(I come across this topic quite a bit and I think it’s hard for some people to understand so I am going to get a little nerdy here and see if I can clarify how financial instruments are created and used in the process of “funding” the economy’s needs). Endogenous money is an essential understanding for anyone who wants to better comprehend how the monetary system works. Okay, okay. Let me step back a second. First, what is endogenous money? Endogenous money refers to money that grows from...

Read More »The Difference Between Asset Price Inflation & Consumer Price Inflation

One of the more common responses to the fact that inflation is low is the idea that the inflation is all in asset prices. So, for instance, if someone were to say that all the Fed’s post-crisis stimulus didn’t result in inflation you might look at stock prices and argue that the price increases all flowed into stocks. That’s not necessarily wrong, but I think it needs to be well understood because asset price inflation is generally good for the economy while consumer price inflation could...

Read More »The Best Investment Strategy: DISCIPLINE

I was reading this article in the NY Times about a wide ranging diet study. They performed a meticulously controlled test to study what type of diet works best. Their conclusion: “The bottom line is that the best diet for you is still the one you will stick to. No one knows better than you what that diet might be. You’ll most likely have to figure it out for yourself.” One of my favorite things about investing is its similarities with dieting and health. Mainly, investing is really...

Read More »Why Does Money Make Some People Miserable?

I have a general theory of happiness that can be roughly summarized as follows: “Human beings find happiness by finding affirmation in their existence.” Basically we are all wandering through life knowing we have a limited amount of time here hoping there might be somewhere else we all go when we die, but really hoping this isn’t all for nothing. And in the case that this is all for nothing we seek affirmation from other humans that our time here was meaningful and important, even if...

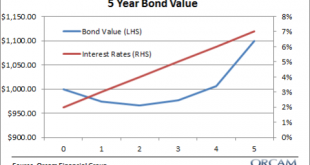

Read More »Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”

Share the post "Repeat After me: “Bonds Don’t Necessarily Lose Value When Rates Rise”"If you take a basic finance course the first thing you learn about bonds is that bond prices are inversely correlated to interest rates. So, when rates rise bonds prices fall and vice versa. This idea is so ingrained into people’s heads that it seems to have become the only thing that anyone can remember about bonds. And in today’s low interest rate environment this thinking is usually applied as...

Read More »Understanding Modern Portfolio Construction [New Research]

Share the post "Understanding Modern Portfolio Construction [New Research]" My newest research paper, Understanding Modern Portfolio Construction, is available on SSRN. This paper is the culmination of years of work and I consider it to be the most important piece of research I’ve published. I wrote this paper in much the same way that I wrote my paper, Understanding the Modern Monetary System, however, since I’m not an academic economist, this paper is more along the lines of my...

Read More »The Best Econ and Finance Research of 2015

Share the post "The Best Econ and Finance Research of 2015" SSRN published their top 10 papers of 2015 and my paper Understanding the Modern Monetary System came in at #6. I’m incredibly humbled to be on a list like this where the names Fama, French, Asness and Faber are listed. Of course, many of these papers are old and so they end up on a list like this because they’re legacy papers that have stood the test of time. My paper was originally written in 2011 and has gone through a...

Read More »The Best of the Financial Blogosphere in 2015

Share the post "The Best of the Financial Blogosphere in 2015" If you didn’t pay much attention to the financial markets you’re in luck because it wasn’t a whole lot of fun. And if you didn’t read a single financial blog all year you’re also in luck because here’s a great round-up of some of the best items from the financial blogosphere: Share the post "The Best of the Financial Blogosphere in 2015" Got a comment or question about this post? Feel free to use the Ask Me Anything section...

Read More »Three Things I Think I Think You Should be Reading

Share the post "Three Things I Think I Think You Should be Reading" Here are three things I think I think you should be reading: 1) Here’s a very smart piece by Jesse Livermore over at Philosophical Economics. Jesse questions the validity of backtesting, systematic approaches and the importance of looking into these approaches with a grain of salt. I’m a big fan of well reasoned skepticism in finance and economics and Jesse always does a nice job of making you think deeply and thoroughly...

Read More » Heterodox

Heterodox