Blog Lets’s talk up the benefits of taxing carbon Brits support the principle that polluters must pay, but we need to to see the benefits of carbon taxes too By Chaitanya Kumar 23 October 2023 Tax is a simple and effective way of reducing the impact of pollution on people while holding polluters accountable. The UK’s carbon tax has had a considerable impact over the last decade. The UK Carbon Price Support (CPS) was an additional tax on polluters, primarily power generators, introduced in 2013 above the market price set by the EU Emissions

Topics:

New Economics Foundation considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Lets’s talk up the benefits of taxing carbon

Brits support the principle that polluters must pay, but we need to to see the benefits of carbon taxes too

23 October 2023

Tax is a simple and effective way of reducing the impact of pollution on people while holding polluters accountable. The UK’s carbon tax has had a considerable impact over the last decade.

The UK Carbon Price Support (CPS) was an additional tax on polluters, primarily power generators, introduced in 2013 above the market price set by the EU Emissions Trading Scheme (EU ETS). At a premium of £18 a tonne, it was instrumental in pricing out coal from the power system, dramatically cutting the UK’s carbon emissions and pushing the country ahead of the other G7 nations.

The tax has been a boost to the exchequer, generating almost in tax revenue £10bn in the last decade. Yet none of those billions has been ploughed back into public goods, such as the green economy or other initiatives. A 2019 study showed how countries like Switzerland, Sweden, Denmark and Ireland and France have either used their carbon tax revenue to lower household bills or allocated it for spending on green infrastructure. Unlike other countries, all the UK’s receipts have disappeared into general funds.

So it’s deeply worrying to hear politicians attempt to play off the concerns of families hit by inflation, against efforts to get to net zero. Especially given we know that the cost-of-living crisis itself was largely driven by an explosion in the cost of heating homes with gas, often to the benefit of energy companies like BP and Shell. Instead, our leaders ought to be playing up the huge economic positives of going fast towards our climate targets.

Both the government and opposition are clearly missing a simple trick — of showing how taxes on carbon pollution, which consumers ultimately pay through their bills, will be used to ease the burden of the transition.

A useful parallel is the windfall tax on energy producers which boosted the Treasury’s coffers during the last fiscal year. The tax offered a simple narrative for the government, and particularly for the opposition — that energy companies, which are raking in billions every quarter, should rightly be taxed and the revenue given back to households and firms. In fact, the principle that the ‘that principle polluter pays’ is popular with the public.

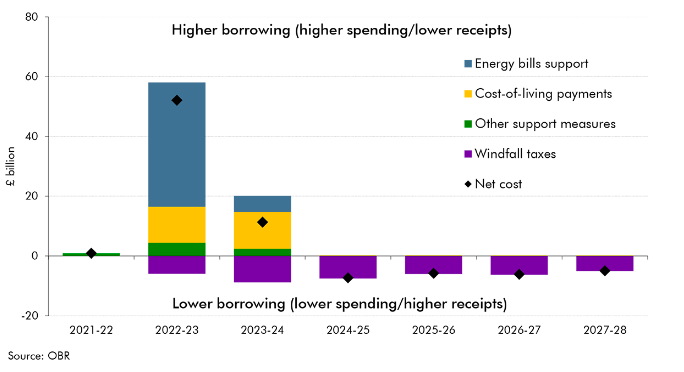

The tax also made basic economic sense helping the government recoup almost half the cost of the energy bills support given to households. The windfall tax generated £39 billion towards the overall £79 billion cost of energy support measures, according to the Office for Budget Responsibility.

Last year, at the height of the energy crisis, government coffers ballooned over £6bn with higher than normal receipts from the carbon market. This is equivalent to funding the Energy Bill Support scheme of the government for more than half the population. But it hardly made the news. Considering the febrile nature of our current politics and the weaponisation of net zero, it would perhaps be sensible for politicians to start talking about how they are already taxing pollution and how they intend to support households in the net zero transition through that revenue.

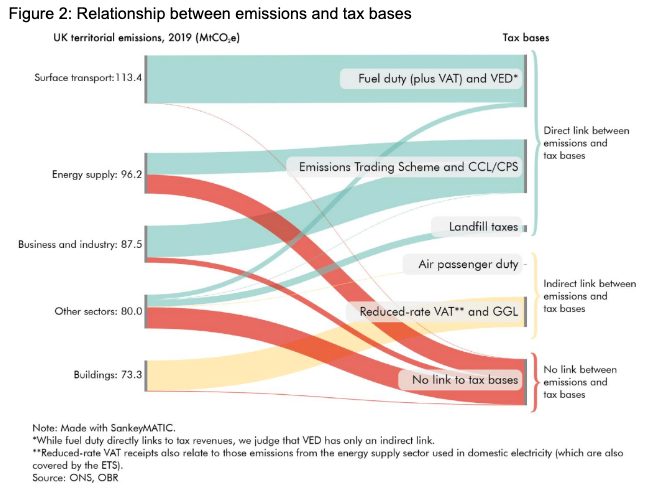

This is of course a play on winning the political narrative on net zero as the actual revenues from these taxes are set to decline over the coming decade. This is ultimately good news as it would indicate that there is less and less carbon to be taxed. However, it would open the political window for exploring more comprehensive carbon taxes that capture sectors that aren’t covered by the UK ETS (eg. surface transport and buildings). Figure 2 below from the OBR explores how different emissions are taxed, or not taxed, under current policy. A quarter of all territorial emissions are not linked to any tax base while a further 16% have only an indirect link.

As things heat up towards the elections in the UK and both leading parties seemingly align on traditionally conservative policies on economic matters of tax and borrowing, it would seem we are back to the Osbourn era of austerity, if only by stealth. So finding new ways of taxing polluters and pollution will be important if we are to get out of the fiscal straitjackets that politicians have tied themselves in. Here are a few ideas worth considering:

- Carbon fee and dividend — which builds on the above idea of recycling the revenue from carbon taxes back to people via bills, income tax rebates or other easily administered mechanism.

- Carbon takeback obligation — wherein polluters are obligated to put back into the ground or into permanent storage, the amount of carbon they have emitted by extracting and burning fossil fuels. The idea goes beyond a simple tax which, if not adequate, will give polluters a free reign. The takeback scheme instead imposes an obligation, and a corresponding penalty, for sequestering and storing carbon.

- Private jet tax and a frequent flyer levy- both of these will reduce the significant impact of flying by increasing the cost of flying privately and frequently.

Merely renaming the existing carbon tax, soporifically titled the Carbon Price Support (CPS), could be a useful tool in playing to the public’s notion of fairness and taxing the polluters, as long as the tax revenues are appropriately used in mobilising society wide support for the transition.

Image: Eric Latham

Topics Climate change Macroeconomics