From Shimshon Bichler and Jonathan Nitzan Like most of those subjected to the capitalist mode of power, Toro Molina, the protagonist of Budd Schulberg’s novel The Harder They Fall (1947), knows nothing about the larger scheme of things. From boom to doom Until a few months ago, the stock market narrative in the United States could have been summarized by the popular acronym BTFD – or ‘buy the fucking dip’. Analysts and strategists, emboldened by the world’s synchronized recovery, Trump’s pro-business policies and ample liquidity, predicted that equities would continue rising and recommended that investors take advantage of any temporary eakness to augment their stock holdings in anticipation of further upside. But the atmosphere of boom has since given way to doom and gloom. With

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Shimshon Bichler and Jonathan Nitzan

Like most of those subjected to the capitalist mode of power, Toro Molina, the protagonist of Budd Schulberg’s novel The Harder They Fall (1947), knows nothing about the larger scheme of things.

- From boom to doom

Until a few months ago, the stock market narrative in the United States could have been summarized by the popular acronym BTFD – or ‘buy the fucking dip’. Analysts and strategists, emboldened by the world’s synchronized recovery, Trump’s pro-business policies and ample liquidity, predicted that equities would continue rising and recommended that investors take advantage of any temporary eakness to augment their stock holdings in anticipation of further upside.

But the atmosphere of boom has since given way to doom and gloom. With equity markets having entered ‘correction’ territory, many observers, including some of the world’s richest investors, now warn of a coming crash and a protracted ‘bear market’.

- EPS: the stylized facts

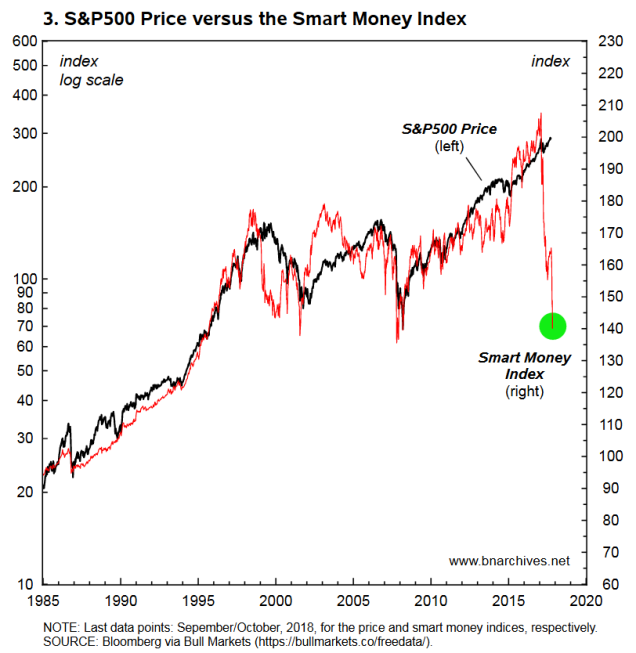

Figure 1 sets this shifting sentiment in a long-term context. The chart, which begins in the early 1970s, shows the annual growth rates of U.S. and global earnings per share (EPS), smoothed as 12-month trailing averages, (in this piece, we use the terms ‘earnings’ and ‘profits’ interchangeably).

The historical pattern of both series is highly stylized and very similar. In both cases, EPS growth is cyclical, mean-reverting and oscillating within clear bounds. Although there are some glaring exceptions, in general earnings growth rates tend to peak at around +25% and trough at around -10% (a more pedantic plot showing the series’ historical means one standard deviation would convey the same pattern only with more clutter).

The historical pattern of both series is highly stylized and very similar. In both cases, EPS growth is cyclical, mean-reverting and oscillating within clear bounds. Although there are some glaring exceptions, in general earnings growth rates tend to peak at around +25% and trough at around -10% (a more pedantic plot showing the series’ historical means one standard deviation would convey the same pattern only with more clutter).

- Has earnings growth peaked?

According to the data, current EPS growth rates hover around their upper historical bound: the U.S. rate is just shy of +25% (circled in green), while the global rate (including the U.S.) is already down from its +20% peak.

It is of course possible for both U.S. and world EPS to continue rising at somewhat lower rates – as they did, for example, during the late 1990s and mid-2000s. But based on the historical record, the likelihood of a sharp downward reversal from these elevated levels seems high – particularly given mounting indications of a global slowdown.

4. Why should falling earnings matter for the stock market?

To the uninitiated, the answer might seem obvious: stock prices discount corporate earnings, meaning that when earnings decelerate or drop – all else remaining the same – so must equity prices.

Or must they?

Note that Figure 1 depicts the growth of current EPS (accrued over the past 12 months). In theory, though, stocks should capitalize not current earnings, but future earnings, and not future earnings in the abstract, but future earnings all the way to eternity (Benjamin Graham, quoted in Zweig 2009: 28).

