800 billion over 10 years is something, but not enough to turn things around as it’s maybe .25% of GDP per year or so. Historically it’s taken a good 5% of GDP deficit to reverse a decline, which today means close to a 1T deficit annually. And interesting how they just jumped all over Trump for his tax plan that they claimed would add 1T to the debt over 10 years… Massive Spending and Tax Package Leaves Deficit Fears Behind Congress passed far-reaching legislation Friday to fund the government through September and to extend tax breaks for business and low-income families. They passed a .15 trillion government spending bill and approved a multiyear highway funding package. They also ended a Medicare funding cliff and agreed to make permanent tax credits, steps that add more than 0 billion to deficits over the coming decade. The spending bill, which also lifted a 40-year ban on oil exports, won the support of 166 House Democrats and 150 Republicans, a majority of the House GOP. Another bad one: Chicago Fed National Activity IndexHighlightsSubdued inflation pressure over the coming year is the conclusion of the monthly national activity report where the index came in at minus 0.30 in November, below a downward revised minus 0.17 in October and below the low-end Econoday forecast.

Topics:

WARREN MOSLER considers the following as important: FED, Government Spending

This could be interesting, too:

NewDealdemocrat writes Inflation is decelerating substantially towards the Fed target ADDENDUM: the huge impact of shelter

NewDealdemocrat writes Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace

Mike Norman writes My new podcast episode is out

Mike Norman writes My new podcast episode is out.

800 billion over 10 years is something, but not enough to turn things around as it’s maybe .25% of GDP per year or so.

Historically it’s taken a good 5% of GDP deficit to reverse a decline, which today means close to a 1T deficit annually.

And interesting how they just jumped all over Trump for his tax plan that they claimed would add 1T to the debt over 10 years…

Massive Spending and Tax Package Leaves Deficit Fears Behind

Congress passed far-reaching legislation Friday to fund the government through September and to extend tax breaks for business and low-income families. They passed a $1.15 trillion government spending bill and approved a multiyear highway funding package. They also ended a Medicare funding cliff and agreed to make permanent tax credits, steps that add more than $800 billion to deficits over the coming decade. The spending bill, which also lifted a 40-year ban on oil exports, won the support of 166 House Democrats and 150 Republicans, a majority of the House GOP.

Another bad one:

Chicago Fed National Activity Index

Highlights

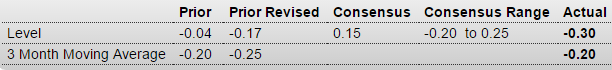

Subdued inflation pressure over the coming year is the conclusion of the monthly national activity report where the index came in at minus 0.30 in November, below a downward revised minus 0.17 in October and below the low-end Econoday forecast. The negative reading is consistent with below average economic growth, in a reminder that the Fed is raising rates at a time when the economy is far from booming. The 3-month average is at minus 0.20, only marginally improved from October’s revised minus 0.25.Weakness in exports is a key negative right now for the economy, underscored in a very sharp decrease for the production component to minus 0.27 from minus 0.11. Much of this decline, however, likely reflects the weather-related slowdown in utility output. The consumption & housing component pulled down the index by minus 0.06 points, which however is improved from October’s minus 0.11, while sales/orders/inventories came in little changed at minus 0.02. The only one in the positive zone is employment though this component did slow to plus 0.05 from 0.08.

This doesn’t help GDP growth:

U.S. Banking Regulators Step Up Rhetoric on Commercial Real-Estate Loans

“The agencies have observed substantial growth in many CRE asset and lending markets, increased competitive pressures, rising CRE concentrations in banks, and an easing of CRE underwriting standards,” said the Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency. They vowed to “continue to pay special attention to potential risks” in 2016, and said supervisors may ask for banks to raise more capital or take other actions to remedy risks that haven’t been addressed.