the following: -Persons experiencing homelessness usually have poor health outcomes, making it especially challenging to find and sustain employment. -There are several non-profits in Calgary that assist persons experiencing homelessness to find and sustain work. -Persons finding the most success in those programs tend to be relatively...

Read More »How to Measure and Monitor Poverty? LIM vs LICO vs MBM.

The federal government has promised to launch a Canadian Poverty Reduction Strategy in the coming weeks or months on the basis of now completed consultations with Canadians and the still ongoing deliberations of an advisory committee. As part of this process, there has been discussion about which poverty or low income measure or measures should be used for the purpose of monitoring levels and trends in the incidence of poverty and gauging the impact of poverty reduction policies. At various...

Read More »Budget Fails to Crack Down on Private Corp Tax Shelter

2018 Federal Budget Analysis February 14, 2018Watch this space for response and analysis of the federal budget from CCPA staff and our Alternative Federal Budget partners. More information will be added as it is available. Commentary and Analysis Some baby steps for dad and big steps forward for women, by Kate McInturff (CCPA) An ambition constrained budget, by David Macdonald (CCPA) Five things […] Canadian Centre for Policy AlternativesCED in Manitoba - The Video January 29, 2018Community...

Read More »Clarksonian Mega-Challenges for Canada and North America Michèle Rioux

Stephen Clarkson This is the final essay in the PEF series to commemorate the life of Stephen Clarkson. It is fitting that it is written by Michèle Rioux, a colleague in Quebec. Stephen worked closely with many in Quebec and the relationship between Quebec and Canada was an important part of his analysis of North America. Michèle Rioux is a Professor in the Department of Political Science, UQAM and Research Director at the Center for research on integration and globalization (Centre...

Read More » Progressive Economics Forum

Progressive Economics Forum