Presenting the Lecture Here is the audio file of Jamie Galbraith inaugural Godley-Tobin Lecture. Due to the weather he recorded the lecture before hand. The paper will appear in the Review of Keynesian Economics (ROKE) soon. Jamie presents a macro discussion of income distribution, which he correctly points out has been absent from most discussion of inequality in recent times.Further, he connects his concern with the data (the UNIDO data that his team at UTIP has worked on for years...

Read More »The inaugural Godley – Tobin Memorial Lecture

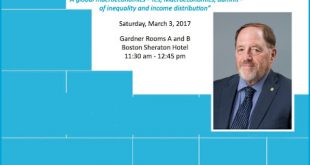

The inaugural Godley – Tobin Memorial Lecture at the Eastern Economic Association meetings in Boston on Saturday March 3, 11.30am – 12.50pm. The lecture pays tribute to both Godley and Tobin's emphasis on being non-hyphenated Keynesians (more on that for a later post).The lecture is sponsored by the Review of Keynesian Economics (ROKE) and will be delivered by Professor James K. Galbraith, whose talk is titled “A global macroeconomics – Yes, macroeconomics damn it – of inequality and...

Read More »International Workshop on Demand-led Growth, Conflict Inflation, and Macro Policy

At my alma mater the Federal University of Rio de Janeiro (UFRJ), to be co-sponsored by the Review of Keynesian Economics (ROKE). Call for papers to come soon in this channel. Stay tuned.

Read More »The Godley-Tobin Lectures

The Review of Keynesian Economics (ROKE) is honored to announce the creation of the Godley-Tobin Lectures, an annual lecture to be delivered at the Eastern Economic Association meetings.Wynne Godley and James Tobin represent the best among Keynesian economists. Both scholars insisted they were non-hyphenated Keynesians, meaning Keynesianism transcends the political disputes that often accompany economics. There is a deeper scientific validity to Keynesianism, something we reaffirmed in our...

Read More »CALL FOR PAPERS: Special issue of ROKE on ‘Monetary policy and negative nominal interest rates’

In light of increased unemployment, the absence of strong economic growth and the threat of deflation in many countries, the recent financial crisis led many to expect a shift in monetary policy. Central banks were at the forefront of these changes, by shunning ‘conventional’ policies in favor of so-called unconventional ones. After experimenting with Quantitative Easing, a number of countries have recently officially adopted negative interest rates in the hope of reviving their moribund...

Read More »Grenoble Winter School– December 7-9

Public debt crisis, austerity and deflation: the case of Greece

From the new issue of the Review of Keynesian Economics (ROKE). By Marica Frangakis from the Nicos Poulantzas Institute, Athens, Greece. From the abstract:Greece is the country in which the eurozone's public debt crisis began in late 2009. The policy response of the EU elites was to provide financial assistance on condition that a strict austerity-cum-deregulation policy is applied under the watchful guidance of the European Commission, the European Central Bank and the IMF (the so-called...

Read More » Heterodox

Heterodox