It’s been over 10 years since I published Understanding the Modern Monetary System, one of the most widely read papers in the SSRN research database. I published this paper because I was having trouble finding a succinct but thorough explanation of money and macroeconomics during the financial crisis. Further, many of the mainstream explanations of concepts like QE, banking, inflation and money appeared outdated at best and wrong at worst. Since then most of the concepts in this paper...

Read More »We’re Moving!

Thanks to everyone who has read Pragmatic Capitalism for the last 15 years. I’ve loved writing this blog, but we need to consolidate our financial content going forward. It’s become too difficult publishing content to so many different platforms and when Google killed Feedburner it compounded the problems. We’ve created a new, FREE newsletter service called Discipline Alerts. It will push macro research, outlooks and educational content to you using the same format as the old...

Read More »Has Housing Bottomed?

There was a glimmer of hope in the housing data from January. The stock market rallied sharply and there was a lot of commentary about how the economy is headed back to boom time. I am not so confident and I still firmly believe that the “muddle through” scenario I mentioned in my full year outlook is the baseline. And I would argue that the asymmetric risk to this outlook is to the downside, not the upside. Housing is the Economy. I hesitate to attribute economic growth entirely...

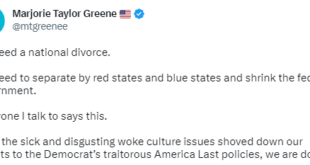

Read More »The Economics of a United States Divorce

Congresswoman Marjorie Taylor Greene got a lot of attention over the weekend when she stated that the USA needs a “national divorce”: I try to remain as objective as possible when I am writing here so I am going to apologize in advance if this post sounds political, but secession is a pretty political topic so let’s dig into the economics of the matter because I don’t think MTG has thought this one through. First, I should start by making it clear that MTG’s comments are highly...

Read More »Three Things I Think I Think – No Landing

1) Soft Landing, Hard Landing, No Landing?1 The COVID years just get weirder and weirder. The COVID hangover is especially weird. We’ve all been hoping for inflation to decelerate, but it remains stubbornly high. Meanwhile the economy is decelerating across the board, but remains…surprisingly strong. You see it in almost all the data. For example, below is a chart of Real GDP and payroll growth on a one year basis. You’ve had a pretty significant slowdown in both. But they’re not...

Read More »The Investor’s Podcast: ESG Investing, The Death of 60/40 and More

I joined The Investor’s Podcast again this week to discuss a wide range of topics. The YouTube chapters in the interview are linked below and you can listen to the full audio here. I caught some flak for my comments on ESG investing and whether Central Banks should have a climate change mandate. I didn’t answer this as clearly as I’d wished, but my general comments were accurate in my view. In short, the Fed (and other Central Banks) operate with very blunt instruments. Fighting...

Read More »2023 Market Outlook: Inflation, Recession, and the Fed w/ Cullen Roche (TIP523)

Stig Brodersen has invited back Investment expert Cullen Roche to discuss how to optimize your portfolio for financial independence and sleeping well at night. IN THIS EPISODE, YOU’LL LEARN: 00:00:00 - Intro 00:00:38 - What the difference is between CPI and PCE 00:08:23 - Whether central bankers should be elected? 00:15:24 - What the velocity of money is, and how it impacts inflation? 00:20:23 - What it means for inflation and the US dollar that the world is...

Read More »I am Not a Dog Person Anymore

When I was 10 years old I read the classic “Where the Red Fern Grows”. It’s a book about a young boy who adopts two dogs who eventually get into a fight with a mountain lion and die. I hated that book because it was the first time I was really confronted with the concept of death in a deeply emotional way. When I was 30 I was bike riding through the Englischer Gartens when I came across a flock of sheep. The sheep were at the edge of a road and one decided to cross the road in front...

Read More »FAQ Answers – Part 2

Here’s the second batch of answers from the Ask Me Anything. If you missed part 1 you can catch it here. Topics include Bitcoin, ESG investing, the debt ceiling, the death of 60/40 and more. I hope you enjoy this and if you do please like and subscribe to the YouTube channel and we’ll do more videos in the future. Video chapters: 00:00 Introduction 00:20 How should we think about Bitcoin? 02:48 Is the debt ceiling a legitimate default risk? 05:45 What’s your...

Read More »Ep. 257: Cullen Roche Interview with Michael Covel on Trend Following Radio

My guest today is Cullen Roche, the founder of Orcam Financial Group, a financial services company based out of San Diego. He also runs a very well-known blog called Pragmatic Capitalism (pragcap.com). The topic is his book Pragmatic Capitalism: What Every Investor Needs to Know About Money and Finance. In this episode of Trend Following Radio we discuss: ▪️ Entrepreneurism ▪️ Investing in yourself ▪️ The advantages of starting a blog ▪️ Why the word “pragmatic” is a word that...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism