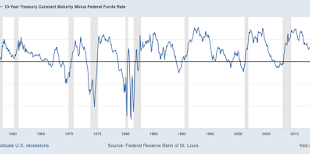

The inverted yield curve, as it is well-known, indicates a forthcoming recession. I used it last year to suggest that the recession was not in the near horizon. The conventional explanation follows Wicksellian ideas (see this old post). In the Wicksellian story, one can think of the 10 year bond rate as a proxy for the natural rate of interest, and the Fed Funds for the monetary or banking rate. Hence, whenever the short-term rate (Fed Funds) is above the long-term one, it would be...

Read More »Latin American corner: Neo Fisherism, New Keynesianism and monetary policy in Latin America (II)

By Naked Keynes (Anonymous Guest Blogger)The positive relationship between nominal interest rates and inflation is not a new stylized fact in economic theory. In the 19th Century Thomas Tooke (1774-1858) considered it a general rule illustrated by the data presented in his History of Prices and the State of Circulation, 1792-1856 (published over the period 1838-1857). Tooke rationalized the positive relationship between inflation and interest rates by postulating that the interest rate...

Read More »Lance Taylor on Loanable Funds and the Natural Rate

New paper on INET. Here is from Lance's conclusion: ... writing in the General Theory after leaving his Wicksellian phase, Keynes said that “... I had not then understood that, in certain conditions, the system could be in equilibrium with less than full employment….I am now no longer of the opinion that the concept of a ‘natural’ rate of interest, which previously seemed to me a most promising idea, has anything very useful or significant to contribute to our analysis (pp. 242-43).”...

Read More » Heterodox

Heterodox