“Financial Assets = Liabilities.” It’s one of the great accounting-identity truisms of economic understanding — both among traditional, mainstream economists, and even (especially) among many heterodox, “accounting based” practitioners. It seems obvious: When a company issues and sells bonds, it posts a liability to its balance sheet; the bond buyers hold financial assets on theirs.[1] The problem is, that truism isn’t even close to true. The most obvious example is corporate equity shares — financial assets by any definition. The asset value of outstanding shares is vastly larger than firms’ book value, shareholders’ equity — the bottom-line balancing item on the liability side of firms’ balance sheets. Over the last half century, the market-to-book ratio of the S&P 500 has ranged

Topics:

Steve Roth & Sabri Öncü considers the following as important: Article, Finance & Regulation

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

T. Sabri Öncü writes Argentina’s Economic Shock Therapy: Assessing the Impact of Milei’s Austerity Policies and the Road Ahead

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Ann Pettifor writes Global Economic Governance: What’s “Growth” Got to Do with It?

“Financial Assets = Liabilities.” It’s one of the great accounting-identity truisms of economic understanding — both among traditional, mainstream economists, and even (especially) among many heterodox, “accounting based” practitioners. It seems obvious: When a company issues and sells bonds, it posts a liability to its balance sheet; the bond buyers hold financial assets on theirs.[1]

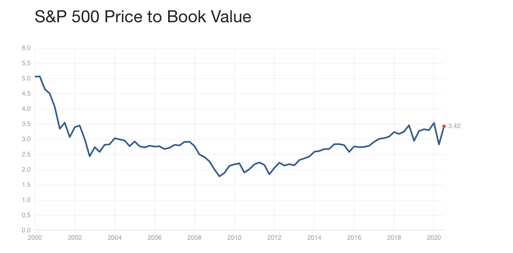

The problem is, that truism isn’t even close to true. The most obvious example is corporate equity shares — financial assets by any definition. The asset value of outstanding shares is vastly larger than firms’ book value, shareholders’ equity — the bottom-line balancing item on the liability side of firms’ balance sheets. Over the last half century, the market-to-book ratio of the S&P 500 has ranged between 2X and 5X.

The discrepancy exists even for U.S. Treasury bonds outstanding, though that discrepancy is quite small.

As soon as a new financial asset is issued, at least if it’s tradeable in the markets, its price starts changing. Asset holders look at their brokerage statements, which are marked to market instant by instant, and see that they have more or less assets. Meanwhile the liabilities on issuers’ balance sheets remain (mostly) unchanged. Financial Assets ≠ Liabilities.

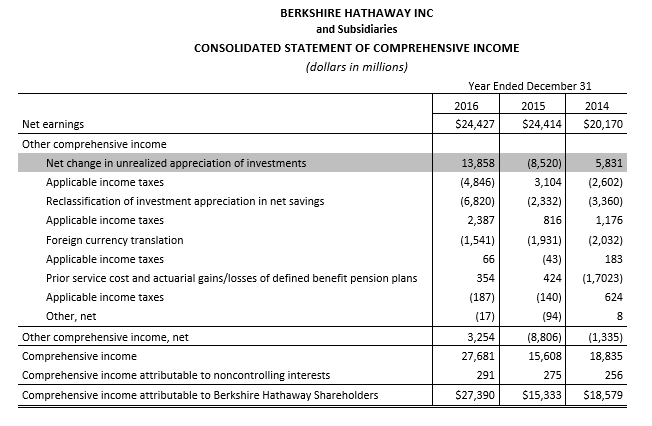

Economists can hardly be blamed for this incorrect understanding. The national accounts themselves obscure this reality. If you look at the Flow [2] tables in the [US] Fed’s quarterly Financial Accounts or “Flow of Funds,” for instance, you won’t find any accounting for changes in asset holdings due to changes in market prices — revaluation. So those tables can’t explain changes in assets and net worth from period to period. They’re accounting-incomplete — certainly so if you compare them to the Consolidated Statements of Comprehensive Income that publicly traded corporations are required to publish quarterly. publish quarterly.[3]

The same is true, even more, of The National Income and Product Accounts (NIPAs) — though those accounts make no claim or aspiration to such complete accounting; they don’t include anything resembling sectoral balance sheets.

How can we make An Inquiry into the Nature and Causes of the Wealth of Nations absent a comprehensive accounting of wealth accumulation?

Happily, there is a set of complete, fully stock-flow-consistent sectoral accounting statements available, based on the System of National Accounts (SNA) standards developed and promulgated by the United Nations and allied institutions. Think of them as Generally Accepted Accounting Practices (GAAP), but for countries. In the U.S., the SNA-compliant accounts are called the Integrated Macroeconomic Accounts (IMAs). They were released only in 2006, with quarterly tables released in 2012 (annual-only for financial subsectors). Their data extends back to 1960. You’ll find them as the “S” tables at the end of the Fed’s quarterly “Z.1” or Financial Accounts report. They’re also very conveniently available in interactive form here, and all the sectoral tables are available in a single Excel workbook here.

In the IMAs, each sector has a balance-sheet account (with Net Worth as the bottom-line item), and crucially, a Revaluation account tallying “Changes in net worth due to nominal holding gains/losses,” broken out for various asset classes. With this inclusion, each sector’s table fully explains change in net worth during an accounting period.

But that finally returns us to the title of this article: the net worth of firms. There is what seems to be a very particular oddity in the IMAs, which on examination yields a rather revelatory understanding of economies and economic statements:

In the twenty-five years since 1995, according to the IMAs, the net worth of the U. S. nonfinancial firms sector has been positive in only two.

