Please visit https://warrenmosler.com/blog/ for new posts!

Thank you!

Articles by Warren Mosler

Housing permits and starts, GDP forecast

October 19, 2022Permits back on trend after a post-Covid bounce?

Starts down a bit but perhaps leveling off around pre covid levels.

Certainly not a major collapse yet:

Multi-family doing better than single-family:

Another tick up in the Fed Atlanta’s GDP calculations:

Read More »Housing permits and starts, GDP forecast

October 19, 2022Permits back on trend after a post-Covid bounce?

Starts down a bit but perhaps leveling off around pre covid levels.

Certainly not a major collapse yet:

Multi-family doing better than single-family:

Another tick up in the Fed Atlanta’s GDP calculations:

Read More »Industrial production, EU trade, miles driven

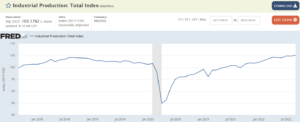

October 18, 2022No sign here that the rate hikes have slowed growth:

This is what has been hurting their currency:

This series is showing signs of slowing, perhaps due to working from home:

Read More »Industrial production, EU trade, miles driven

October 18, 2022No sign here that the rate hikes have slowed growth:

This is what has been hurting their currency:

This series is showing signs of slowing, perhaps due to working from home:

Read More »Retail sales, consumer sentiment

October 15, 2022Leveled off well above pre-Covid levels, and were held down by falling gasoline prices- no recession here:

Adjusted for CPI/inflation:

This was falling from the post-Covid fiscal collapse but has since recovered with the rate hikes:

Read More »Retail sales, consumer sentiment

October 15, 2022Leveled off well above pre-Covid levels, and were held down by falling gasoline prices- no recession here:

Adjusted for CPI/inflation:

This was falling from the post-Covid fiscal collapse but has since recovered with the rate hikes:

Read More »Commercial real estate leading index, producer prices, consumer prices, jobless claims

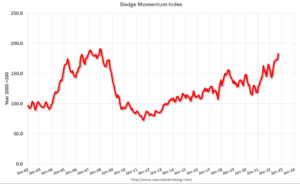

October 13, 2022Looking up, as have been most indicators since the rate hikes, which continue to add serious amounts of interest income paid by government (deficit spending) to the economy:

Still high enough for the Fed to keep raising rates, etc:

Higher than expected:

New claims went up a bit, probably due to the hurricane, but remain very low historically:

Read More »Commercial real estate leading index, producer prices, consumer prices, jobless claims

October 13, 2022Looking up, as have been most indicators since the rate hikes, which continue to add serious amounts of interest income paid by government (deficit spending) to the economy:

Still high enough for the Fed to keep raising rates, etc:

Higher than expected:

New claims went up a bit, probably due to the hurricane, but remain very low historically:

Read More »Employment, GDP Nowcast, oil prices, equity comment

October 8, 2022Employment growth remains strong as rate hikes continue to contribute to a now rising federal deficit that is supporting growth, contrary to Fed expectations. This leads to more hikes intended to soften growth and inflation that in fact support growth and inflation:

The Saudis are on the warpath after a falling out with President Biden, scrapping their July deal that included bringing down oil prices (which was probably accomplished by the Saudis confidentially discounting their official selling prices). It now looks to me like prices are to rise to the point where demand sufficiently falls off, which could be at least $10/gal gasoline/$300 crude oil, as a guess, and bring on a serious recession.

If so, headline inflation will consequently resume its upward climb and

Read More »Employment, GDP Nowcast, oil prices, equity comment

October 8, 2022Employment growth remains strong as rate hikes continue to contribute to a now rising federal deficit that is supporting growth, contrary to Fed expectations. This leads to more hikes intended to soften growth and inflation that in fact support growth and inflation:

The Saudis are on the warpath after a falling out with President Biden, scrapping their July deal that included bringing down oil prices (which was probably accomplished by the Saudis confidentially discounting their official selling prices). It now looks to me like prices are to rise to the point where demand sufficiently falls off, which could be at least $10/gal gasoline/$300 crude oil, as a guess, and bring on a serious recession.

