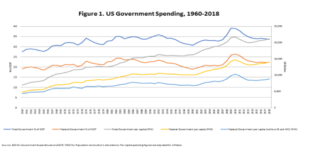

By L. Randall Wray This blog is based on the testimony I provided to the US House of Representatives. My written statement will be published in the Congressional Record (a version is also at the Levy Economics Institute: http://www.levyinstitute.org/publications/statement-of-senior-scholar-l-randall-wray-to-the-house-budget-committee. The full statement was co-authored with Yeva Nersisyan. I will argue that the Federal Government’s deficit and debt are not so scary as we are led to...

Read More »STATEMENT: House Budget Committee, “Reexamining the economic costs of debt”, Nov 20, 2019

By L. Randall Wray This blog is based on the testimony I provided to the US House of Representatives. My written statement will be published in the Congressional Record (a version is also at the Levy Economics Institute: http://www.levyinstitute.org/publications/statement-of-senior-scholar-l-randall-wray-to-the-house-budget-committee. The full statement was co-authored with Yeva Nersisyan. I will argue that the Federal Government’s deficit and debt are not so scary as we are led to...

Read More »STATEMENT: House Budget Committee, “Reexamining the economic costs of debt”, Nov 20, 2019

By L. Randall Wray This blog is based on the testimony I provided to the US House of Representatives. My written statement will be published in the Congressional Record (a version is also at the Levy Economics Institute: http://www.levyinstitute.org/publications/statement-of-senior-scholar-l-randall-wray-to-the-house-budget-committee. The full statement was co-authored with Yeva Nersisyan. I will argue that the Federal Government’s deficit and debt are not so scary as we are led to...

Read More »ALTERNATIVE PATHS TO MMT

[ed. This was part Randy’s Talk at ICAPE.] By L. Randall Wray First I’ll clearly state what MMT is and then outline four paths that lead to MMT’s conclusions: history, logic, theory and practice. What is MMT? It provides an analysis of fiscal and monetary policy that is applicable to national governments with sovereign currencies. There are four requirements that identify a sovereign currency: the national government a) chooses a money of account; b) imposes obligations (taxes, fees,...

Read More »Wray Appearing Before Congress

L. Randall Wray will be providing testimony for Congress on November 20 at 10 am. The topic is the government debt and deficits. His full statement will be available at 10:30AM at the Levy Institute. His goal is to explain a) why we needn’t fear sovereign government deficits and debt; b) why in some important sense, deficits and rising debt are “normal”; c) the deficit is in any case largely outside the control of Congress; d) deficits and rising debt ratios will not lead to government...

Read More »MMT: REPORT FROM THE FRONT (PART 3)

By L. RANDALL WRAY In this part, I’ll resume with comments on the critical contributions to the special issue of rwer. We finished Part 2 with a discussion of the shocking lack of citations to MMT literature in the critiques—especially the dearth of citations to the more academic contributions (as opposed to the summaries of MMT written for undergrads and the general public). Let me return to the oversight of contributions made by scholars such as Fullwiler and Tymoigne—who have mostly...

Read More »MMT: REPORT FROM THE FRONT (PART2)

By L. Randall Wray PART 2 In Part 1 I discussed the third annual MMT conference that was recently held at Stony Brook, and you can find the program as well as videos of the conference here: (https://www.mmtconference.org/). In this Part 2 I discuss a special issue of real-world economics review devoted to MMT (http://www.paecon.net/PAEReview/issue89/whole89.pdf). As usual, my report stretched out to become too long for just 2 blogs so there will be a Part 3, coming later this week. And...

Read More »MMT: REPORT FROM THE FRONT

By L. Randall Wray PART 1 As many readers know, the third annual MMT conference was recently held at Stonybrook, and you can find the program as well as videos of the conference at the link: (https://www.mmtconference.org/). In addition, real-world economics review has just issued a new volume devoted to MMT (http://www.paecon.net/PAEReview/issue89/whole89.pdf). I’ll briefly address both, in two parts. I’ll talk about the conference in this one, and about the RWER papers in the second...

Read More »Bloomberg Interview: Wray on Modern Monetary Theory

Michael Stephens | July 31, 2019 Bloomberg Businessweek‘s Cristina Lindblad and Peter Coy sat down with L. Randall Wray for an in-depth interview on Modern Monetary Theory: $title = the_title('','',false); ?> if ($title == 'Contributors') { //get_levy_contributors(); } ?> Comments

Read More »JAPAN DOES MMT?

L. Randall Wray In recent days the international policy-making elite has tried to distance itself from MMT, often going to hysterical extremes to dismiss the approach as crazy. No one does this better than the Japanese. As MMT began to gather momentum, its developers began to receive a flood of calls from reporters around the world enquiring whether Japan serves as the premier example of a country that follows MMT policy recommendations. My answer is always the same: No. Japan is the...

Read More » Heterodox

Heterodox