From Lars Syll Empirical efforts at testing the correctness of the rational expectations hypothesis have resulted in a series of empirical studies that have more or less concluded that it is not consistent with the facts. In one of the more well-known and highly respected evaluation reviews made, Michael Lovell (1986) concluded: it seems to me that the weight of empirical evidence is sufficiently strong to compel us to suspend belief in the hypothesis of rational expectations, pending the accumulation of additional empirical evidence. And this is how Nikolay Gertchev summarizes studies on the empirical correctness of the hypothesis: More recently, it even has been argued that the very conclusions of dynamic models assuming rational expectations are contrary to reality … If taken as

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

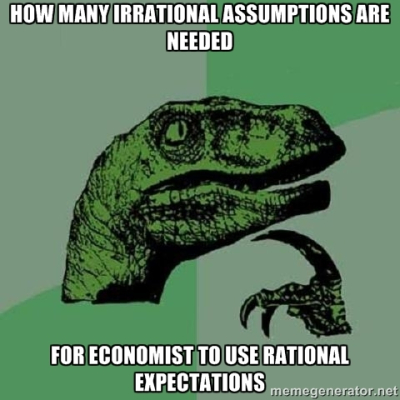

Empirical efforts at testing the correctness of the rational expectations hypothesis have resulted in a series of empirical studies that have more or less concluded that it is not consistent with the facts. In one of the more well-known and highly respected evaluation reviews made, Michael Lovell (1986) concluded:

Empirical efforts at testing the correctness of the rational expectations hypothesis have resulted in a series of empirical studies that have more or less concluded that it is not consistent with the facts. In one of the more well-known and highly respected evaluation reviews made, Michael Lovell (1986) concluded:

it seems to me that the weight of empirical evidence is sufficiently strong to compel us to suspend belief in the hypothesis of rational expectations, pending the accumulation of additional empirical evidence.

And this is how Nikolay Gertchev summarizes studies on the empirical correctness of the hypothesis:

More recently, it even has been argued that the very conclusions of dynamic models assuming rational expectations are contrary to reality … If taken as an empirical behavioral assumption, the RE hypothesis is plainly false; if considered only as a theoretical tool, it is unfounded and selfcontradictory.

Those who want to build macroeconomics on microfoundations usually maintain that the only robust policies and institutions are those based on rational expectations and representative actors. As I have tried to show elsewhere — in On the use and misuse of theories and models in economics and Rational expectations: a fallacious foundation for macroeconomics in a non-ergodic world — there is really no support for this conviction at all. On the contrary. If we want to have anything of interest to say on real economies, financial crises and the decisions and choices real people make, it is high time to dump macroeconomic models building on representative actors and rational expectations microfoundations in the pseudo-science dustbin.