In 2020, after Democrats had retaken control of the House of Representatives, the third version of the larger bill managed to actually pass the House under the more reasonable title of the Patient Protection and Affordable Care Enhancement Act. Of course, it didn’t even get a vote in the Senate. In early 2021, a temporary version of this bill by Rep. Lauren Underwood, was in the American Rescue Plan (ARP). It passed both the House & Senate on a party-line vote. It was signed into law by President Biden. The ARP accomplished what all of the prior versions were hoping to, with one caveat: It sunset after two years . . . i.e., the end of December 2022. Thankfully and in early August, Senate Democrats and the House Democrats passed the Inflation

Topics:

run75441 considers the following as important: ACA Signups.net, ARP/IRA, Charles Gaba, Education, Healthcare, Healthcare Insurance Premiums, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

In 2020, after Democrats had retaken control of the House of Representatives, the third version of the larger bill managed to actually pass the House under the more reasonable title of the Patient Protection and Affordable Care Enhancement Act. Of course, it didn’t even get a vote in the Senate.

In early 2021, a temporary version of this bill by Rep. Lauren Underwood, was in the American Rescue Plan (ARP). It passed both the House & Senate on a party-line vote. It was signed into law by President Biden. The ARP accomplished what all of the prior versions were hoping to, with one caveat: It sunset after two years . . . i.e., the end of December 2022.

Thankfully and in early August, Senate Democrats and the House Democrats passed the Inflation Reduction Act (IRA), which was formally signed into law by President Biden on April 16th. Along with all the other provisions, the IRA also included a three-year extension of the ARP’s enhanced & expanded ACA subsidies, through the end of 2025.

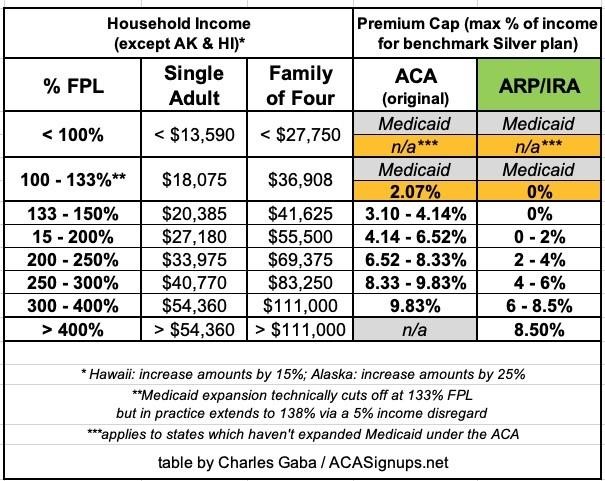

AB: Here’s a table which compares the original ACA subsidy formula against the enhanced/expanded subsidies included under the ARP/IRA. Just in case, you do not understand what the enhancement are till EOY 2025; I will list them first.

- To qualify for Medicaid, you must have income <100% FPL. Eliminated

- To qualify for Medicaid, you must have income <133% FPL. Eliminated. Medicaid eligibility is now up to 150%.

- ACA kicks in at >150% to 200% FPL. Premium Cap at 0 to 2% of income (benchmark Silver plan)

- ACA at >200% to 250% FPL Premium is now 2 to 4% of income and down from 6.52 to 8.33% of income.

- ACA at >250% to 300% FPL. Premium is now 4 to 6% of income and down from 8.33 to 9.83% of income.

- ACA at >300% to 400% FPL. Premium is now 6 to 8.5% of income. Down from 9.83%.

- ACA >400% FPL. Premium at 8.5%

Granted this is not Single Payer or Medicare. It is still a lot better than what it was. The improvement also covers those left out by states. It also covers through 2025. All of the above is in the chart below. I broke it out in case you did not understand the chart.

We did review single people in my last post here: “Does The IRA Lower YOUR Health Insurance Premiums? Singles,” – Angry Bear (angrybearblog.com)

First up is the;

