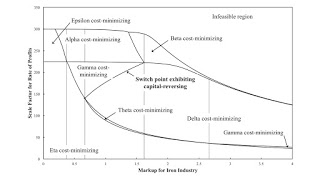

Figure 1: Variation in Switch Points with the Markup in the Iron Industry1.0 Introduction I finally use the tools of pattern analysis that I have been inventing to tell a practical story. I build on the example which I began in my previous post. Workers would be better off if an increase in wages led to greater employment, not less. A long-period change in relative markups among industries can result in firms in some industries obtaining a greater rate of profits at the expense of firms in other industries. But such a change can also create a switch point that exhibits capital-reversing. Around such a switch point, a higher wage is associated with firms adopting a technique of production in which more labor is hired, in the economy as a whole, to produce a given net output. Thus, the

Topics:

Robert Vienneau considers the following as important: Example in Mathematical Economics, Full Cost Prices, Labor Markets

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Robert Vienneau writes Double Fluke Cases For Triple-Switching In The Corn-Tractor Model

Robert Vienneau writes The Emergence of Triple Switching and the Rarity of Reswitching Explained

Robert Vienneau writes Recap For A Triple -Switching Example

|

| Figure 1: Variation in Switch Points with the Markup in the Iron Industry |

I finally use the tools of pattern analysis that I have been inventing to tell a practical story. I build on the example which I began in my previous post.

Workers would be better off if an increase in wages led to greater employment, not less. A long-period change in relative markups among industries can result in firms in some industries obtaining a greater rate of profits at the expense of firms in other industries. But such a change can also create a switch point that exhibits capital-reversing. Around such a switch point, a higher wage is associated with firms adopting a technique of production in which more labor is hired, in the economy as a whole, to produce a given net output. Thus, the change in relative markups leaves workers in a better position to press for a greater share of the surplus product.

2.0 PostulatesIn telling this story, I am assuming that possibilities in a simple model - but not too simple - can enlighten us on possibilities in the actual economy. My example is one of an economy in which three commodities (iron, steel, and corn) are produced by means of commodities. I take corn as numeraire and assume wages are paid out of the surplus at the end of the year. Firms have a choice of two processes in each industry for producing the output of that industry. Details are in the last post

Any actually-existing economy cannot ever be expected to be in equilibrium. Nevertheless, I assume that prices of production cast light on tendencies over time for market prices. I realize that this is a contentious claim, especially for Post Keynesians that take issues of fundamental uncertainty seriously.

I assume, for this story, that some sort of long period wage is taken as given when calculating prices of production. It reflects norms about consumption, institutions like how widespread labor unions are, minimum wages, conventions on how bargaining for wages, worker militancy, the policy of the monetary authority, and so on. Some of these influences can be changed, with consequent effects on long period wages and prices of production.

Prices of production also reflect conventions on relative rates of profits. In the example, the rate of profits in the iron industry is 100 s1r, 100 s2r in the steel industry, and 100 s3r in the corn industry. I take it that these conventions can be changed, also with resulting effects on the rate of profits.

3.0 Results and DiscussionFigure 1, at the top of this post, graphs the scale factor for the rate of profits, r, against the markup, s1, in the iron industry. In drawing this graph, the markups in the steel and corn industries, s2 and s3, are taken as unity. The maximum rate scale factor for the rate of profits is also graphed, with the region above it in the graphed labeled as an infeasible region. The thin vertical lines show markups in the iron industry at which four-technique patterns occur.

Switch points between the Delta and Gamma technique appear on the wage frontier in two parameter ranges for the markup in the iron industry. For s1 between approximately 0.66653 and 1.6195, the switch point between these techniques exhibits capital-reversing. If the markup in the iron industry is slightly below this range, a persisting increasing alters prices of production so that workers pressing wage claims can be more advantageous to them. If the markup in the iron industry is slightly above this range, an increase in the markups in the steel and corn industries can benefit the workers in the same way.

