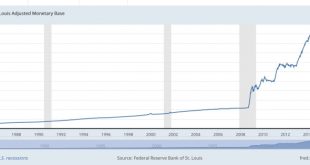

The central idea of Modern Monetary Theory (MMT), as I understand it, is that, rather than worrying about budget balances, governments and monetary authority should set taxation levels, for a given level of public expenditure, so that the amount of money issued is consistent with low and stable inflation. In this context, the value of the net increase in money issue is referred to as seigniorage. To the extent that seigniorage is consistent with stable inflation, it is achieved by...

Read More »Ten Year Plans

The Morrison government has just announced what it calls a climate policy, promising expenditure of $2 billion. I’ll have more to say about this later, but I want first to point out that the promised expenditure is to be allocated over ten years, at an average rate of $200 million a year. That’s only marginally more than the government spent on advertising in 2017-18, which is appropriate, I suppose, for what is basically a PR exercise. The big problem here is the new practice of...

Read More »Prebutting the CIS: Lifters and leaners, yet again

Robert Carling of the Centre for Independent Studies has just released a paper, with the title “Voting for a Living“, an even more offensive reprise of Joe Hockey’s “lifters and leaners” rhetoric of a few years ago. The Oz (no link) ran a report by with the opening claim The top fifth of households by income are almost entirely supporting the bottom 60 per cent of earners Of course, this is absurd. The actual CIS paper centres on the fact that 60 per cent of the population receive...

Read More »Turnbull’s class war

The right is fond of decrying as “class war” any proposal that would benefit Australian workers and low income families. But, we finally have a genuine “class war” election in view and it has been launched by Malcolm Turnbull, with his attempt to tie future governments into massive income tax cuts for high income earners. The good news here is that, despite some wavering, Labor held its nerve, opposed the second and third stages of the package and voted against the entire bill. Some...

Read More »Fortune favours the brave (updated)

Most of the political commentariat were convinced that Bill Shorten had got things badly wrong by announcing his policy on dividend imputation immediately before the Batman by-election. It was even more striking that, despite the pressure, Shorten didn’t cave into demands for changes to the policy. Michelle Grattan, for example, described the policy as an “own goal“. After Labor’s easy win, she backed off a little bit, but still claimed that Labor “has a selling job“. M Maybe so, but I’d...

Read More »Fortune favours the brave

Most of the political commentariat were convinced that Bill Shorten had got things badly wrong by announcing his policy on dividend imputation immediately before the Batman by-election. It was even more striking that, despite the pressure, Shorten didn’t cave into demands for changes to the policy. Michelle Grattan, for example, described the policy as an “own goal“. After Labor’s easy win, she backed off a little bit, but still claimed that Labor “has a selling job“. M Maybe so, but I’d...

Read More »Financing a UBI/GMI

A couple of months ago, I wrote a post making some observations on the closely related ideas of a Universal Basic Income or Guaranteed Minimum Income. The most important was Observation 1: Any UBI scheme can be replicated by a GBI with the same effective marginal tax rates, and vice versa I meant to follow up with a more detailed exploration of financing issues, but all sorts of other things intervened. However, I’ve now prepared a draft, which is over the fold. Comments and criticism...

Read More »Three observations on guaranteed and universal basic income

I’ve been working for a while on the idea of Universal Basic Income (UBI), and the closely related alternative of a Guaranteed Basic Income (GBI), in which the payment is phased out as income increases. I’ve now developed a very simple model to illustrate some of the crucial points. Here are three observations. Only Observation 2 requires the model, and the assumption that the distribution of income is broadly similar to that prevailing in Australia today. Observation 1: Any UBI scheme...

Read More »Restating the case against trickle down

I’ve just given a couple of talks focusing on inequality, one for the Global Change Institute at UQ, following a presentation by Wayne Swan and the second at a conference organized by the TJ Ryan Foundation (including great talks by Peter Saunders, Sally McManus, and others), where I was responding to a paper by Jim Stanford from the Centre for Future Work. Because I was speaking second in both cases, I didn’t prepare a paper or slides, but tailored my talk to complement the one before....

Read More » Heterodox

Heterodox