NEP’s Pavlina Tcherneva appears on the Laura Flanders Show. Pavlina says the current practice of gender-blind and race-blind fiscal policy lacks visions and helps no one. Congress, according to Pavlina is focusing on the wrong things. A self ascribed feminist economist, Pavlina says feminist fiscal policy is real, not simply ideological, and should be a central part of the American economy. We’ll encourage growth, she says, by creating employment — not the opposite. And employment begins...

Read More »Will the Crisis of Confidence at Deutsche Bank Spread?

NEP’s Bill Black recently appeared on [email protected]’s radio show discussing the issues related to the settlement the DOJ is pursuing from Deutsche Bank. It has also appeared on the website. You can view it here. Share this:

Read More »‘Two Million Felonies’: Will The Wells Fargo Scandal Finally Change Wall Street?

Nothing clarifies the mind of a bank board member than the loss of lucrative business deals. Wells Fargo’s CEO says he will pay a penalty for presiding over his bank’s fraud wave. Could stricter sanctions follow, perhaps even a criminal investigation? We spoke with William K. Black Jr., economist and white-collar criminologist, about the implications of the Wells Fargo case and the laws that might have been broken. Rest of the post is at Huffington Post. Read it here. Share this:

Read More »Deutsche Bank is Too Big to Fail, Too Big For Big Fines?

NEP’s Bill Black appears on The Real News Network. Topic of discussion is Deutsche Bank, the German bank that was at the center of the LIBOR scandal and is likely to face upwards of $5 billion in a settlement with the Justice Department. Video is below. If you would like to see with a transcript, it is here.[embedded content] Share this:

Read More »‘Control Fraud’ – Corrupt Bankers Do It, Congress Ignores It

The bipartisan shellacking Senators gave John Stumpf, the Wells Fargo CEO, last week made for great television, but did nothing about the real scandal: Our government continues to look the other way as many top bankers thumb their noses at fraud laws. There is a term for the criminality that infects our biggest banks and damages the economy, and there is a solution to this problem. But there is also an obstacle. Read more of David Cray Johnston’s post: ‘Control Fraud’ – Corrupt Bankers Do...

Read More »CROWDSOURCING the COLLECTIVE “WE”

By J.D. ALT Let’s jump ahead to the day (surely it will come, right?) when we realize a general consensus has actually been established that, yes, it IS possible to sustainably pay for collective goods and services by the direct issuing of sovereign fiat dollars―that our federal government doesn’t have to collect taxes in order to have dollars to spend, that it doesn’t have to issue Treasury bonds to get the dollars it needs but imagines it doesn’t have. Now that we’re here in this future...

Read More »Does a Golden Parachute Await Wells Fargo CEO John Stumpf?

NEP’s Bill Black appears on The Real News Network and explains why criminal prosecutions of executives time after time are not happening. The video is below and if you would like to view with a transcript, click here.[embedded content] Share this:

Read More »WHY ARE WE GATHERED HERE? Remarks Made at the 13th International Post Keynesian Conference

L. Randall Wray The following text reproduces my notes for my talk on the final night of the conference; I think there is a video of the entire panel that will be posted up on the conference site later This conference is dedicated to the memory of Landon Rowland, a local Renaissance man. You have heard both Robert Skidelsky and Chancellor Leo Morton speak of his accomplishments. Over the years, Landon regularly invited Bill Black and me to lunch to discuss our view of the state of the...

Read More »NEP’s Bill Black appears on The Monitor

NEP’s Bill Black talks with Mark Bebawi – host of The Monitor on KPFT in Houston. The topic of conversation is the Wells Fargo scandal and the settlement. You can listen to the podcast here. Share this:

Read More »Minsky Meets Brazil Part IV

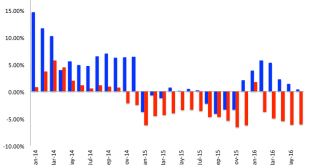

By Felipe Rezende Part IV This last part of the series (see Part I, II, and III here, here and here) will focus on the Brazilian response to the crisis. What Should Brazil do? The Brazilian current crisis fit with Minsky’s theory of instability (see here, here and here). The traditional response to a Minsky crisis involves government deficits to allow the non-government sector to net save. That is, if the private sector desire to net save increases, then fiscal deficits increase to allow it...

Read More » New Economic Perspectives

New Economic Perspectives