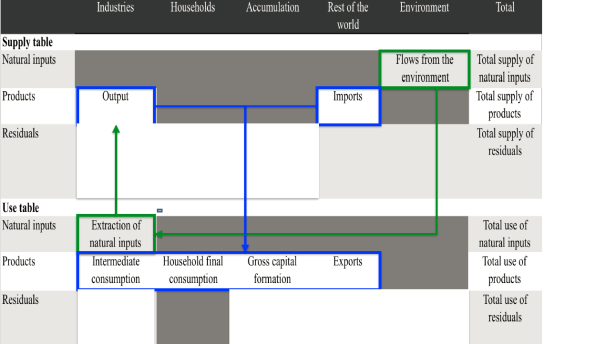

There is a somewhat fuzzy discussion going on about exports, imports and the economy: are (net) exports (imports) good for Australia a country, or not. Look here. And here. It is a complicated question, which made Steve Keen state: “I don’t want to see, and obviously won’t tolerate, further arguments about exports as costs and imports as benefits. I want to see a detailed double-entry bookkeeping exploration of the monetary (and capacity-utilization/real GDP/physical) implications of trade surpluses and deficits“. The good news: such systems are available. No need to invent them. ‘Supply and use’ tables which also keep track of physical flows are alive and kicking, see graph, source here. Same for input-output models, here a bit on the influence of exports on German employment. The

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

There is a somewhat fuzzy discussion going on about exports, imports and the economy: are (net) exports (imports) good for Australia a country, or not. Look here. And here. It is a complicated question, which made Steve Keen state: “I don’t want to see, and obviously won’t tolerate, further arguments about exports as costs and imports as benefits. I want to see a detailed double-entry bookkeeping exploration of the monetary (and capacity-utilization/real GDP/physical) implications of trade surpluses and deficits“. The good news: such systems are available. No need to invent them. ‘Supply and use’ tables which also keep track of physical flows are alive and kicking, see graph, source here. Same for input-output models, here a bit on the influence of exports on German employment.

The bad news, they are actual not double bookkeeping but manifold bookkeeping efforts: a selling company, a buying company, the bank of the selling company and the banks of the buying company as well as a ‘nature’ account which keeps track of different non-monetary flows of natural inputs and outputs. Here, I will concentrate on the physical implications.

To state this in normal langauge: if you’re an oil exporter, the argument that exports could have been used for domestic consumption and are a cost is silly (the argument that stocks of oil are depleted however isn’t). But the argument isn’t silly in the case that grain is exported during a famine. This might add to the income of some people – but others literally starve. The classical example is Ireland where, in the winter of 1846/1847 400.000 people died while food was exported until the spring of 1847. Note that in this case it is not about net exports or imports: every sack of grain not exported would have ameliorated the domestic situation. Returning to the money economy: exports can of course also be needed

- to earn foreign currency

- to enable companies and economies to reap benefits of scale (the Rotterdam harbour, Danish windmill production).

- And an increase in the current account surplus might also lead to an increase of employment, as long as this increase is not caused

- by price developments (oil)

- or by an increase of labour extensive exports while labour intensive products are imported.

- it is however totally possible that a country with a sizeable current account surplus also has high unemployment. Germany until 2017 is a case in point.

- An increase in foreign earnings can however easily be thwarted by an inflow of foreign credit which, later, has to be paid back (possibly when your own money is devaluated). This is very complicated, I advise readers to read Brad Setser about this. My own stance on this is influenced by the very short time it took (a couple of years) for many countries in eastern and southern Europe to go from sustainable current account deficits of 3 or 4% of GDP to deficits of 10, 15 or even 20% of GDP – deficits which of course have a counterpart in unsustainable surpluses in countries like Switzerland, the Netherlands, Germany and Denmark.

- Aside of this: an individual company might need a foreign customer to survive.

Basically, input-output tables enable economists to gauge the influence of (important) sectoral exports or imports on the economy. Which does require knowledge about the labour intensity of exports and imports – information which is, however, available. There is not need for fuzzines. And, important: we do have to look at the dynamic side. How do exports, and imports, influence an economy over time. Last point: I assume all participants in these kinds of discussion agree that we don’t need German style current account surpluses in combination with an economy close to full employment is unsustainable and not the way to go ahead.