Figure 1: The Demand for Labor1.0 Introduction Wages and employment are not determined in competitive markets by the interaction of well-behaved supply and demand curves, as portrayed in much introductory economics. At least, no reason exists to thinks so. Every once in a while I like to recall that this is an implication of the Cambridge Capital Controversy. 2.0 Technology Consider a very simple competitive capitalist economy in which corn and iron are produced from inputs of labor,...

Read More »Wages, Employment Not Determined By Supply And Demand

1.0 Introduction I do not think I have presented an introductory example in a while in which an increased wage is associated with firms wanting to employ more labor, given the level of net output. This example is presented as a matter of accounting for a vertically integrated firm. Exact calculations with rational numbers are tedious in this example. I expect that if anybody bothers to check this, they would use a spreadsheet. As far as I can tell, Microsoft Excel uses double precision...

Read More »The Emergence Of The Reverse Substitution Of Labor

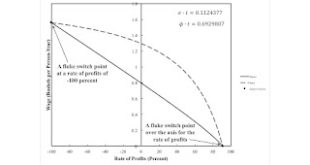

Figure 1: A Wage Frontier With Two Fluke Switch Points This post is a rewrite of this, without the attempt to draw a connection to structural economic dynamics. This post presents an example with circulating capital alone. Table 1 presents the technology for an economy in which two commodities, iron and corn, are produced. Managers of firms know of one process for producing iron and two for producing corn. Each process is specified by coefficients of production, that is, the required...

Read More »Reminder: Wages, Employment Not Determined By The Supply And Demand Of Labor

1.0 Introduction Over a half-century ago, economists reached a consensus. The model in which employment and real wages are explained by the intersection of a downwards-sloping labor demand function and a supply function is incoherent, not even wrong. This incoherence was demonstrated under the assumptions of perfect competition and of firms that have adjusted their plant and other capital inputs. I do not know what Greg Mankiw and Jonathan Gruber are doing, but it certainly is not...

Read More »The Emergence Of The Reverse Substitution Of Labor

Figure 1: A Wage Frontier With Two Fluke Switch Points This post presents an example with circulating capital alone. Table 1 presents the technology for an economy in which two commodities, iron and corn, are produced. One process is known for producing iron, and two are known for producing corn. Each process is specified by coefficients of production, that is, the required inputs per unit output. The Alpha technique consists of the iron-producing process and the first corn-producing...

Read More »Reminder: Wages, Employment Not Determined By Supply And Demand For Labor

Figure 1: The Wage as Functions of Employment by Industry1.0 Introduction This post repeats a common theme of mine. It builds on an example I have previously gone on about. I use this example to graph, given the wage, the amount of labor firms would like to employ in each industry, per unit of gross output in each industry. These graphs are derived for an economy in which three commodities are produced: iron, steel, and corn. I also graph the amount of labor firms would like to employ...

Read More »On David Card’s Nobel

The Sveriges Riksbank prize in economic sciences in memory of Alfred Nobel this year goes to David Card, Joshua Angrist, and Guido Imbens. I cannot say much about instrumental variables, Angrist, or Imbens. Since I have been pointing to Card's work with Alan Krueger on minimum wages for decades, I thought I might say somthing about his half of the prize. I do not have much new to say. I find both natural experiments and meta-analysis intriguing. Both Card and Krueger's natural...

Read More »Bushwa From Jeffrey Clemens In The Journal of Economic Perspectives

"The labor supply curve slopes upward, reflecting differences in workers’ reservation wages (as driven by outside opportunities related, perhaps, to leisure, home production, and economic assistance that can be received while out of work). The labor demand curve slopes downward, tracing out the relationship between the quantity of labor employed and the marginal revenue product of that labor. This, in turn, reflects the assumption of a constant price (due, perhaps, to a perfectly...

Read More »Vienneau (2005) Is A Necessary Resource For Arguments About A Minimum Wage

Maybe, perhaps, that is a bit hyperbolic. But it has been known for at least half a century that, even in competitive markets, wages and employment cannot be explained by the interaction of well-behaved supply and demand curves for labor. If you do not want to read me, check out, for example, Garegnani (1970) or Opocher and Steedman (2015). Shove (1933) illustrates how far awareness of the difficulties go. White (2001) is a demonstration that I am not the only one to draw practical...

Read More »“When Economists Are Wrong”

In a blog associated with the Frankfurter Allegmeine, Gerald Braunberger criticizes the effects of Sraffian political economy on Italian policy in the 1970s. I rely on google translate and subject matter expertise to make some sense out of this. By the way, Bertram Schefold shows up in the comments. I would like to know more about the motivations behind this. Does Braunberger think the public is increasingly aware that mainstream economics is broken? Before I disagree, I note Braunberger...

Read More » Heterodox

Heterodox