By Felipe Rezende Part IV This last part of the series (see Part I, II, and III here, here and here) will focus on the Brazilian response to the crisis. What Should Brazil do? The Brazilian current crisis fit with Minsky’s theory of instability (see here, here and here). The traditional response to a Minsky crisis involves government deficits to allow the non-government sector to net save. That is, if the private sector desire to net save increases, then fiscal deficits increase to allow it...

Read More »Minsky Meets Brazil Part III

By Felipe Rezende This part of the series (see Part I and II, here and here) will focus on macroeconomic and microeconomic aspects to financial fragility and provision for liquidity. Minsky’s framework not only sheds light on how to detect unsustainable financial practices, but the position adopted in this paper is that the current Brazilian crisis does fit with Minsky’s instability theory. This is a Minsky’s crisis in which during economic expansions market participants show greater...

Read More »Minsky Meets Brazil Part II

By Felipe Rezende This series will discuss at length the underlying forces behind Brazil’s current crisis. Building on Keynes’ investment theory of the cycle, Minsky’s work suggests that the structure the economy becomes more fragile over a period of tranquility and prosperity. That is, endogenous processes breed financial and economic instability. While Minsky adopted Keynes’ “investment theory of the cycle”, he added a financial theory of investment, with a detailed exposition of the...

Read More »Minsky Meets Brazil

By Felipe Rezende Part I This series will discuss at length the underlying forces behind Brazil’s current crisis. A consensus has emerged in Brazil (and elsewhere) blaming Rousseff’s “new economic matrix” policies for the country’s worst crisis since the Great Depression (see here, here, here, here, and here). With the introduction of policy stimulus through ad hoc tax breaks for selected sectors seen as a failure to boost economic activity and the deterioration of the fiscal balance –...

Read More »Is there a solution to Brazil’s crises?

By Felipe Rezende This is the first of a series of posts on the Brazilian crises. There are two major crises Brazil’s president Dilma Rousseff is facing: one is a political crisis and the other is Brazil’s sharpest recession in 25 years. Brazil’s Political Crisis The political crisis has two main pillars: a) a vast corruption scandal (with evidence of a kickback scheme funneling billions of dollars from state-run firms and, more recently, in a massive data leak over possible tax evasion,...

Read More »Endogenous financial fragility in Brazil: Does Brazil’s National Development Bank reduce external fragility?

By Felipe Rezende Introduction The creation of new sources of financing and funding are at the center of discussions to promote real capital development in Brazil. It has been suggested that access to capital markets and long-term investors are a possible solution to the dilemma faced by Brazil’s increasing financing requirements (such as infrastructure investment and mortgage lending needs) and the limited access to long-term funding in the country. Policy initiatives were implemented...

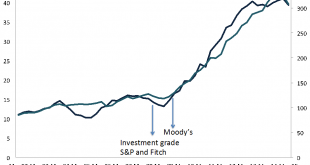

Read More »Reactions to S&P Downgrade: S&P analyst confirms there is no solvency issue

Reactions to S&P Downgrade: S&P analyst confirms there is no solvency issue By Felipe Rezende In previous posts (see here and here), I discussed Standard & Poor’s (S&P) downgrade of Brazil’s long-term foreign currency sovereign credit rating to junk status, that is, to ‘BB+’ from ‘BBB-‘ and its decision to downgrade Brazil’s local currency debt to a single notch above “junk” status. S&P hosted a conference call on Monday morning to explain its downgrade of Brazil’s...

Read More » Heterodox

Heterodox