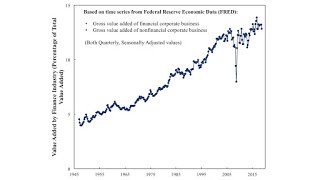

The Growing Importance of Finance in the Post-War U.S. Economy As I understand it, Marco Rubio takes from Post Keynesians the idea that, during the post-war golden age, investment decisions were dominated by industrial firms. But now, they are dominated by financial corporations. This change has been accompanied by deleterious effects on economic growth, stagnant wages, and an upward shift in the distribution of income and wealth. The increasing importance of finance in the economy in the United States, at least, is illustrated by the above graph. The impact of the global financial crisis is immediately apparent in 2008. The distinction between having investment directed by finance or by industry might not make any sense to you if you think of every investment as like purchasing a

Topics:

Robert Vienneau considers the following as important: Profile of an Economist

This could be interesting, too:

Robert Vienneau writes Paul Davidson (23 October 1930 – 20 June 2024)

Robert Vienneau writes David Champernowne

Robert Vienneau writes Toni Negri, Bob Solow, Tony Thirwall

Robert Vienneau writes Victoria Chick (1936 – 2023), James Crotty (1940 – 2023), Makoto Itoh (1936 – 2023)

|

| The Growing Importance of Finance in the Post-War U.S. Economy |

As I understand it, Marco Rubio takes from Post Keynesians the idea that, during the post-war golden age, investment decisions were dominated by industrial firms. But now, they are dominated by financial corporations. This change has been accompanied by deleterious effects on economic growth, stagnant wages, and an upward shift in the distribution of income and wealth. The increasing importance of finance in the economy in the United States, at least, is illustrated by the above graph. The impact of the global financial crisis is immediately apparent in 2008.

The distinction between having investment directed by finance or by industry might not make any sense to you if you think of every investment as like purchasing a bond. In this sort of way of looking at things, every investment can be evaluated by a Return On Investment, taking suitable account of risk, the payback period, and so on. It does not matter if one is talking about a college degree; research and development in, say, clean energy; a painting by Monet; or a stock option. To the financier, it is all one.

I take some of the most notable work of Alfred Eichner (1937-1988) as a description of the previous era. Eichner learned a lot about how corporations set prices by looking at the results of Senate Committee on the Judiciary, Subcommittee on Antitrust and Monopoly, as chaired by Estes Kefauver. Various corporate executives from the steel industry testified. Rubio, as I understand it, could similarly investigate how American businesses operate now.

Eichner theorized megacorporations. These are corporations that operate multiple plants and produce multiple products and that try to maintain market power. Eichner took aboard the idea, as developed by Gardiner Means and Adolfe Berle (1932), that ownership and control are separate in the modern corporation. In a sense recently explained by Dan Davies, Eichner's approach is microfounded. His theory is consistent with recognizing the principal agent problems that come about when a corporate board is somewhat independent of stock owners, when corporate executives are another group of personnel, and so one. According to Eichner, managers in the megacorp are interested in pursuing a satisfactory rate of growth, not in maximizing economic profits.

Eichner recognizes that corporations set prices as a markup on costs. He builds on the survey findings of R. L. Hall and C. J. Hitch. Eichner's ideas relate to theories of administered or full cost pricing. I guess they are consistent with Robin Marris's managerial theory of the firm.

Markups vary among industries and within an industry over time. How is the markup set? According to Eichner, the markup, at least for industry leaders in price-setting, are put at the level needed to finance investment for planned growth targets. Eichner draws an analogy to a tax, in the Soviet Union, on turnover. This tax was used to finance planned investment.

Eichner had some correspondence with Joan Robinson. He saw his theory of the megacorp as compatible with Post Keynesian theories of growth.

I explicitly do not claim that this theory is descriptive of how investment is determined nowadays in the United States. But I find lots of interesting ideas here.

References- Alfred S. Eichner. 1973. A Theory of the Determination of the Mark-up Under Oligopoly pp. 1184-1200.

- William Milberg (ed.) 1992. The Megacorp & Macrodynamics: Essays in memory of Alfred Eichner M. E. Sharpe.

Heterodox

Heterodox