Blog The autumn budget: A step in the right direction but still falling short There were some welcome wins in Labour's first budget, though it's unlikely to deliver the change we need on inequality and public services By Amy Clancy 04 November 2024 In many ways, this was a brave first budget from the chancellor. By redefining public debt, the chancellor opened the door for increased investment in vital infrastructure. This bold move is more than just a budget tweak; it represents a significant shake-up of the fiscal rules. However, investing in

Topics:

New Economics Foundation considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

The autumn budget: A step in the right direction but still falling short

There were some welcome wins in Labour's first budget, though it's unlikely to deliver the change we need on inequality and public services

04 November 2024

In many ways, this was a brave first budget from the chancellor. By redefining public debt, the chancellor opened the door for increased investment in vital infrastructure. This bold move is more than just a budget tweak; it represents a significant shake-up of the fiscal rules. However, investing in infrastructure alone, without comparable investment in people and services, is like buying a new fleet of vehicles without budgeting for fuel and maintenance.

One of the main areas in which this budget falls short is ensuring the wealthiest pay their fair share of taxes. Despite opportunities for significant tax reform, the budget’s modest adjustments left untouched key mechanisms that could support the poorest in society and help fund public services. Aligning capital gains tax with income tax could have raised an additional £14 billion annually, providing a substantial boost to essential services that have suffered from years of cuts and underinvestment.

This missed opportunity has real consequences. Tax is not only a way to fund public services that have been battered by over a decade of austerity, but also a tool for reducing inequality. Failing to close the significant gap between the richest and the poorest by equalising taxes on wealth and income perpetuates an unfair system that favours those who accumulate wealth passively over those who earn through work.

Furthermore, NEF’s analysis on the budget’s tax threshold adjustments reveals how raising tax-free thresholds may actually deepen inequality. While this move increases disposable income, the benefit flows disproportionately to wealthier households, who gain nearly eight times as much compared to the poorest. This disparity underscores a critical gap in the budget: while some gains were made, policies that focus on genuine wealth redistribution are essential to close the income gap sustainably.

Positive Steps Forward

While imperfect, the budget does include many welcome measures, which NEF has advocated for.

