With a federal election taking place in Canada in fewer than three weeks, I’ve written a 950-word overview of the Liberal Party’s housing platform. It’s available here: https://nickfalvo.ca/ten-things-to-know-about-the-liberal-partys-housing-platform/ Nick Falvo is a Calgary-based research consultant with a PhD in Public Policy. He has academic affiliation at both Carleton University and Case Western Reserve University, and is Section Editor of the Canadian Review of...

Read More »Trudeau’s proposed speculation tax

Posted by Nick Falvo under BC, bubble, cities, economic thought, foreign investment/ownership, globalization, housing, inequality, interest rates, investment, Liberal Party policy, monetary policy, municipalities, Ontario, party politics, prices, private equity, regulation, Role of government, taxation, Toronto, wealth. September 25th, 2019Comments: none I’ve written a blog post about the Trudeau Liberals’ recently-proposed speculation tax on residential real estate owned...

Read More »Trudeau’s proposed speculation tax

I’ve written a blog post about the Trudeau Liberals’ recently-proposed speculation tax on residential real estate owned by non-resident, non-Canadians. The full blog post can be accessed here. Nick Falvo is a Calgary-based research consultant with a PhD in Public Policy. He has academic affiliation at both Carleton University and Case Western Reserve University, and is Section Editor of the Canadian Review of Social Policy/Revue canadienne de politique sociale. You can...

Read More »Ontario Election: Inequality Impacts of Fiscal Plans

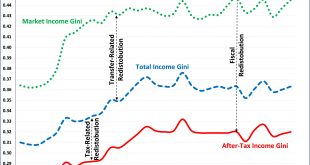

In the context of Ontario’s upcoming June 7 election, I just finalized an article on the CCPA’s “Behind the Numbers” blog, exploring the fiscal plans of the three major political parties from a historical and comparative context. I concluded that while the Ontario election offers voters three distinct fiscal visions, it is also true that all three would maintain Ontario’s comparatively low program expenditures and own-source revenues, at least during their first term. Building on my prior...

Read More » Heterodox

Heterodox