It’s pretty eye-popping. “Nonfinancial firms aren’t worth anything, are worth less than nothing?” No. Rather, these notional net worth figures reveal an important accounting and economic reality, embodied in a quirk of the IMAs’ accounting: net worth is meaningless for firms. Or to put it another way: unlike households, firms don’t own their own net worth. Their bottom-line, right-hand side balancing item is not net worth, it’s shareholders’ equity. The possessive apostrophe says it all: shareholders own firms’ net worth.[4]

And ultimately, all that value is owned by the household sector. (This ignoring the Rest of World sector, non-domestic ownership, for simplicity.) Sure, firms own shares in firms which own shares in firms, but ultimately households own it all. Because since 1865 in the U.S., nobody can own “equity shares” in households, in people. People own firms but firms don’t own people. It’s a one-way, asymmetrical ownership relationship. The IMAs reflect that asymmetry.

Jumping to the IMAs’ Household balance sheet, you see exactly that: household assets include the total value of all firms, at current market prices (“market capitalization”). The firms sector [5] is a wholly-owned subsidiary of the household sector. Its value is “telescoped” onto the left-hand side of the household sector balance sheet.

And this is how the IMAs’ apparent quirk arises, for three reasons. First, there’s an attempt to present all sectors similarly, with net worth at the bottom. (Even though sectors aren’t all treated the same in other matters, for good and necessary reasons; their accounting realities are fundamentally different.) That’s problematic when firms don’t actually have anything that’s meaningfully called net worth.

Second, the IMAs post firms’ equity liabilities to their balance sheets as just another liability — not broken out as a singular item as in corporate reports. Think: “Liabilities and Shareholders’ Equity.”

Third, The IMAs post firms’ equity liabilities not at book value, but at market value. Another oddity results: when share prices go up, firms’ liabilities do as well, so their net worth goes down. It’s kind of wacky.

Again, this results from a desire for accounting consistency and closure. The firm sector’s market-priced equity liabilities equal households’ market-priced equity assets. What goes missing is a key measure for firms: book value, the standard measure of shareholders’ equity. It’s quite easy to calculate: subtract firms’ equity liabilities from their total liabilities, and subtract that from their total assets. It’s annoying that the IMAs don’t do that for us as the firms’ bottom line, or at least in a memo item. But the exercise is a great way to understand the underlying economic and ownership reality that the IMAs reveal so well.

Understanding the Wealth of Nations

Some may be wondering, “Why does all of this matter?” It’s important because it reveals a giant lacuna in economists’ understanding of wealth accumulation, the wealth of nations, and the relationship between wealth and “real capital.” Contrary to a quite ubiquitous conception, for instance, neither the household sector’s Net Saving (in the Current Account), or Capital Account accumulation, comes even close to explaining the sector’s wealth accumulation.

Over the twenty years 2000–2019, the U.S. household sector’s Net Saving was $14 trillion, while its net worth increased by $75 trillion. Of that, $38 trillion is attributable to nominal holding gains, unrelated to the sector’s current-account Saving. And of that, $27 trillion is attributable to nominal holding gains on equity shares.

Not all of that $27 trillion materialized magically, of course. The firm sectors’ book value (roughly, their cumulative saving on behalf of their household owners) also increased over that period, by $21 trillion. That explains much, but not nearly all, of the equity holding gains accrued by households. Even in this one equity asset category, there’s a $6 trillion remainder, unexplained — equivalent to $48,000 for every American household.

Absent the complete accounting embodied in the IMAs, these quite massive numbers are completely invisible to economists, and their models. The economy doesn’t balance to “saving.” In an important sense, that’s just an artificial, residual balancing item.

The economy balances to net worth: the wealth of nations.

Footnotes:

[1] This is the very definition of a financial asset: it has a related liability on another balance sheet. Nonfinancial assets, such as land titles, don’t. All liabilities are inherently financial; the debt is due to some entity, which holds that obligation as an asset on its balance sheet.

[2] Renamed the Transactions tables as of June 2018, with the following note (emphasis added): “As of this publication, the term “flow” is being replaced by the term “transactions.” The concept being referred to, which is the acquisition of assets or incurrence of liabilities, is not being changed. The change in terminology is intended to prevent confusion with the broader concept sometimes called “economic flow,” which is the change in level from one period to the next and is composed of transactions, revaluations, and other changes in volume. The new terminology brings the Financial Accounts of the United States into better alignment with international guidelines in the System of National Accounts 2008 (SNA2008).”

[3] berkshirehathaway.com/2016ar/2016ar.pdf page 37

[4] It’s revealing to compare nonprofits, which like households and unlike for-profit firms, don’t have shareholders. They own their own net worth (if anyone does). That’s why they’re included in the household sector accounting, and that sector is properly labeled “Households and Nonprofit Institutions Serving Households” (NPISHes).

[5] There are actually three firms sectors in the IMAs: corporate nonfinancial, corporate financial, and noncorporate nonfinancial (with additional tables detailing subsectors of the financial sector). For brevity, simplicity, and clarity, we speak of them here collectively as “the firms sector.”

Photos

The photos at the head of this article are from the following sources, with our appreciation:

“The Wealth of the Nation” by Seymour Fogel https://commons.wikimedia.org/wiki/File:The_Wealth_of_the_Nation,_Seymour_Fogel.jpg

Women at work in a Lancashire Rubber Factory https://commons.wikimedia.org/wiki/File:Women_at_work_in_a_Lancashire_Rubber_Factory_Q28232.jpg

Jakob Fugger and his principal accountant, M. Schwarz https://en.wikipedia.org/wiki/Bourgeoisie

Amazon warehouse: https://www.flickr.com/photos/[email protected]/16278498935