William K. Black January 30, 2016 Bloomington, Minneapolis Well, this is slightly embarrassing. Gary Aguirre, Bill Black, Richard Bowen, and Michael Winston came together to form a pro bono effort by bank whistleblowers to restore the rule of law on Wall Street. As a placeholder in the drafting process, I called us the “Bank Whistleblowers’ Group” and that name survived the drafting process and was announced yesterday by me on New Economic Perspectives (NEP). Michael Winston deserves...

Read More »Announcing the Bank Whistleblowers United Initial Initiatives

William K. Black January 29, 2016 Bloomington, Minnesota Revised January 30, 2016 I am writing to announce the formation of a new pro bono group and a policy initiative that we hope many of our readers will support and help publicize. Gary Aguirre, Bill Black, Richard Bowen, and Michael Winston are the founding members of the Bank Whistleblowers United. We are all from the general field of finance and we are all whistleblowers who are unemployable in finance and financial regulation...

Read More »Tax Credits and Dollars—Playing Charades with Low-Income Housing

By J.D. Alt Here is what the HUD.GOV website says about the status of low-income housing in America: “Families who pay more than 30 percent of their income for housing are considered cost burdened and may have difficulty affording necessities such as food, clothing, transportation and medical care. An estimated 12 million renter and homeowner households now pay more than 50 percent of their annual incomes for housing. A family with one full-time worker earning the minimum wage cannot afford...

Read More »Will those who led the financial system into crisis ever face charges?

This is Terry Carter’s latest work and appears in the American Bar Association Journal. He interviews Bill Black along with other prominent figures about the lack of prosecution brought against those responsible for the financial crisis. You can read it here. [Translate]

Read More »Wall Street Declares War on Bernie Sanders

By William K. Black Wall Street billionaires are freaking out about the chance that Bernie Sanders could be elected President. Stephen Schwarzman, one of the wealthiest and most odious people in the world, told the Wall Street Journal that one of the three principal causes of the recent global financial trauma was “the market’s” fear that Sanders may be elected President. Schwarzman is infamous for ranting that President Obama’s proposals to end the “carried interest” tax scam that allows...

Read More »Money and Banking – Part 3

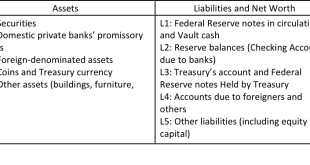

By Eric Tymoigne (A quick note: I noticed that the M&B posts get posted on other blogs. If you want me to respond to you, you should comment at NEP.) MONETARY BASE AND THE BALANCE SHEET OF THE FED. The previous post examined the balance sheet of the central bank: Now that we have an understanding of how the balance sheet of the Federal Reserve works, it is possible to go into the details of how the Fed operates in the economy in terms of monetary policy. To understand what the Fed...

Read More »NEP’s Bill Black on The Real News

Bill appears on The Real News along with Public Banking Institute founder Ellen Brown. They are discussing Hillary’s record on regulating Wall Street. You can watch the video below and for the video with transcript, you can visit The Real News here. [embedded content] [Translate]

Read More »Sovereign Spending in a Market Economy

By J.D. ALT Even if we assume the principles of modern fiat money will be generally accepted at some point in the future, we must yet confront the problem that sovereign spending is a difficult issue for market economies. It could easily unfold that even with the new “modern” money perspective in place, a serious recession could still find federal stimulus spending unnecessarily constrained. This difficulty was on full display in the last recession when Obama’s stimulus package was finally...

Read More »Money and Banking – Part 2

By Eric Tymoigne Central bank balance sheet and immediate implications The previous post reviewed basic balance-sheet mechanics. This post begins to apply them to the Federal Reserve System (Fed). Balance Sheet of the Federal Reserve System For analytical purpose, the balance sheet of the Fed can be presented as follows: Below is the actual balance sheet of the Federal Reserve System prior to the recent crisis (from Board of Governors’ series H4.1, Factors Affecting Reserve Balances). It...

Read More »Why Minsky Matters: An Introduction to the Work of a Maverick Economist

Victoria Bateman has a review of Randall Wray’s book “Why Minsky Matters: An Introduction to the Work of a Maverick Economist” over at Times Higher Education. You can read the review here. [Translate]

Read More » New Economic Perspectives

New Economic Perspectives