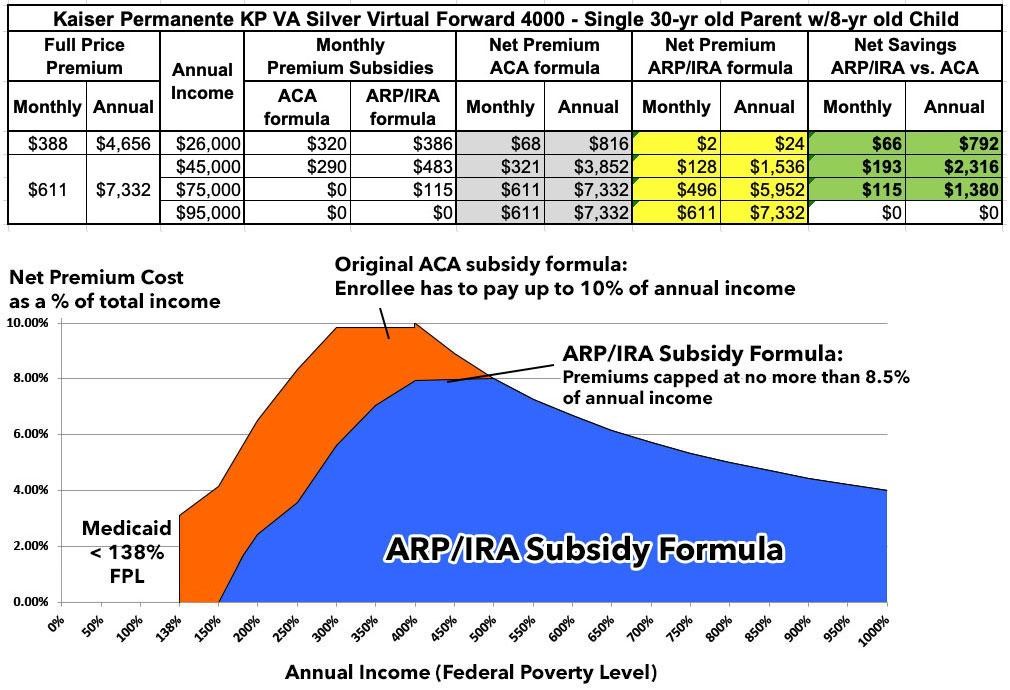

30-yr old Single Parent with an 8-yr old child

Things get slightly more complicated here because in Virginia, children are eligible for the CHIP program in households earning up to 200% FPL. Coverage for a single parent earning around $26,000/year (~141% FPL) and one child. The result would be the child enrolled in CHIP while the parent would be eligible for a subsidized ACA exchange plan. The full-price premium therefore depends on whether it’s covering just one person (the parent) or both parent and child.

In this scenario, the single parent goes from having to pay $68/month on a $26,000/year income to paying almost nothing under the enhanced subsidies of the IRA (a nominal $2/month).

At $45,000/year, both are in a subsidized ACA plan, saving over $2,300/year thanks to the IRA.

At $75,000/year, they’d have to pay the full $611/month under the original ACA formula, but this drops to $496/month under the IRA. While the IRA has a hard net premium cap of 8.5% of income, this parent never actually sees that as even at full price they never pay more than 8% of their income anyway.

