In my last post, I debunked the myth of the "reserve pool" of British workers. In this post, I discuss three more labour force myths that refuse to die: the myth of the "tide of unskilled immigration"the myth of the falling participation rate, and the myth of the "workless yoof". There's also an update about my charity walk in the Lake District last Saturday, and a couple of pics. Read the post here. It's free to read.

Read More »Why the Tories’ “put people to work” growth strategy has failed

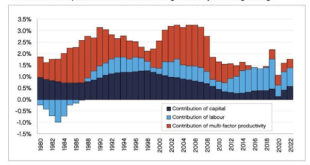

What do you do when your economy is in the doldrums and you need to kickstart growth?Why, you put more people to work, that's what you do.This has been the Tories’ strategy since 2010. The sustained attack on welfare benefits has all been focused on “making work pay” - encouraging, and at the margin forcing, people with illnesses, disabilities and caring responsibilities into paid work. But there is another way of putting more people to work, and that is to import them. In a new report, the...

Read More »Demons deserve our sympathy

My latest Coppola Comment post reflects on what we mean by "demons". Are they really the evil spirits of myth? Or are they a metaphor for something else - something all too human, and for many people, all too familiar?I spent last Saturday singing Elgar’s Dream of Gerontius. There’s a famous “Demon’s Chorus” in this piece, which made me think… well, about the demons. I felt sorry for them. Seriously. In the Dream of Gerontius, demons are an auditory representation of mindless evil and...

Read More »Trade lunacy is back

It’s election season in the U.S., marred only by the minor complication of a criminal trial involving one of the candidates. Trump is on the campaign trail, and he is going big on trade policy. Or rather, trade lunacy.Here’s Gavin Bade at Politico attempting to explain Trump’s trade policy: Trump is considering a 10 percent universal import tariff, the former administration officials said, and one result of that policy could be to make the dollar weaker relative to other currencies. This is...

Read More »The West must no longer tolerate Israel’s human rights breaches

My latest post at Substack examines the state of play in Gaza after six months of war. Fair to say, it is truly horrible. But more importantly, there is now overwhelming evidence that Israel has deliberately and systematically violated international humanitarian law. These violations could amount to genocide.On 28th March, the International Court of Justice decided that the situation in Gaza had significantly worsened since its original order in January imposing six "provisional measures"...

Read More »Is Gaza starving?

“Over one million people in Gaza are starving,” proclaims a dramatic headline in the Wall Street Journal. Citing a new report from the International Food Security Phase Classification (IPC), a partnership of 15 international agencies and non-government organisations, the Journal goes on to say: More than a million people in the Gaza Strip, around half of the enclave’s population, are experiencing famine-like conditions, according to new estimates by food-insecurity experts who found evidence...

Read More »We need to talk about the state pension

My post-Budget article for the Radix thinktank considers the future of the State Pension in the light of the Chancellor's changes to National Insurance. The headline news in the Budget was a 2p cut in the main rate of National Insurance contributions for employed and self-employed people. This was the second such cut, the first being in the Autumn statement. And the Chancellor expressed an intention to go much further. He trailed the idea of abolishing personal National Insurance...

Read More »The tragedy of Gaza

Dear friends, I said I wouldn't post any more on this site. But Elon Musk doesn't like me posting Substack links on Twitter. And Substack itself is a mess. The home page looks amateurish, and new posts don't even appear on it until they've amassed enough views to push down previous posts. It's an absurd way of organising a site. So I have decided in future to post links to my Substack posts here. Hopefully this will mean you can find them more easily, both on Google and Twitter. Some of my...

Read More »Sunset

Dear friends, this is my last post on this site. Coppola Comment has moved to Substack. You can find the new site here. Why the move? Well, Blogger has become increasingly difficult to use. The code generator is buggy and I constantly have to mess around with the HTML to make posts look half decent. I don't have the time for this nonsense. I just need a nice straightforward CMS that doesn't make my life difficult. Also, those of you who subscribed by email will know that for some time now...

Read More »A fractional reserve crisis

This is a slightly amended version of a keynote speech I gave on 14th April 2023 at the University of Ghent, for the Workshop on Fintech 2023. The crisis that has engulfed crypto in the last year is a crisis of fractional reserve banking. Silvergate Bank and Signature Bank NY were fractional reserve banks. So too were Celsius Network, Voyager, BlockFi, Babel Finance and FTX. And still standing are the crypto fractional reserve banks Coinbase, Gemini, Binance, Nexo, MakerDAO, Tether,...

Read More » Francis Coppola

Francis Coppola