I turn 40 years old today. Since I hate birthday presents I figured I’d pass along some of the presents people have taught me over the last 40 years. 1) Always try to be a good person. This is the most obvious one and also often the hardest one. Life is hard and everyone is fighting their own personal battles. Help them through it by being kind enough to try to understand their battle. 2) Never mistake money for wealth. The person who mistakes money for wealth will live a life...

Read More »EVERYONE Funds Their Spending

One of the most confused (and confusing) elements of endogenous money is the idea of “funding”. Endogenous money is not a new theory, but it is not well understood even to this day. Even many supposed endogenous money theorists, like the MMT people, misunderstand it and as MMT has gained some popularity I am seeing increasing misinterpretations. So let’s dive in and see if I can’t explain this more succinctly and clearly. Endogenous money is the fact that anyone can expand their balance...

Read More »The Best Investment Strategy: DISCIPLINE

I was reading this article in the NY Times about a wide ranging diet study. They performed a meticulously controlled test to study what type of diet works best. Their conclusion: “The bottom line is that the best diet for you is still the one you will stick to. No one knows better than you what that diet might be. You’ll most likely have to figure it out for yourself.” One of my favorite things about investing is its similarities with dieting and health. Mainly, investing is really...

Read More »How to Overcome Your Fear of Bonds

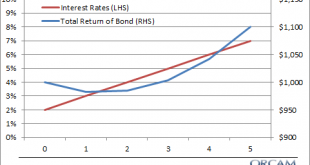

I specialize in building relatively conservative “all weather” style indexing portfolios. They are designed for people who have a reasonably long time horizon (at least 5-10 years), don’t want to go through another 2008, but also want to generate a decent return above the rate of inflation. This means I end up managing a lot of fixed income because being a long only equity manager would expose investors to too much 2008 risk and owning cash guarantees a negative inflation adjusted return....

Read More » Heterodox

Heterodox