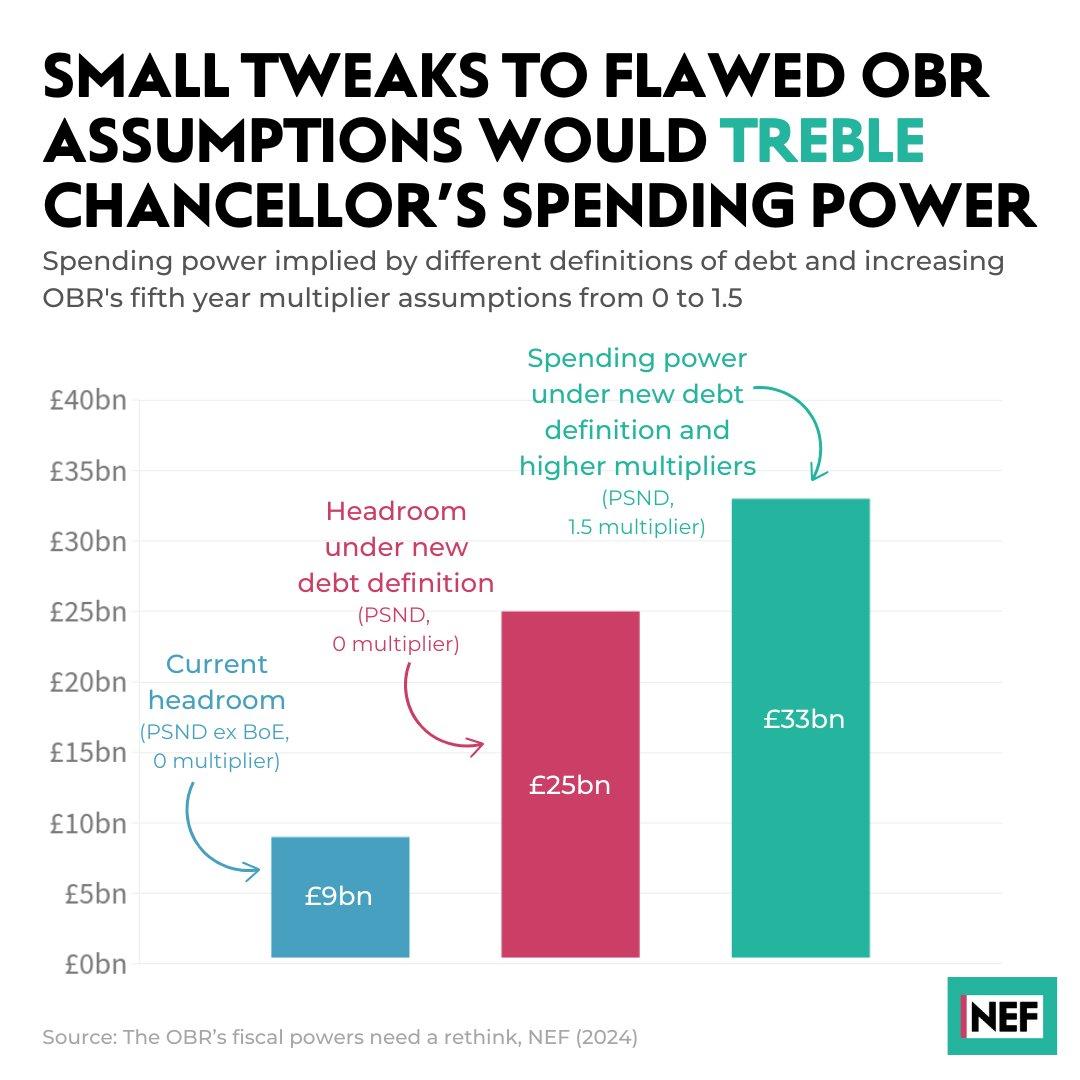

1. 10-Year Growth Forecasts: The OBR will produce 10-year growth forecasts to better assess the long-term benefits of investment. However, more small changes to these assumptions could unlock tens of billions in extra spending power.

2. Capital Gains and Inheritance Tax Reform: Raising capital gains and closing inheritance tax loopholes is a good first step towards making our tax system fairer. However, fully equalising capital gains and income tax, which NEF has been calling for, could have raised an additional £14 billion annually.

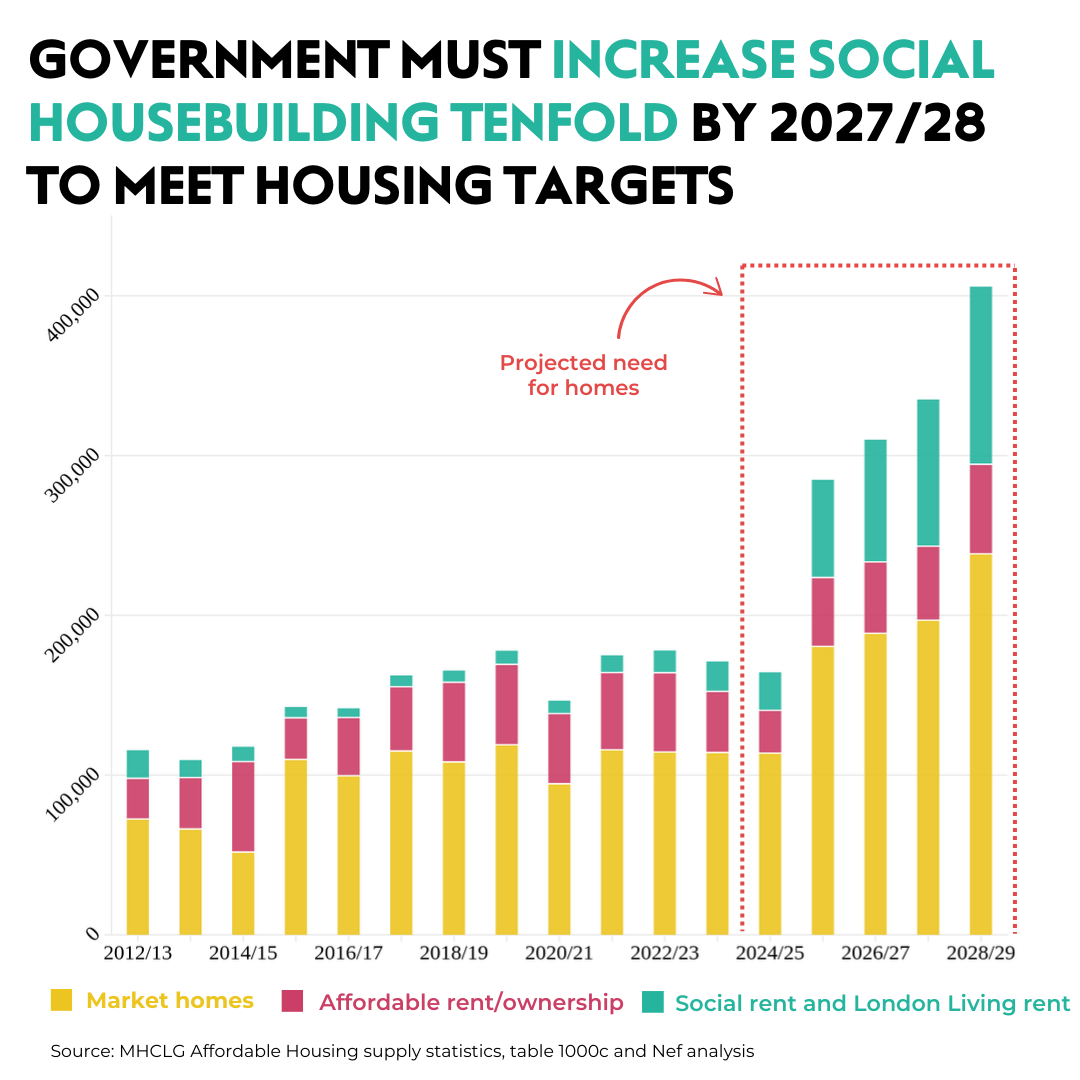

3. Social Housing Investment: Increasing funding for social housebuilding is welcome news. However, much more is needed at the spending review to meet the government’s own house building target of 1.5million. NEF analysis found they will need to be building 90,000 social homes annually by 2027/2028.

4. Right-to-Buy Reform: Reducing discounts on Right to Buy and allowing councils to retain 100% of sales revenue was a welcome change. This will help slow the loss of social homes and support local councils in building more of their own housing, and curbing rising homelessness.

5. Stamp Duty on Second Homes: Increasing stamp duty on second homes, as NEF has been calling for, is a positive move to prioritise primary homeownership. However, further steps, like charging overseas buyers and including national insurance for landlords, could raise an additional £1 billion.

6. Universal Credit Debt Deductions: Reducing the debt deduction rate on Universal Credit is a step toward alleviating hardship of those trapped in a cycle of debt and low-income. Earlier this year, NEF analysis showed that the government was taking £1.6bn a year from low-income households for debt repayments. However, the maximum deduction rate of 25% can still severely impact low-income households.

While we celebrate these positive changes, they are only partial solutions to broader systemic issues.

NEF has and will continue to advocate for bold, people-focused policies, calling for measures like eliminating the two-child limit on benefits and implementing accessible, affordable public transportation nationwide. These policies would have immediate, tangible benefits for individuals and families struggling under current economic pressures.

A Challenge for Future Budgets

The Autumn Budget shows signs of progress but ultimately reflects a cautious approach. The Chancellor has shown courage in increasing borrowing for investment, but there’s more to be done. With stagnant public services and rising inequality, the challenge ahead is clear: deliver a budget that raises living standards, rebuilds essential services, and ensures the wealthiest contribute fairly. The opportunity is there, but it will take sustained, people-first policies to seize it.

For a deeper look at NEF’s recommendations, read the full analysis on the Autumn Budget and thresholds here.

Image: Flickr