Figure 1: Real Factor Price Frontier1.0 Introduction I am planning on posting at an even slower rate for a while. This post continues my exploration of a way of visualizing the choice of technique proposed by Carlo Milana. In this post, I show how to correctly apply his visualization to an example from my 2017 ROPE paper. 2.0 Technology Two techniques are available for producing corn, the consumption good. Each technique consists of a flow-input, point-output technology, with a finite number of dated labor inputs. The technology can also be represented with intermediate produced commodities explicitly shown. Table 1 sets out the example as a Leontief input-output table, in some sense. Each column lists the inputs in a production process needed to produce a unit output of the

Topics:

Robert Vienneau considers the following as important: Example in Mathematical Economics, Sraffa Effects

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Robert Vienneau writes Double Fluke Cases For Triple-Switching In The Corn-Tractor Model

Robert Vienneau writes The Emergence of Triple Switching and the Rarity of Reswitching Explained

Robert Vienneau writes Recap For A Triple -Switching Example

|

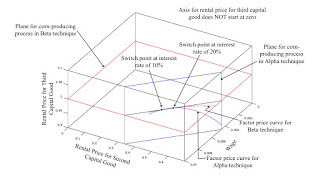

| Figure 1: Real Factor Price Frontier |

I am planning on posting at an even slower rate for a while.

This post continues my exploration of a way of visualizing the choice of technique proposed by Carlo Milana. In this post, I show how to correctly apply his visualization to an example from my 2017 ROPE paper.

2.0 TechnologyTwo techniques are available for producing corn, the consumption good. Each technique consists of a flow-input, point-output technology, with a finite number of dated labor inputs. The technology can also be represented with intermediate produced commodities explicitly shown. Table 1 sets out the example as a Leontief input-output table, in some sense. Each column lists the inputs in a production process needed to produce a unit output of the commodity named in the column heading. The entries for the row for corn are all zero, indicating it is not an input into any production process. All processes require a year to complete and completely use up their commodity inputs in producing their outputs. Each process requires a year to complete, and inputs must be hired at the start of the year, independently of when payments for inputs are contracted to be paid out. The example includes four factors of production: labor, and three capital goods.

| Input | Industry 1 | Industry 2 | Industry 3 | Corn Industry | |

| Alpha | Beta | ||||

| Labor | 50 | 0 | 115 | 66 | 0 |

| Commodity 1 | 0 | 1 | 0 | 0 | 0 |

| Commodity 2 | 0 | 0 | 0 | 1 | 0 |

| Commodity 3 | 0 | 0 | 0 | 0 | 1 |

| Corn | 0 | 0 | 0 | 0 | 0 |

The Alpha process consists of the processes for producing the first two commodities and the corn-producing process labeled Alpha. The Beta process consists of the process for producing the third commodity and the corn-producing process labeled Beta. The net output of a technique, when all processes comprising that technique are operated at the unit level, is a bushel of corn. The non-labor inputs needed to continue production with that technique are reproduced in the same quantities with this activation of processes.

3.0 Price SystemI here formulate systems of equations (and inequalities) in terms of spot prices and rental prices for factors of production. A rental price pays for the services of a factor of production, and is paid at the end of the year. I formulate the example with the following variables:

- wL: The wage, paid at the end of the year. Also known as the rental price for labor.

- p1: The spot price for the first produced capital good.

- w1: The rental price for the services of the first capital good.

- p2: The spot price for the second produced capital good.

- w2: The rental price for the services of the second capital good.

- p3: The spot price for the third produced capital good.

- w3: The rental price for the services of the third capital good.

- pc: The spot price for corn.

- r: The interest rate.

In a circulating capital model of long period positions, rental prices and spot prices relate like so:

wj = pj(1 + r), j = 1, 2, 3

Since this is not a model of a slave economy, no spot price exists for labor. Corn is never used as a factor of production and does not have a rental price.

The price equations are such that no extra profits can be made in any process. Furthermore, costs do not exceed revenues in any operated process. Corn is assumed to be the numeraire. Figure 1, above, graphs the solution. This is actually a two-dimensional representation of a projection of a four-dimensional structure into three dimensions. The fourth dimension is the rental price for the first produced capital good.

3.1 Prices for the Alpha TechniqueSuppose managers of firms have adopted the Alpha technique. The condition that the corn-producing process in the Alpha technique is adopted and pays no extra profits is expressed as:

66 (wL/pc) + (w2/pc) = 1

The above equation gives rise to the blue plane in the figure. The analogous condition for the process to produce the first capital good is expressed as:

50 (wL/pc) = (p1/pc)

The same sort of condition for the process for producing the second capital good is:

(w1/pc) = (p2/pc)

When the Alpha technique is adopted, prices may or may not enable managers of firms to activate the process for producing the third capital good. This condition is express as an inequality:

115 (wL/pc) ≥ (p3/pc)

In the graphed solution, the above inequality is treated as an equality, giving rise to the factor-price curve for the Alpha technique. An inequality arises for the corn-producing process in the Beta technique.

(w3/pc) ≥ 1

The above inequality cannot be combined with the other equations in the Alpha price system except between the switch points. That is, the factor price curve for the Alpha technique is the factor price frontier only between the switch points.

3.1 Prices for the Beta TechniqueNow suppose that managers of firms have adopted the Beta technique. The condition that the corn-producing process in the Beta technique is adopted and pays no extra profits is expressed as:

(w3/pc) = 1

The above equation gives rise to the red plane in the figure. The analogous condition for the process to produce the third capital good is expressed as:

115 (wL/pc) = (p3/pc)

Inequalities arise for the processes for producing the first and second capital goods:

50 (wL/pc) ≥ (p1/pc)

(w1/pc) ≥ (p2/pc)

Likewise, an inequality arises for the corn-producing process in the Beta technique:

66 (wL/pc) + (w2/pc) ≥ 13.3 Solution of Price Equations

Table 2 displays the solution for the two systems of equations and inequalities. The equations impose a relationship between the wage and the interest rate, either of which could be given from outside the period of production. Spot prices for the three capital goods can be found by discounting rental prices to the start of the year.

| Price | Alpha | Beta |

| (wL/pc) | 1/(2 (33 + 25 (1 + r)2)) | 1/(115 (1 + r)) |

| (w1/pc) | 25 (1 + r)/(33 + 25 (1 + r)2) | 10/23 |

| (w2/pc) | 25 (1 + r)2/(33 + 25 (1 + r)2) | 10 (1 + r)/23 |

| (w3/pc) | 115 (1 + r)/(2 (33 + 25 (1 + r)2)) | 1 |

In both systems of equations, the rental prices of factors of production are expressed as functions of the interest rate. That is, factor price curves in Figure 1 are specified parametrically. Both factor price curves lie in their respective planes. Switch points lie on the intersection of the two planes in Figure 1. Outside the switch points, the factor price curve for the Beta technique is the factor price frontier. Between the switch points, the factor price curve for the Alpha technique is the factor price frontier.

4.0 ConclusionMilana is correct in asserting that the interest rate is not a factor price, that is, a rental price for the services of a factor of production. The label "factor price frontier" should properly be reserved for a locus in the space of rental prices. This post has illustrated these claims by showing how to draw such a factor price frontier for a reswitching example with a specific structure.

Heterodox

Heterodox