By Thornton “Tip” Parker As NEP readers know, the economy consists of private, government, and foreign sectors. Financial flows among the sectors always add up to zero; that is, one sector’s deficits must be offset by surpluses in either or both of the others. If the private sector imports more than it exports, ignoring investment flows, it will run a financial deficit while the foreign sector runs a surplus and the economy will then slow down as money in the private sector becomes...

Read More »A Perfect Example

By J.D. Alt Recent news reports lament the on-going collapse of America’s coal industry―specifically the spectacular loss of jobs which is devastating not only families but entire local economies and communities. On a PBS news report, a woman who’d worked for a local mining company for thirty years teared up and asked the reporter, “What in the world am I going to do?” At a recent event sponsored by Wyoming Public Radio, attendees were asked to fill out 5X7 cards with suggestions about how...

Read More »Video

By J.D. Alt I spent the last couple days reading and contemplating “Political Aspects of Full Employment”, the transcript of a lecture―given in 1942!!―to the Marshall Society by economist Michal Kalecki. This was recommended to me by Nat Uerlich in his May 2 comment to my post “False Choice or Real Possibilities.” Many thanks to Mr. Uerlich for taking the time to make the comment. I urgently recommend Professor Kalecki’s lecture to anyone who feels a little fuzzy (as I have lately been...

Read More »The Urgent Need to Save Orthodox Economists from their Crippling Myths

William K. Black February 29, 2016 Brooklyn, N.Y. A blogger has trolled all heterodox economists as believers in the “occult.” More precisely, he is upset about “econ people” (who are likely not economists) and who tweet him or post comments on his blog site. The blogger further complains that these commenters say that they believe in heterodox economics and “new methodologies [that] are poised to topple mainstream economics.” He then goes on to say: “My typical response is to ask...

Read More »The Ogre & the Cog

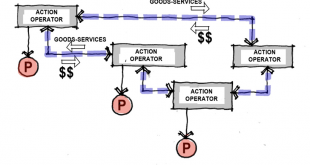

By J.D. ALT Classically, we imagine money being aggregated by an entrepreneur who uses it to build a factory, purchase raw materials, hire labor, and begin manufacturing widgets which are then sold in the marketplace. This same result could be had by the process of an ogre appropriating a factory by intimidation, acquiring raw materials by force, and using slave labor to produce the widgets. The difference is that, in the first case, the process produces customers (the laborers) who can...

Read More »DEBT-FREE MONEY PART 4: AMERICAN COLONIAL CURRENCY

By L. Randall Wray In Part Three I argued that the government issues currency as its liability and imposes tax liabilities on its subjects/citizens that can be paid in that currency. When taxes are paid, both the government and its taxpayers are “redeemed”. I cited Innes’s argument that the universal law of credit is that the issuer of a debt must take it back. This is the fundamental notion behind redemption of debts. To be sure, debt is much older than money. No human has ever...

Read More »THE VALUE OF REDEMPTION: DEBT-FREE MONEY PART 3

Sorry that it has taken me a while to get back to my multi-part series on debt-free money. This is the third part of the current series, although I had previously written several other blogs on the related topics of debt-free money, positive money, and 100% money. See links at the bottom. This post will focus on the concept of “redemption” as the most fundamental requirement of indebtedness. This seems to confuse readers. For example, Eric Lonergan calls this a “fantastic linguistic...

Read More »Explaining Why Federal Deficits Are Needed

By Thornton (Tip) Parker Most MMT advocates probably took months to get comfortable with it. But like a personal computer, one need not understand its innards to use its power. The great power of MMT is its lesson that the federal government can create new dollars by running deficits to do things that should be done. But the lesson is counterintuitive and will be rejected by voters unless it can be explained convincingly in a few minutes. This paper offers five nuggets for explaining it...

Read More »Real Fiscal Responsibility, Vol. II: The Peterson Network, Inequality, and the Failure of Neoliberalism

This is how the mission of the President’s National Commission on Fiscal Responsibility and Reform was defined by the White House on February 18, 2010: The Commission is charged with identifying policies to improve the fiscal situation in the medium term and to achieve fiscal sustainability over the long run. Specifically, the Commission shall propose recommendations designed to balance the budget, excluding interest payments on the debt, by 2015. This result is projected to stabilize the...

Read More »Tax Credits and Dollars—Playing Charades with Low-Income Housing

By J.D. Alt Here is what the HUD.GOV website says about the status of low-income housing in America: “Families who pay more than 30 percent of their income for housing are considered cost burdened and may have difficulty affording necessities such as food, clothing, transportation and medical care. An estimated 12 million renter and homeowner households now pay more than 50 percent of their annual incomes for housing. A family with one full-time worker earning the minimum wage cannot afford...

Read More » Heterodox

Heterodox