Blog Families across the country are feeling the squeeze Graduates, nurses, and minimum wage workers are making sacrifices on essentials like the weekly shop or replacing clothes and shoes in London, the red, and blue walls By Jeevun Sandher, Sam Tims 24 October 2022 Families are already struggling to afford the essentials, like household bills or a trip to the dentist. That is set to get significantly worse in the year ahead as earnings and social security payments fall short of rising prices and rents. New analysis by the

Topics:

New Economics Foundation considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Families across the country are feeling the squeeze

Graduates, nurses, and minimum wage workers are making sacrifices on essentials like the weekly shop or replacing clothes and shoes in London, the red, and blue walls

24 October 2022

Families are already struggling to afford the essentials, like household bills or a trip to the dentist. That is set to get significantly worse in the year ahead as earnings and social security payments fall short of rising prices and rents. New analysis by the New Economics Foundation (NEF) shows that, by next April, a broad spectrum of working-age families across the UK — graduate couples, nurses, and shop workers on the minimum wage in London, and the red and blue walls – all won’t be able to afford the cost of living.

The energy price freeze did not end the cost of living crisis. Almost half of us are struggling to pay our energy bills and there are 2.6 million children going hungry. Even with the energy price cap frozen, rising food and rental costs will hit those on lower incomes hardest. It is unclear what the government plans to do when the price freeze ends, but it is likely that households will face higher energy prices through their bills and/or through higher prices as businesses pass on energy costs to consumers.

Our analysis uses the Minimum Income Standard (MIS), which is the UK’s leading approach to measuring living standards based on need and is used to calculate the‘real’ Living Wage paid by companies like Ikea and KPMG, and football clubs like West Ham, Liverpool, and Everton.

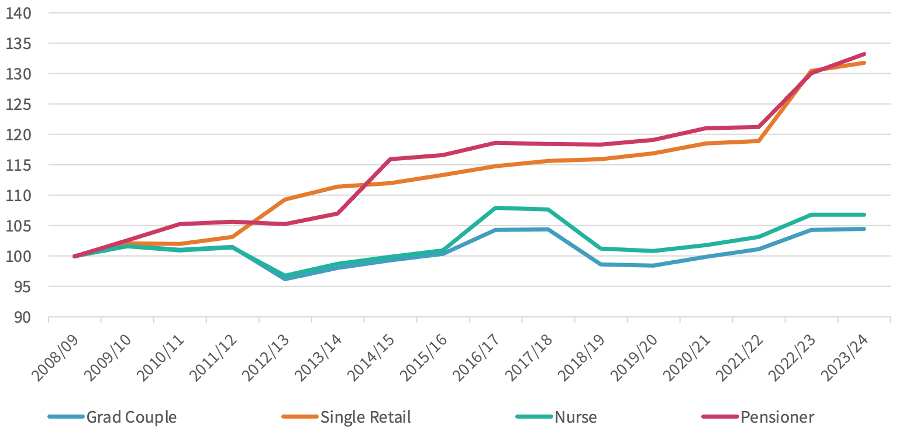

With necessities like rent and food rapidly increasing, the cost of meeting the MIS is rising in real terms. We expect overall inflation to be at just over 10.5% and rents at 7.5% next April. Figure 1 shows that the MIS will rise slightly faster by 11.3% in 2023/24 for a single person because both energy and food prices are set to increase faster than the headline inflation rate in the coming year.

Figure 1: The MIS has risen faster than prices in recent years

Real value of the cost of living for four household types in the red wall, as measured by the MIS

Source: Annual MIS budgets data from the CRSP. 2023/24 inflation estimated at 10.5% with different rates for food, energy and rent.

As both earnings and social security payments are expected to increase by only 5.5%, families across the spectrum are set to be worse off in real terms and unable to afford the cost of essentials. We’ve calculated how many families will be below the MIS in a London local authority (Haringey), a red wall constituency (Bolsover), and a blue wall one (north-west Somerset).

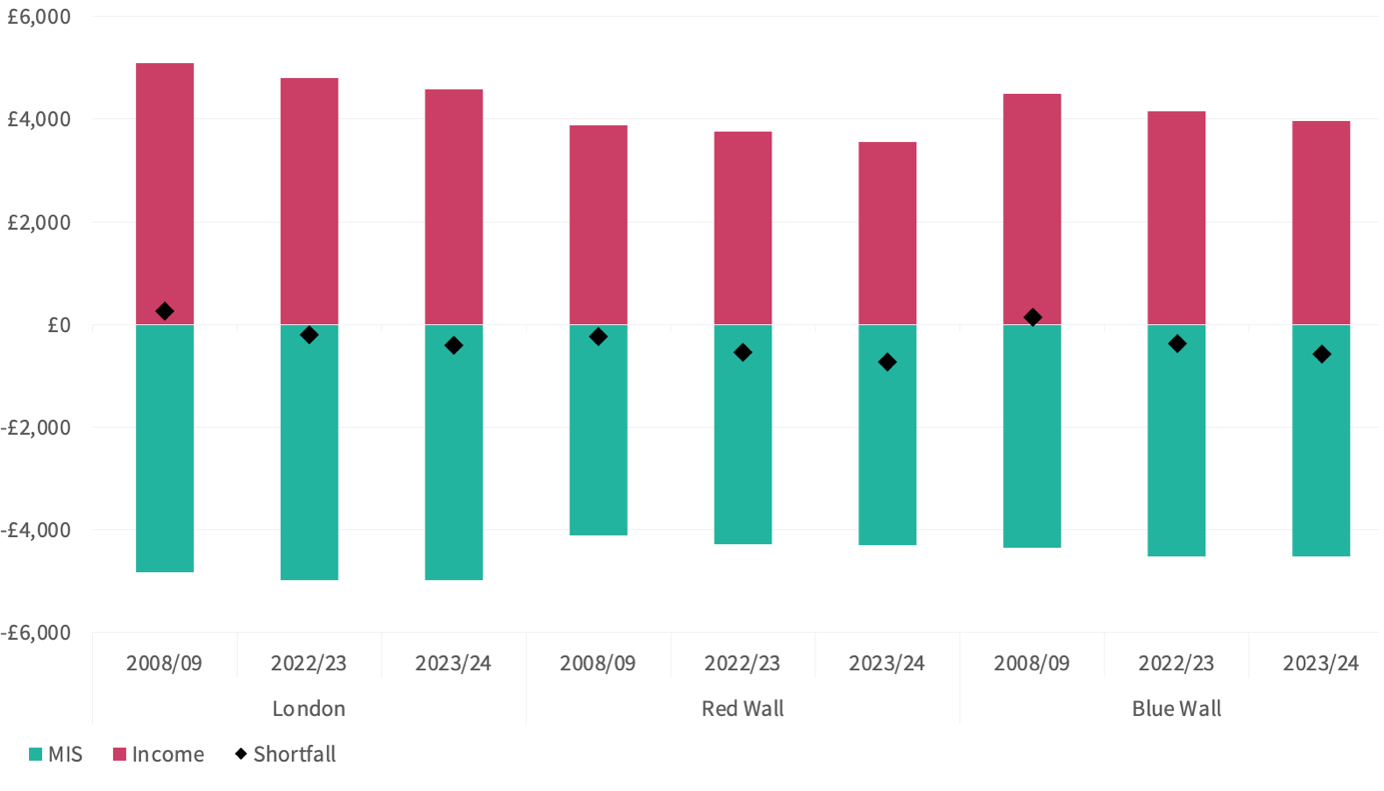

Even graduate families we might consider comfortable cannot afford the MIS in any part of the country we examine, with those in the red wall on the lowest wages facing the largest shortfalls. A graduate couple with two children in London, the blue wall, and red wall are between £200 (London) and £540 (red wall) a month short of the MIS in 2022/23. This shortfall is set to rise to between £410 (London) and £740 (red wall) next year.

A key reason why graduates cannot afford the cost of living is that they face a higher marginal tax rate in the form of student loan repayments set at 9% on earnings over £27,295 in 2022/23. This threshold will fall to £25,000 in 2023/24, meaning an effective tax rise of around £200 a year with a lower repayment threshold.

Figure 2: Graduate families cannot afford a basic standard of living

Illustrative net income of two graduates with two children compared to their MIS before housing costs, over time and region, in 2022/23 prices

Source: Annual MIS budgets data from the CRSP, earnings based on ASHE datasets. 2023/24 inflation estimated at 10.5% with different rates for food, energy and rent.

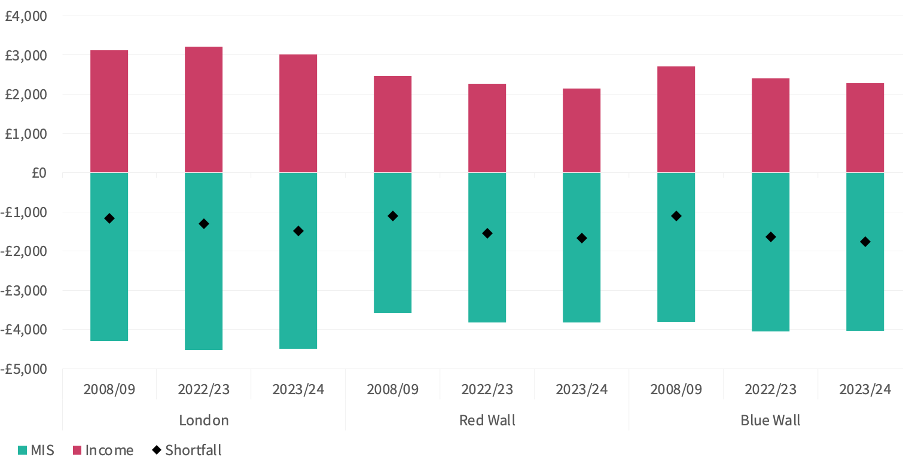

Unsurprisingly, those in lower paid jobs are struggling even more. The minimum wage is nowhere near sufficient to ensure a retail worker can afford the cost of essentials in any part of the country. A single full-time worker on the minimum wage is £470 a month short of the MIS in London; £380 in the red wall; and £400 in the blue wall this year. That is set to rise dramatically in the year to come to £580, £480, and £490 respectively.

Our analysis finds that in 2022/23, only single minimum wage workers in London received any support from social security. Minimum wage workers, who do not gain any additional social security payments for their children or a disability, generally earn too much to receive Universal Credit (UC) payments and nowhere near enough to afford a basic standard of living. Minimum wage workers in London previously gained some UC payments for their housing costs but, as of next year, their rise in nominal earnings coupled with a freeze in housing entitlement means they won’t even get that.

The government’s response to the cost of living crisis has been to provide one-off payments for those on means-tested benefits and a payment to those receiving disability support. If the same policy lever is used in the year to come, none of the minimum wage workers we examine here would receive this extra support, despite the growing shortfall between their income and living costs.

Figure 3: Minimum wage workers are sinking further below the MIS

Illustrative net income of a worker on the national living wage compared to their MIS before housing costs, over time and region, in 2022/23 prices

Source: Annual MIS budgets data from the CRSP, earnings based on ASHE datasets. 2023/24 inflation estimated at 10.2% with different rates for food, energy and rent.

