One of the persistent themes since 2008 is the theory that there has been excessive “asset price inflation”. I’ve talked about this quite a bit before, but it is worth repeating. And no, “assflation” does not refer to the 19 lbs we’ve all put on during COVID. It refers specifically to the term “asset inflation”. This is the idea that the “inflation” that was supposed to show up in consumer prices has been showing up in asset prices like stocks and housing. There’s a bit of truth to this,...

Read More »Government Bond Markets Aren’t “Free” Markets

This is one of those posts that is operational in nature, but will sound political to some people. Before you send me a mean email please try not to politicize the issue.¹ I hope this is helpful. Here’s a question I got from Twitter: “Cullen, why not let government bond markets be free and not manipulated?” I see this one a lot and it’s based on a misunderstanding of “free markets” and how they relate to the government. So let’s dive in. First, currencies are essentially imposed on us. So...

Read More »How Bond Vigilantes Really Think

Discussions on interest rates tend to fall into two camps – the state based view and the market based view. The state based view says that the government can always control the cost of its interest while the market based view argues that the market (typically “bond vigilantes”) can control the rate of interest. I find both of these views confused or at least misleading. One of the nice things about being an actual bond portfolio manager is that I see how prices are set every day. I’ve...

Read More »Passive Investing isn’t Hurting the Economy

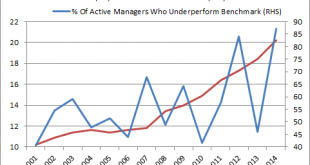

Share the post "Passive Investing isn’t Hurting the Economy" The new sales pitch for the high fee active manager goes something like this: “passive investing has gotten so large that this creates greater opportunities for us to take advantage of these inefficiencies and outperform the market.” In fairness, this comment is partly true because more passive investors should create the need for more active investors (in the form of market making, index arbitrage opportunities, etc.) but it...

Read More »Why Has Heterodox Economics Become Orthodox on Wall Street?

Share the post "Why Has Heterodox Economics Become Orthodox on Wall Street?" I recently noted that heterodox economics is not so heterodox anymore.¹ There’s been a growing trend, especially on Wall Street, in the use of heterodox economic models and particularly Post-Keynesian Economic models. What’s the cause of this surge in popularity? I think it’s derived from two primary sources: Orthodox economic models largely ignore the financial system (though this has improved recently) and...

Read More »“Heterodox” Economics is not so Heterodox Anymore

Share the post "“Heterodox” Economics is not so Heterodox Anymore" Noah Smith says that “heterodox” economics is occult (mystical) because someone in his Twitter feed was bothering him.¹ Noah also says there just isn’t any accessible research on heterodox economics.² Both of these statements are incorrect. I’ve noticed a strong trend in the last 10 years where heterodox economics is becoming increasingly mainstream where the rubber meets the road – on Wall Street. Now, Noah has a...

Read More »Bernie Sanders and the Santa Claus Growth Plan

Share the post "Bernie Sanders and the Santa Claus Growth Plan" Drama. Major drama in political economics. In case you haven’t been paying attention: Gerald Friedman released some estimates about the Bernie Sanders growth plan with an expected 5.3% GDP. You can read the document here. 4 former Council of Economic Advisers wrote a letter to Sanders saying the plan was wildly unrealistic and undermined progressive economics. Paul Krugman agreed with this calling the plan “voodoo” and stating...

Read More »We’re in Uncharted Waters

Share the post "We’re in Uncharted Waters" Last year I expressed the concern that the global economy of the future might be excessively influenced by a black box economy – China. But as 2016 has picked up the turmoil that 2015 started, it’s become clear that this is not the global economy of the future. It is the global economy we are dealing with now. And the fears over China have created a market environment of uncertainty – the market’s worst enemy. A lot of people keep asking me...

Read More »Fiscal Policy Has Failed the US Economy

Share the post "Fiscal Policy Has Failed the US Economy" The story of the post-crisis economic period is simple: The housing boom left the household sector mired in a deep debt hole. This was further exacerbated by the leverage Wall Street added on top of the household sector’s debt. This left the banks and household sector needing a great deal of support. Since 2008 we’ve seen huge amounts of stimulus from the Federal Reserve and global Central Banks, but we’ve had trouble transitioning...

Read More »Was Raising Rates a Yuge Mistake?*

Share the post "Was Raising Rates a Yuge Mistake?*" The recent market jitters have a lot of people saying that the Fed might have made a yuge mistake by raising rates. I’ve been a vocal proponent against raising rates, but I am not convinced that this was a policy error (just yet). The risk/reward doesn’t look great in a world where the US economy is fairly weak and global growth is clearly slowing. Here’s my thinking: The risk with rate hikes is creating an extreme divergence in global...

Read More » Heterodox

Heterodox