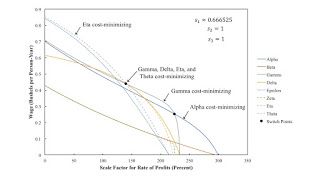

3.1 Selected Examples of Wage FrontiersI presented three examples of wage frontiers in the previous post. I might as well present two more examples of the wage frontiers here. Figure 2 shows the wage frontier for the value of markups at the point where the switch point between the Gamma and Delta techniques exhibits capital-reversing. The Delta and Theta techniques are only cost-minimizing at the switch point. (One cannot visually distinguish between the wage curves for these two techniques around the switch point.)

|

| Figure 2: The Wage Frontier at a Four-Technique Pattern, with Capital Reversing Appearing |

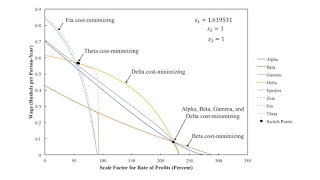

Figure 3 shows the wage frontiers for the value of markups at the point in parameter space where the "perverse" switch point between the Gamma and Delta techniques disappears from the wage frontier. In this illustration, the Alpha and Gamma techniques are cost-minimizing only at the the switch point. For a slightly larger markup in the iron industry, the wage curves for neither the Alpha nor the Gamma technique appear on the wage frontier.

|

| Figure 3: The Wage Frontier at a Four-Technique Pattern, with Capital Reversing Disappearing |

The graph in Figure 1 demonstrates that at least two patterns over the axis for r and four four-technique patterns arise in this example.

The outer two four-technique patterns resemble one another in some ways. In both cases, processes in two industries are changed, for the (middle) technique that is replaced between the left and the right of the pattern. The Gamma and Epsilon techniques differ in the processes used to produce iron and steel. The same process is used, in both techniques, to produced corn. Similarly, the Gamma and Theta techniques differ in the processes used to produce iron and corn. They share the same process in the production of steel.

The inner four-technique patterns differ from the outer two, but resemble one another. They both show a single switch-point on one side of the pattern being transformed to three switch points on the other side. The wage curves for two new techniques, at least in the region around the switch point, appear on the wage frontier for the parameter values of the markup with the three switch points. I have not previously presented such a pattern. (The structure of the example, in which two processes, but no more than two, are defined for each industry ensure that a three-technique pattern cannot arise in the example. If the wage curves for three techniques intersect in a single switch point, the wage curve for a fourth technique must also go through that switch point as well.)

This example points out the need for normal forms for patterns. I want to formalize the idea that some patterns are topological equivalent, yet differ for others. The presentation of two normal forms for four-technique patterns, which I have only gestured at here, does that.

4.0 By Way of ConclusionI like how this story combines ideas I take from Kalecki and Sraffa. I do not worry about the labor theory of value, but just take as given that capitalist firms are able to acquire some part, over above what is paid out in wages, of the surplus product.

AppendixI document that two mainstream economists stated that reswitching has implications for labor markets and income distribution:

"One final and somewhat fanciful remark may be made with reference to this [reswitching] example. Two mixed types of stationary state ... are possible... Both use the same equipment, but the question of ... what income-distribution between labour and capital is fixed, is left in this model for political forces to decide. It is interesting to speculate whether more complex situations retaining this feature are ever found in the real world." -- D. G. Champernowne (1953- 1954)

"By contrast, one who believes technology to be more like my 1966 reswitching example than like its orthodox contrast, will have a more sanguine view about how successful militant power by organized labor can be in causing egalitarian shifts in the distribution of income away from property even in the long run." -- Paul A. Samuelson (1975)References

- D. G. Champernowne (1953-1954). The Production Function and the Theory of Capital: A Comment. The Review of Economic Studies, V. 21, No. 2: pp. 112-135.

- Paul A. Samuelson (1975). Steady-State and Transient Relations: A Reply on Reswitching. Quarterly Journal of Economics, V. 89, No. 1: pp. 40-47.

- Graham White (2001). The Poverty of Conventional Economic Wisdom and the Search for Alternative Economic and Social Policies. The Drawing Board: An Australian Review of Public Affairs, V. 2, No. 2: pp. 67-87.

Heterodox

Heterodox