Michael Stephens | May 11, 2020 [embedded content] $title = the_title('','',false); ?> if ($title == 'Contributors') { //get_levy_contributors(); } ?> Comments

Read More »What MMT Is, and Why We Should Not Wait for the Next Crisis to Live Up to Our Means

L. Randall Wray | April 4, 2020 by Yeva Nersisyan and L. Randall Wray As MMT has been thrust into the spotlight, misrepresentations and misunderstanding have followed. MMT supposedly calls for cranking up the printing press, engaging in helicopter drops of cash or having the Fed finance government spending by engaging in Quantitative Easing. None of this is MMT. Instead, MMT provides an analysis of fiscal and monetary policy applicable to national governments with...

Read More »We Need Class, Race, and Gender Sensitive Policies to Fight the COVID-19 Crisis

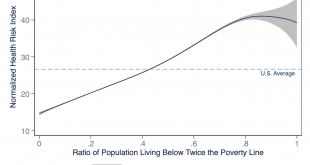

Luiza Nassif-Pires, Laura de Lima Xavier, Thomas Masterson, Michalis Nikiforos, and Fernando Rios-Avila Disproving the belief that the pandemic affects us all equally, data collected by New York City Department of Health and Mental Hygiene and a piece published today in the New York Times shows that the novel coronavirus is “hitting low-income neighborhoods the hardest.”[1] In a forthcoming policy brief, we share evidence that this pattern would be the case and provide a solid...

Read More »What If We Nationalized Payroll?

As the coronavirus pandemic rages on, the US Congress appropriated a whopping $2 trillion budget to tackle it (about 10% of GDP). The focus was on expanded unemployment benefits and cash assistance to families, as well as grants and loans to small firms and large corporations in hopes that they will halt the torrent of layoffs. Across the ocean, Denmark took a different approach. The Danish government announced that it would cover 75–90% of certain worker salaries for the next 3 months....

Read More »Home Quarantine: Confinement With the Abuser?

by Ana Luíza Matos de Oliveira, Lygia Sabbag Fares, Gustavo Vieira da Silva, and Luiza Nassif Pires Even though Covid-19 has already killed thousands worldwide and is paralyzing global economic activity, President Jair Bolsonaro insists on referring to it as a “little flu.” Despite the president’s efforts to avoid a halt to the economic activity in Brazil, the rhythm in the country has slowed down and people who can afford to stay confined at home are doing so. This week, several cities...

Read More »The Coronavirus Does Not Discriminate; Unfortunately Our Economic System Does

In the last 24 hours, two big news stories regarding the economic impact of the Covid-19 pandemic have broken. The first is news that the Senate has passed a $2 trillion stimulus package that legislators claim is intended to alleviate the economic damage caused by the responses to the unfolding pandemic: closures of schools and businesses as well as the social isolation of much of the population. The second–a reported 3 million new unemployment claims in the last week alone–is a direct...

Read More »Tcherneva on the Green New Deal and Job Guarantee in France

Michael Stephens | February 5, 2020 Pavlina Tcherneva recently participated in a hearing before a parliamentary group (La France insoumise) of France’s National Assembly on the subject of the Green New Deal and the job guarantee (the intro is in French; Tcherneva’s testimony is in English): [embedded content] $title = the_title('','',false); ?> if ($title == 'Contributors') {...

Read More »Minsky Explains Financial Instability

Michael Stephens | December 10, 2019 In this rare video from 1987 (there is very little surviving footage of Minsky discussing his work), Hyman Minsky summarizes his theory of the financial fragility at the heart of modern capitalist economies: [embedded content] This was part of an event in Bogotá, Colombia (which is discussed in this working paper by Iván D. Velasquez). $title =...

Read More »Join Us for the 11th Minsky Summer Seminar

Michael Stephens | October 23, 2019 The Hyman P. Minsky Summer SeminarLevy Economics Institute of Bard CollegeBlithewoodAnnandale-on-Hudson, N.Y. June 7–13, 2020 The Levy Economics Institute of Bard College is pleased to announce the 11th Minsky Summer Seminar will be held from June 7–13, 2020. The Seminar will provide a rigorous discussion of both the theoretical and applied aspects of Minsky’s economics, with an...

Read More »Bloomberg Interview: Wray on Modern Monetary Theory

Michael Stephens | July 31, 2019 Bloomberg Businessweek‘s Cristina Lindblad and Peter Coy sat down with L. Randall Wray for an in-depth interview on Modern Monetary Theory: $title = the_title('','',false); ?> if ($title == 'Contributors') { //get_levy_contributors(); } ?> Comments

Read More » Multiplier Effect

Multiplier Effect