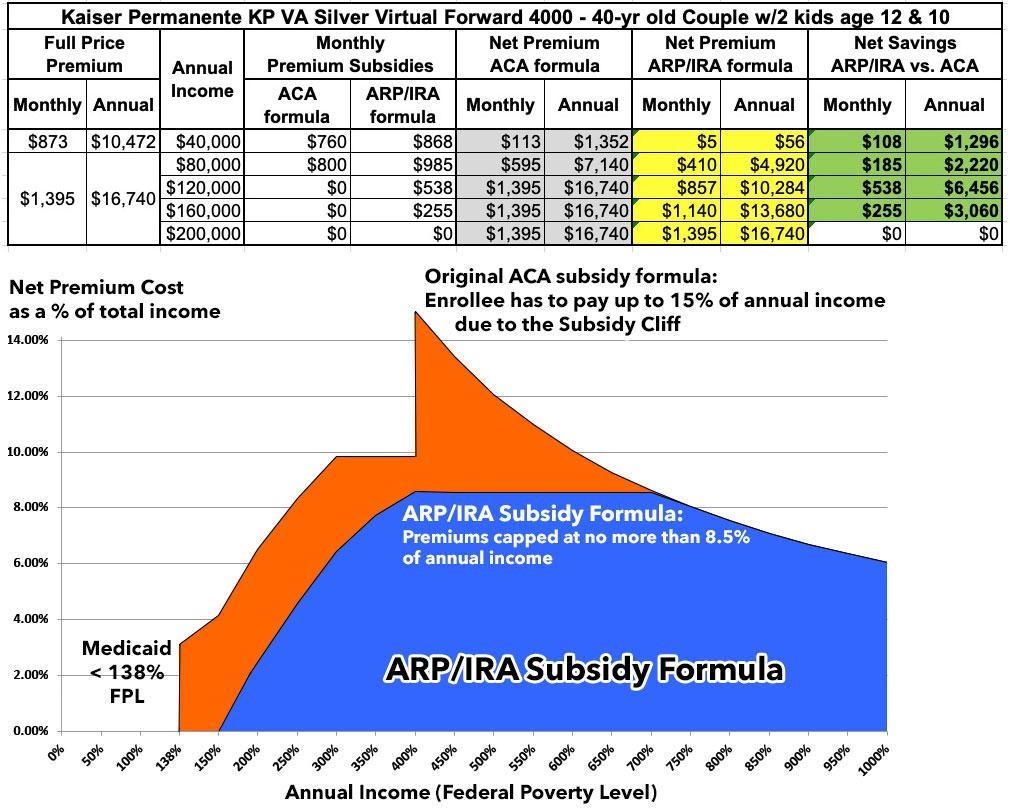

Next, let’s look at a “nuclear family,”

A 40-yr old couple raising two children ages 12 & 10.

Again, the CHIP factor complicates this a bit; at $40,000/year, this family is only earning 144% FPL, which means the children both qualify for CHIP while the parents can get a heavily-subsidized ACA exchange plan. At full price the benchmark Silver policy would cost $873/month for just the parents, or $1,395/month for all four family members.

Thanks to the IRA’s enhanced subsidies, this family saves thousands of dollars per year…the highest savings shown in the table is over $6,400 saved, but it could theoretically go as high as nearly $7,300 saved if the household happens to earn just over 400% FPL (a little over $111,000/year). At that income level, they’d go from paying 15% of their annual income to just 8.5%.

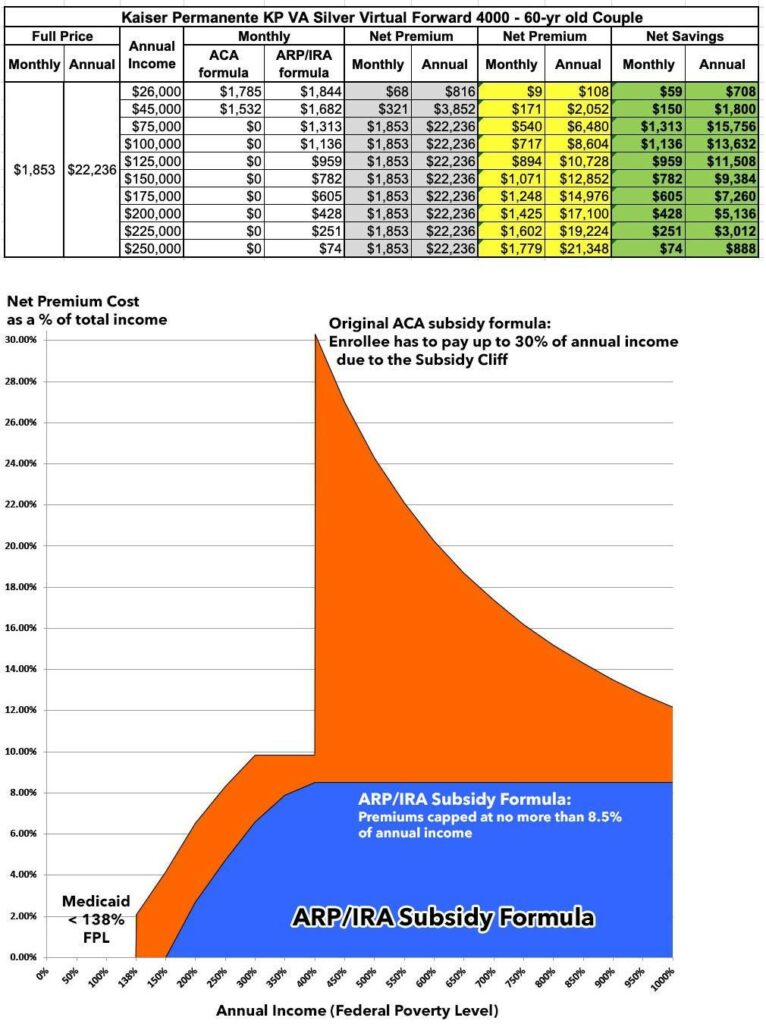

Finally, here’s the real jaw-dropper:

A 60-yr old couple.

At full price, the benchmark Silver plan would cost over $22,000/year at that age…and at that level, the Subsidy Cliff isn’t even a chasm anymore; it’s a sheer freefall from the stratosphere. At just over 400% of the Federal Poverty Level, this couple would have had to pay over 30% of their entire annual income in premiums under the old subsidy formula, making it utterly unaffordable.

Thanks to the ARP/IRA improvements, they’re now capped at no more than 8.5% of their income in net premiums…saving them as much as $16,000/year. That’s not a typo.