If so, headline inflation will consequently resume its upward climb and

Read More »ISM services, ADP, oil, trade, Fed Atlanta GDP Now

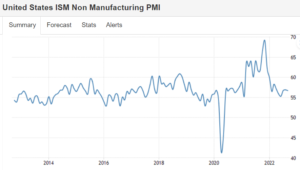

October 5, 2022Remains in positive growth mode:

No recession indication here- this is a forecast for Friday’s employment report:

My take is at the July meeting with President Biden the Saudis agreed to bring prices down in return for various favors. The only way for this to happen was for them to confidentially discount their official selling prices with their customers, and for this was done without consultation with the rest of OPEC+. For reasons unknown to me that agreement has come to an end. Selling price spreads to benchmarks have been modestly increased and the discounting has ended. Additionally OPEC+ has announced large production cuts as cover for the actual reason prices are have reversed and will now rise continuously until policy changes or demand, which is currently

Read More »ISM services, ADP, oil, trade, Fed Atlanta GDP Now

October 5, 2022Remains in positive growth mode:

No recession indication here- this is a forecast for Friday’s employment report:

My take is at the July meeting with President Biden the Saudis agreed to bring prices down in return for various favors. The only way for this to happen was for them to confidentially discount their official selling prices with their customers, and for this was done without consultation with the rest of OPEC+. For reasons unknown to me that agreement has come to an end. Selling price spreads to benchmarks have been modestly increased and the discounting has ended. Additionally OPEC+ has announced large production cuts as cover for the actual reason prices are have reversed and will now rise continuously until policy changes or demand, which is currently

Read More »CB gold purchases, heavy trucks, total vehicle sales, mortgage purchase applications, new homes under construction

October 5, 2022Central Banks Are Stocking Up On Gold

Which Countries Own the Most Gold | SchiffGold

“Central banks purchase a net 270 tons of gold through the first half of the year. This fell in line with the five-year H1 average of 266 tons.”

This is the driving force behind gold. When central banks buy it, they pay for it by crediting a central bank member bank’s account on their own books. It is spending that adds to currency depreciation and ‘inflation’ in general. I call it off balance sheet deficit spending as it ‘doesn’t count’ as deficit spending as reported by the local government or international agencies like the IMF and World Bank. Note that Turkey was the largest buyer which I calculate to be about $5 billion of gold purchases.

No sign of recession from rate hikes here:

Read More »CB gold purchases, heavy trucks, total vehicle sales, mortgage purchase applications, new homes under construction

October 5, 2022Central Banks Are Stocking Up On Gold

Which Countries Own the Most Gold | SchiffGold

“Central banks purchase a net 270 tons of gold through the first half of the year. This fell in line with the five-year H1 average of 266 tons.”

This is the driving force behind gold. When central banks buy it, they pay for it by crediting a central bank member bank’s account on their own books. It is spending that adds to currency depreciation and ‘inflation’ in general. I call it off balance sheet deficit spending as it ‘doesn’t count’ as deficit spending as reported by the local government or international agencies like the IMF and World Bank. Note that Turkey was the largest buyer which I calculate to be about $5 billion of gold purchases.

No sign of recession from rate hikes here:

Read More »Job openings, hires, Manufacturers orders, real estate lending

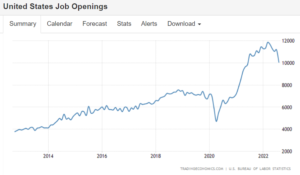

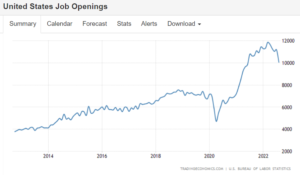

October 4, 2022Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared?

Still a very high number- well above pre-Covid levels:

Back to pre-Covid trend line:

A slight decline for the month but still trending higher. No sign of recession here:

The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:

Read More »Job openings, hires, Manufacturers orders, real estate lending

October 4, 2022Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared?

Still a very high number- well above pre-Covid levels:

Back to pre-Covid trend line:

A slight decline for the month but still trending higher. No sign of recession here:

The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:

Read More »Construction spending, GDP forecast, Canada PMI, earnings forecasts

October 4, 2022So far so good for Q3 that ended Sep 30- about in line with pre-Covid growth rates:

Much like the US, much of the rest of the world is hiking rates with high debt/GDP and supporting their economies that had slowed from fiscal contraction with massive government interest payments- universal basic income for those who already have money:

Looks like the pro forecasters see accelerating earrings ahead- yet more evidence the rate hikes aren’t working in the intended direction:

Read More »Construction spending, GDP forecast, Canada PMI, earnings forecasts

October 4, 2022So far so good for Q3 that ended Sep 30- about in line with pre-Covid growth rates:

Much like the US, much of the rest of the world is hiking rates with high debt/GDP and supporting their economies that had slowed from fiscal contraction with massive government interest payments- universal basic income for those who already have money:

