I have been following with some amusement the death and resurrection of the Bitfinex exchange. Bitfinex was forced to suspend trading after losing nearly 120,000 BTC in a hacking on 2nd August. But instead of going into liquidation, as we might expect, it reinvented itself - as a bank.Bitfinex had been doing bank-like things ever since its creation in 2012. It accepted deposits from some of its customers, and lent out those deposits to other customers - with the depositors' permission,...

Read More »Negative rates and bank profitability

Banks are complaining. "Negative interest rates hurt our margins," they moan. Here's Commerzbank, for example, in its recent results announcement (my emphasis): Mittelstandsbank attained a solid result in a challenging market environment. The operating profit declined in the 2015 financial year to EUR 1,062 million (2014: EUR 1,224 million), yet remains at a high level. The fourth quarter accounted for EUR 212 million (Q4 2014: EUR 251 million). The full year revenues before loan loss...

Read More »A countercyclical credit bubble?

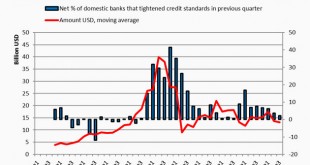

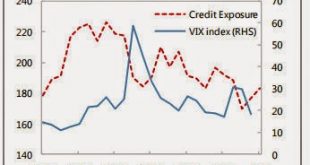

Over at VoxEU, Philippe Bachetta and Ouarda Merrouche have a surprising take on "countercyclical" lending. They show that lending by US and European banks in US dollars to European non-financial corporates massively increased from 2007-2009, and that this helped to soften the effect of the European credit crunch on employment: Over the period 2004 to 2009, we find that foreign credit denominated in dollar to non-financial corporates is countercyclical – it increased sharply (relative to...

Read More »GDP transactions in secondary markets

There is a widespread view that much bank lending is unproductive, i.e. does not raise GDP – or if it does, it does so in an unsustainable way by inflating asset prices or increasing inflation, rather than by increasing production. Many proposals for bank reform therefore envisage restricting banks to “productive” lending, by which usually seems to be meant business finance and short-term consumer credit. Financial transactions on secondary markets, and the purchase of second-hand...

Read More »The Fed’s IOER policy is not “paying banks not to lend”

Mainstream media get this wrong all the time. The latest to go down the "paying banks not to lend" rabbit hole is Binyamin Appelbaum in the New York Times. Because he didn't understand how IOER works, he didn't understand the Fed's strategy, and wrote a post that gets it quite seriously wrong. So I've written a Forbes post attempting to set things straight. Here's a taster: The FOMC has decided not to raise interest rates – for now. But it’s still widely expected that rate rises will come...

Read More »How do you say "dead cat" in Latvian?

This, my third post on Latvia, looks at its recovery from the 2008-9 recession.Latvia is often held up as the "poster child" for harsh austerity measures as the means of returning to strong economic growth. In order to hold its currency peg to the Euro, it embarked on a brutal front-loaded fiscal consolidation in 2009, sacking public sector workers, slashing public sector salaries, cutting benefits and raising taxes. Between 2010 and 2013 it cut its fiscal deficit from 10% of GDP to a...

Read More » Heterodox

Heterodox