By Nathalie Marins, Ricardo Summa & Daniel Consul (Guest bloggers)Currency devaluations can disrupt developing economies by raising import costs and food prices, which in turn reduces real wages. This impact is particularly detrimental to lower-income households, which typically allocate a substantial portion of their income to essential goods. Consequently, when the local currency weakens, governments encounter increased political pressure due to rising prices that erode purchasing...

Read More »Serrano, Summa and Marins on Inflation, and Monetary Policy

[embedded content] This is the full round table on Inflation and Monetary Policy organized by the Bucknell Institute for Public Policy (BIPP), with Franklin Serrano, Ricardo Summa and Nathalie Marins.

Read More »What is heterodox economics?

New working paper published by the Centro di Ricerche e Documentazione Piero Sraffa. From the abstract: This paper critically analyzes Geoffrey Hodgson’s definition of heterodox economics as the refutation of the orthodox view that emphasizes utility maximization as its main theoretical core, and his view that it is the fragmentation of heterodox economics that explains its subsidiary role within the profession. Hodgson’s views led to a series of responses, that criticize his definition, but...

Read More »The 8th Godley-Tobin Lecture

Registration for the Zoom meeting here. After registering, you will receive a confirmation email containing information about joining the meeting.

Read More »Milei and real wages in Argentina

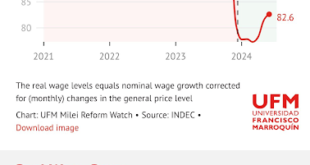

I was interviewed by Max Jerneck for his podcast, and he alerted me to this figure (see below), which apparently come from the Universidad Francisco Marroquín in Guatemala, that has made the rounds, and has been used by right-wing think tanks. If you were to believe this, real wages fell after Milei's assumption. This is obviously sheer ignorance, or, more likely, an attempt to misinform and create doubts about the real effects of his policies. I had read a recent report by Centro de...

Read More »Are we on the verge of a debt crisis?

This was my presentation at the Political Economy Research Institute (PERI) last summer. I was supposed to revise it, but never found the time. So it is now available on Substack. Fundamentally says that the current situation is very different than the debt crisis of the 1980s, and the period between the Tequila, in 94/95 and the Argentine Convertibility default in 2001/02.

Read More »Podcast on the first year of Milei’s government in Argentina

[embedded content]PS: A comment about it appeared in a recent Guardian editorial. There is too much optimism about Milei 'success' in containing inflation, but also a lot of misunderstanding why he managed, and whether it is sustainable.

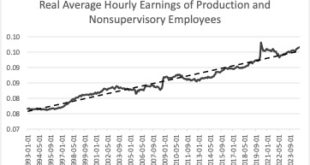

Read More »Inflation, real wages, and the election results

Almost everybody these days accepts at face value that the result of the election was heavily determined by negative perceptions about Bidenomics, and that, in turn, resulted from inflation. Inflation was high (it wasn't, at least not that much), and people were pissed off. This is not just Larry Summers, who had argued (incorrectly in my view) that inflation was caused the large fiscal packages of an excessive generous government.In the heterodox camp, many have suggested that more should...

Read More »Very brief note on the Brazilian real and the fiscal package

The Brazilian real depreciated last week (full meltdown might be a bit of a hyperbole), and in many quarters there has been a suggestion that it is now undervalued, and that would somehow be connected to the dangers associated with the fiscal position, and the willingness of the Lula government to push the spending cuts, and the tax changes, with cuts for those at the bottom of the income distribution and hikes at the other end (more on the fiscal story in a bit).The obvious reason for this...

Read More »Milei’s Psycho Shock Therapy

My short piece for Dollars & Sense on Milei's economic program is out now, here. An early version is available here. Btw, this is the 50th anniversary issue. By coincidence, 20 years ago, a piece of mine on Brazil (and the Lula government back then) was also published on Dissent on their 50th anniversary issue.The Milei piece was written in June and revised around September. Now it seems more clear that they might receive some fresh money from the IMF, which will allow them to continue...

Read More » Naked Keynesianism

Naked Keynesianism