Presented 17 July 2024 | MMT Conference | Leeds University

Read More »Warren Mosler | The 8th Deadly Innocent Fraud

Presented 15 July 2024 | MMT Conference | Leeds University

Read More »Updated blog posts

Please visit https://warrenmosler.com/blog/ for new posts! Thank you!

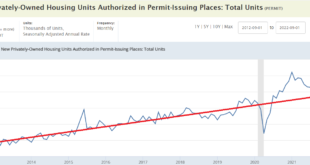

Read More »Housing permits and starts, GDP forecast

Permits back on trend after a post-Covid bounce? Starts down a bit but perhaps leveling off around pre covid levels. Certainly not a major collapse yet: Multi-family doing better than single-family: Another tick up in the Fed Atlanta’s GDP calculations:

Read More »Housing permits and starts, GDP forecast

Permits back on trend after a post-Covid bounce? Starts down a bit but perhaps leveling off around pre covid levels. Certainly not a major collapse yet: Multi-family doing better than single-family: Another tick up in the Fed Atlanta’s GDP calculations:

Read More »Industrial production, EU trade, miles driven

No sign here that the rate hikes have slowed growth: This is what has been hurting their currency: This series is showing signs of slowing, perhaps due to working from home:

Read More »Industrial production, EU trade, miles driven

No sign here that the rate hikes have slowed growth: This is what has been hurting their currency: This series is showing signs of slowing, perhaps due to working from home:

Read More »Retail sales, consumer sentiment

Leveled off well above pre-Covid levels, and were held down by falling gasoline prices- no recession here: Adjusted for CPI/inflation: This was falling from the post-Covid fiscal collapse but has since recovered with the rate hikes:

Read More »Retail sales, consumer sentiment

Leveled off well above pre-Covid levels, and were held down by falling gasoline prices- no recession here: Adjusted for CPI/inflation: This was falling from the post-Covid fiscal collapse but has since recovered with the rate hikes:

Read More »Commercial real estate leading index, producer prices, consumer prices, jobless claims

Looking up, as have been most indicators since the rate hikes, which continue to add serious amounts of interest income paid by government (deficit spending) to the economy: Still high enough for the Fed to keep raising rates, etc: Higher than expected: New claims went up a bit, probably due to the hurricane, but remain very low historically:

Read More » Mosler Economics

Mosler Economics