Responding to today’s ONS Labour Market statistics, New Economics Foundation looks at what’s going on behind the headline figures on wages and inflation. Alfie Stirling, Head of Economics at the New Economics Foundation, said: “While it is welcome news to see regular pay slightly higher at the beginning of 2018 in real terms than at the same time in 2017, the bigger picture makes for grim reading. “Almost 10 years on from the financial crisis, growth in regular wages has stalled dramatically, with earnings growth broadly flat or worse since March 2016. The latest data also shows that when bonuses are included, total pay in February reached the lowest monthly level seen in 2 years. “The bottom line is that Britain’s

Topics:

neweconomics considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Responding to today’s ONS Labour Market statistics, New Economics Foundation looks at what’s going on behind the headline figures on wages and inflation.

Alfie Stirling, Head of Economics at the New Economics Foundation, said:

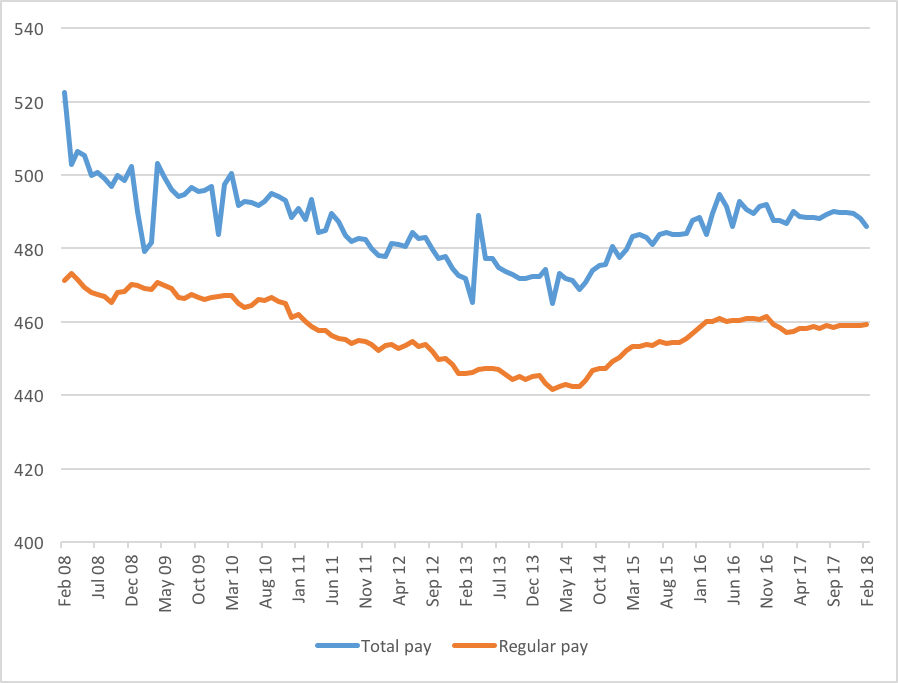

“While it is welcome news to see regular pay slightly higher at the beginning of 2018 in real terms than at the same time in 2017, the bigger picture makes for grim reading.

“Almost 10 years on from the financial crisis, growth in regular wages has stalled dramatically, with earnings growth broadly flat or worse since March 2016. The latest data also shows that when bonuses are included, total pay in February reached the lowest monthly level seen in 2 years.

“The bottom line is that Britain’s current economic model is broken. A growing economy is failing to translate into higher wages for the majority of people, with average earnings not expected to return to their pre-crisis peak until 2025.”

Average weekly total and regular pay (£, 2015 prices)