In those days Caesar Augustus issued a decree that a census should be taken of the entire Roman world. (This was the first census that took place while Quirinius was governor of Syria.) And everyone went to their own town to register.

Luke 1:3 (as will turn out below, this quote is not frivolous)

Summary.

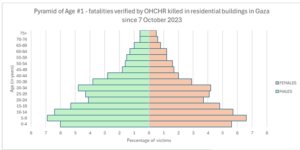

The Gaza Ministery of Health, Airways and the World Health Organization have published robust data sets on victims of war-related violence in Gaza. Médecins Sans Frontières provided the world with a robust qualitative overview of the state of the health system. At the same time, The World Peace Foundation reported on the methodological difficulties of estimating the indirect victims of the war in Gaza. Together, these organisations mention the methodologies that can

Read More »