Graph 1. Printing Francs to satisfy external demand for Francs led to a fast increase of the amount of money in Switzerland. Did this lead to inflation? After 2008 rich people from all over the globe started to buy Swiss Francs. This, of course led to appreciation of the Swiss Franc. The Swiss national bank didn’t like this: bad for exports. And, related to this but much worse, structural lower demand for export products of a small country like Switzerland will erode the manufacturing base of this country. Highly productive fixed capital, specialized knowledge hubs, production ecosystems – these all will flounder. Not good. What to do? Switzerland is a monetary sovereign country. In 2011 the national bank decided to print money and sell it at a fixed Euro-price to foreign rich

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

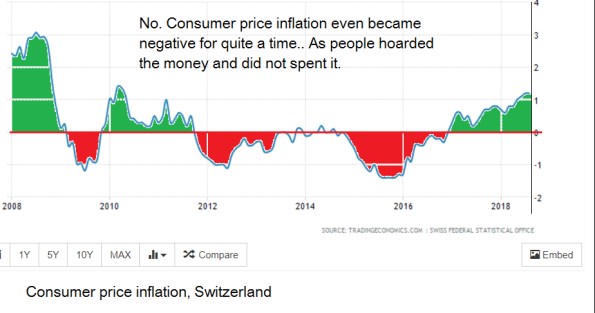

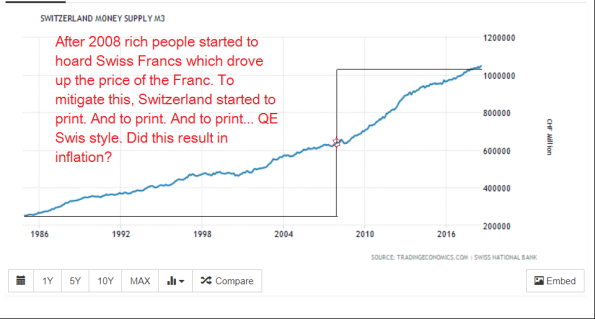

Graph 1. Printing Francs to satisfy external demand for Francs led to a fast increase of the amount of money in Switzerland. Did this lead to inflation?

After 2008 rich people from all over the globe started to buy Swiss Francs. This, of course led to appreciation of the Swiss Franc. The Swiss national bank didn’t like this: bad for exports. And, related to this but much worse, structural lower demand for export products of a small country like Switzerland will erode the manufacturing base of this country. Highly productive fixed capital, specialized knowledge hubs, production ecosystems – these all will flounder. Not good. What to do?

Switzerland is a monetary sovereign country. In 2011 the national bank decided to print money and sell it at a fixed Euro-price to foreign rich people. This policy was highly succesful: the exchange rate of the Swiss Franc (in Euro) stabilized. The ‘cost’ of this policy was of course that Switzerland assembled an awful amount of foreign currencies. The Swiss did lose their nerve at the end of 2014 and tried to stop this policy. Once the understood that this led to a fast and humongous appreciation of the France, with depressing consequences for the Swiss economy, they re-installed it and again with success. Quite some rich foreigners parked their Franc at normal deposits Swiss bank which led to a doubling of the ‘M3’ amount of exchange money. An interesting question: did this increase in the stock of money lead to inflation? The answer is clear: no, it didn’t. While the revaluation at the end of 2014 did lead to deflation. The money was not used in the exchange economy. It was just stacked away.

Graph 2. Despite the fast increase in the amount of money, the Swiss price level declined (mainly because the Franc became more expensive relative to other currencies)