By Felipe Rezende Introduction The creation of new sources of financing and funding are at the center of discussions to promote real capital development in Brazil. It has been suggested that access to capital markets and long-term investors are a possible solution to the dilemma faced by Brazil’s increasing financing requirements (such as infrastructure investment and mortgage lending needs) and the limited access to long-term funding in the country. Policy initiatives were implemented...

Read More »A US Climate Platform: Anchoring Climate Policy in Reality (3/3)

By Michael Hoexter Part I | Part II | Part III 4) Question and Answer Q: I notice that the platform cites amounts of money for some of the government actions proposed and for others it is left open. Why not either leave amounts open or develop a full budget? A: There are a few reasons for this inconsistency: 1) This document and outline is a starting place for a larger scale development of this approach. Some numbers are there to suggest magnitudes in areas where I am more confident that...

Read More »A US Climate Platform: Anchoring Climate Policy in Reality (2/3)

By Michael Hoexter Part I | Part II | Part III 2) Political Demands/Planks of the US Climate Platform (Slogan-Form) 1. Popular Rule Not Big Money Rule 2. Living Wage and Full Employment 3. End Police Abuse, Discriminatory Law Enforcement and Abuse of the 2nd Amendment 4. A Real Economy not a Ponzi Wall Street Economy 5. Electrify Energy Use 6. 100% Zero-Carbon Electricity 7. Prioritize Transportation Options for Health & the Climate 8. Renewable Energy Supergrid 9. Secure Finance for...

Read More »A US Climate Platform: Anchoring Climate Policy in Reality (1/3)

By Michael Hoexter Part I | Part II | Part III Below is a provisional platform of policies, acts of Congress, Constitutional amendments or Presidential actions that would represent a serious and appropriate confrontation by US society and government with the upcoming climate catastrophe. This document is meant to start a public discussion on government actions grounded in economic, human and geophysical reality and is therefore provisional. It is divided into the following parts: 1)...

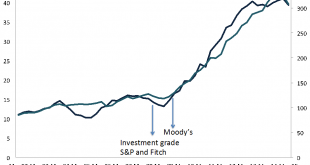

Read More »Reactions to S&P Downgrade: S&P analyst confirms there is no solvency issue

Reactions to S&P Downgrade: S&P analyst confirms there is no solvency issue By Felipe Rezende In previous posts (see here and here), I discussed Standard & Poor’s (S&P) downgrade of Brazil’s long-term foreign currency sovereign credit rating to junk status, that is, to ‘BB+’ from ‘BBB-‘ and its decision to downgrade Brazil’s local currency debt to a single notch above “junk” status. S&P hosted a conference call on Monday morning to explain its downgrade of Brazil’s...

Read More » New Economic Perspectives

New Economic Perspectives