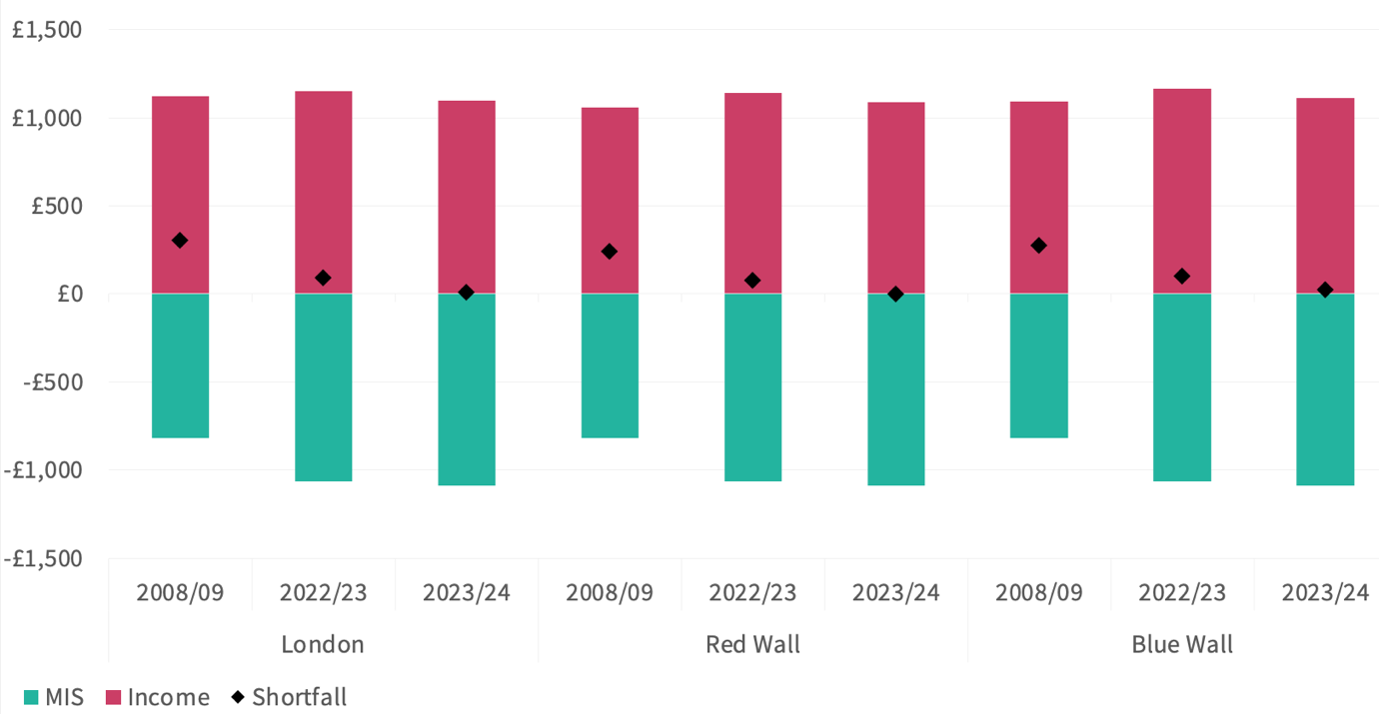

Of all the family types we look at, a nurse with two children is by far the least able to meet the MIS, with incomes falling £1,450 to £1,750 per month short in 2023/24. The key reason is dramatic cuts to nurses’ real earnings over the past decade. With a shocking 5% pay offer this year, the wages of a newly qualified band five nurse are between £1,850 and £2,400 lower this year compared with 2008/09. If nurse pay grows at 5.5% next year, they stand to see a real terms pay cut of £3,000 to £3,800 compared to 2008/09.

When nurses cannot earn enough to afford the basics, it makes us and our loved ones poorer and sicker. Poverty wages for nurses have led to around 50,000 unfilled nursing positions in England, while we’re experiencing record NHS waiting lists and increasing delays at A&E. When we can’t get the healthcare we need, that makes us less productive at work and reduces our long-term prosperity.

Figure 4: Nurses will be over £1,450 short per month of the MIS next year

Illustrative net income of a single nurse with two children compared to their Minimum Income Standard before housing costs, over time and region, in 2022/23 price

Source: Annual MIS budgets data from the CRSP, earnings based on ASHE datasets. 2023/24 inflation estimated at 10.2% with different rates for food, energy and rent.

The only family type we examine that reaches the MIS is single pensioners with no housing costs (i.e. they own their own home outright). This is the typical situation for pensioners – around 75% of pensioners own their own home outright, with another 5% having a mortgage to repay.

Figure 5: Pensioners with no housing costs can afford a basic standard of living

Illustrative net income of a single pensioner with no housing costs compared to their MIS, over time and region, in 2022/23 prices

Source: Annual MIS budgets data from the CRSP, income based on DWP’s Pensioner’s Income Series datasets, data for 2022/23 and 2023/24 uses regional earnings growth. 2023/24 inflation estimated at 10.2% with different rates for food, energy and rent.

Note: This person is eligible for the disabled element of WTC

The chancellor’s plans to end the freeze on energy prices means that families — who are already feeling the squeeze – will face a financial cliff edge next spring. At NEF, we’re calling for a new cost of living support package to begin in April 2023. This would include a new free energy entitlement for all families, a temporary £750 universal payment while energy prices remain elevated, and a permanent £1,000 boost to means-tested benefits.

But in the longer-term, we need to redesign our economy so that families feel the benefits of their hard work, rather than being ground-down by big bills and low incomes. This looks like the permanent boost to incomes through the £1,000 increase to social security payments paid for by wealth taxes; more comfortable, affordable housing so everyone has a safe place to call home; and keeping our energy bills low for good by investing in renewables and home insulation. We can end this cost of living scandal and ensure everyone can always afford life’s essentials.

Notes

Calculated increases in the MIS between 2022/23 and 2023/24 assume a headline inflation rate of 10.5%. We have then adjusted components of the CPI index to account for a 27% increase in energy costs, a 20% increase in food bills and a 7.5% increase in rent. Note that at the time of analysis, the energy price guarantee was still Government policy for April 2023.

Graduate incomes are calculated as the average income within a local authority. Pensioner incomes are calculated as the average income for the region which the constituency is in. Nurse earnings are for a newly qualified Band 5 nurse, with a London uplift in the capital.

The illustrative examples use private rents at the 25th percentile for London, Bolsover and north-East Somerset. Changes in the housing component of the MIS are used to obtain historical rent estimates for each household type. Graduate earnings are taken from the annual survey of hours and earnings regional dataset.

Topics Inequality Work & pay