“Financial Assets = Liabilities.” It’s one of the great accounting-identity truisms of economic understanding — both among traditional, mainstream economists, and even (especially) among many heterodox, “accounting based” practitioners. It seems obvious: When a company issues and sells bonds, it posts a liability to its balance sheet; the bond buyers hold financial assets on theirs.[1]

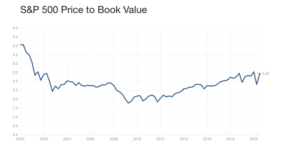

The problem is, that truism isn’t even close to true. The most obvious example is corporate equity shares — financial assets by any definition. The asset value of outstanding shares is vastly larger than firms’ book value, shareholders’ equity — the bottom-line balancing item on the liability side of firms’ balance sheets. Over the last half century, the market-to-book ratio of the S&P 500 has ranged