Looks like the pro forecasters see accelerating earrings ahead- yet more evidence the rate hikes aren’t working in the intended direction:

Read More »Commodity prices, PMI index

October 3, 2022Lots of commodities to or near pre-Covid levels:

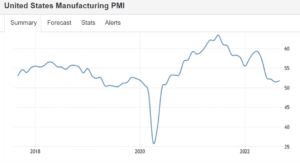

Still looking lower but still positive and not yet indicating recession:

Read More »Personal income and spending, consumer sentiment

September 30, 2022Modest growth continues.The data keeps telling me the rate hikes are helping the economy rather than hurting it:

This is nominal, not adjusted for inflation, and there is no evidence of rate hikes slowing anything down:

Same here for inflation-adjusted consumption:

Too soon to say it is turned up, but better than expected and not indicating a recession:

“The University of Michigan consumer sentiment for the US was revised lower to 58.6 in September of 2022 from a preliminary of 59.5, but remained above 58.2 in August and the highest in five months. Expectations were revised sharply lower (58 vs 59.9 in the preliminary estimate) while current conditions were seen better (59.7 vs58.9). Buying conditions for durables and the one-year economic outlook continued lifting

Read More »Durable goods, housing permits, new home sales, consumer confidence

September 27, 2022No recession here:

Permits for new home construction are down from the post-Covid bounce but remain above pre-Covid levels:

New home sales recovering from rate hike fears and returning to pre-Covid highs, as in fact rate hikes increase gov deficit spending on interest expense paid to the economy, adding to incomes and spending:

Read More »US manufacturing, bank loans

September 25, 2022Stabilizing at modest expansion levels, helped by exports due to relatively low cost US energy:

No sign yet the Fed rate hikes have worked to slow lending and demand as presumed they would:

Read More »Exports, multi-family housing starts, unemployment claims

September 22, 2022US exports continue to grow rapidly as the US has the least expensive energy costs.It’s an indirect way to export energy and it works to keep the $US relatively strong:

New highs and growing rapidly:

No sign of stress here:

Read More »Existing home sales, architecture billing index, Biden response

September 21, 2022Sales had leveled off pre-Covid, then took a Covid dip followed by a recovery bounce,and now seem to be maybe a touch below the pre-Covid range:

Moderate growth in this leading indicator:

I have no idea what this response means as we gravitate towards nuclear war:

Read More »Housing starts, consumer sentiment

September 20, 2022Housing may be bouncing back as the fear of rate hikes is overtaken by the increase in incomes:

Nice move up away from recession, though too soon to say things have reversed:

Read More »Industrial production, retail sales, unemployment claims, comments

September 15, 2022This index is settling in to about a 3.5% annual rate of growth.No recession indication here:

No recession here either:

No sign of recession here:

Markets are being driven by the understanding that the Fed will continue to raise rates until there is a recession, not realizing that rate increases, with debt/GDP as high as it is,result in a sufficiently large increase in government deficit spending on those interest payments to support both the growth of private sector total spending on goods and services as well as to support prices.

So what happens each cycle is the Fed raises rates and supports growth until something else causes a recession. Recent history has seen the automatic stabilizers (tax receipts rising and transfer payments falling with growth) bring down gov

Read More »CPI, Restaurants and airlines, optimism index

September 13, 2022Gone flat since oil prices broke, and means that the strong nominal personal income growth becomes strong real income growth:

Still negative but making a comeback even with the rate hikes:

Read More »Unemployment claims, PMI services, mtg applications and lending

September 8, 2022No sign of recession, and lots of indications the rate hikes that are adding to deficit spending as supporting the economy and prices, and not depressing them, and more rate hikes will only do more of same.

And it doesn’t end until the Fed understands it has had it all backwards:

This is about 85% of the economy.

No recession yet. More and more the data is telling me debt/gdp is plenty high for rate hikes to be supportive of total spending in the economy:

Housing has been weak since the rate hikes, but the declines have been diminishing and with the continuously increasing personal income from (lower but still high) government deficit spending.

I’m expecting housing to show modest growth going forward, in line with the rest of the economy.

Note that applications are

Employment, durable goods orders

September 2, 2022No recession here either:

Asymptotically approaching pre-Covid levels:

Wage growth continues to lag (not cause) the growth rate of the CPI:

Government had more employees under President Trump vs Presidents Obama and Biden? 😉

This doesn’t look like a recession either:

Read More »