Now, it is true that, due to discounting, the deeper we delve into the future, the lower the capitalized value of any given dollar of earnings. But since according to the theorists of finance the future is potentially infinite, discounted future dollars add up and eventually overwhelm the magnitude of current ones.

So, in principle, current earnings should not really matter for stock prices. And, indeed, very often they don’t.

5. The price-EPS correlation: a brief history

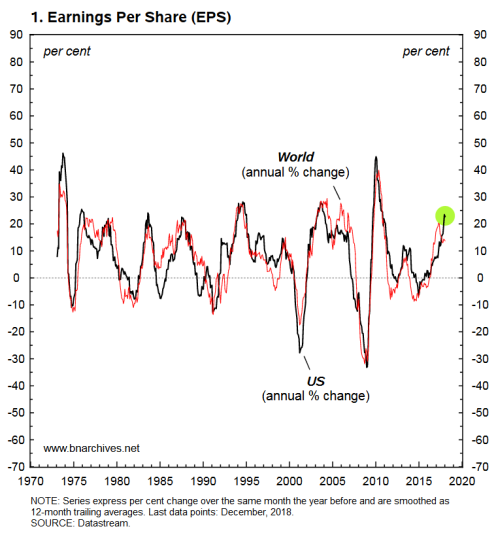

Figure 2 is updated from our RWER paper ‘A CasP Model of the Stock Market’(Bichler and Nitzan 2016: Figure 9, p. 141). The blue dotted series depicts the 12-month trailing Pearson Correlation coefficient between the monthly S&P 500 stock price index and current EPS, with the trailing correlation itself then smoothed as a 10-year trailing average.

As the chart shows, this correlation has changed dramatically over time, tracing a somewhat ragged V‑shape pattern. During the late nineteenth and early twentieth centuries, the price-EPS correlation was high, hovering around +0.4. But from then on, it trended downward, and by the late 1970s it even turned negative.

In other words, during much of the twentieth century, current earnings became decreasingly important and eventually irrelevant for stock prices – exactly as the standard manuals of finance stipulate.

But in the early 1990s the downtrend suddenly reversed. The price-EPS correlation started to rise, and by the early 2010s reached record levels, in excess of +0.6. Unlike the previous downtrend, this upward trajectory is inconsistent with the canons of finance.

- Systemic fear and capitalized power

What does the price-EPS correlation mean, and why has it changed so dramatically over time?

In our work, we answered the first question by proposing to view the price-EPS correlation as a quantitative proxy for the systemic fear of capitalists (Nitzan and Bichler 2009b; Bichler and Nitzan 2010; Kliman, Bichler, and Nitzan 2011; Bichler and Nitzan 2016, 2018; for a critique, see Baines and Hager 2019).

Stated briefly, our logic runs as follows. When capitalists are optimistic about the long-term future of their system – i.e., when they think that the flow of profit will continue indefinitely – there is no reason for them to pay much attention to current earnings. In this ‘business as usual’ scenario, with capitalists abiding by their sacred forward-looking ritual of capitalization, equity prices reflect long-term profit expectations (as well as other factors, such as risk and the discount rate) and are impacted only marginally or not at all by profits that are earned here and now. The result is a low or even negative price-EPS correlation, as witnessed for example during the 1970s and 1980s.

By contrast, when capitalists become apprehensive about the long-term prospect of their system – in other words, when they are struck by systemic fear – they grow uncertain about and have difficulty envisioning the future flow of profit. This deep incertitude forces them to abandon their forward-looking ritual and instead capitalize stocks based on what they can be certain of here and now – that is, on current profit. The result is a high price-EPS correlation, as witnessed for instance since the early 2000s. [1]

Now why did our ‘systemic fear index’ decline during much of the twentieth century, only to reverse course and rise sharply since the 1990s? The answer, we suggest, has to do with the solid black series shown in Figure 2. This series measures the ratio between the S&P 500 price index and the U.S. average wage rate, and we label it the power index.

Capitalist power, we claim, gets capitalized differentially – that is, by weighing the value of one’s assets or income relative to those of others (Nitzan 1992, 1998; Nitzan and Bichler 2009a). In this case, where our focus is on the broad power of capitalists relative to workers, a simple power index can be calculated by comparing stock prices to wages.

The remarkable – and perplexing – thing about our power and systemic fear indices is that they are so tightly and systematically correlated: over the past century and half, their Pearson Correlation measures +0.84 out of a maximum of 1. And the question is why.

Why should the ups and down of the price-EPS correlation bear any relationship to the gyrations of the stock price/wage ratio? Indeed, assuming our labelling of the two series is valid, why should the systemic fear of capitalists oscillate together with their differential power? If anything, shouldn’t they move inversely to one another?

- The dialectics of power and fear

As far as we know, this question has never been posed before, let alone answered. Indeed, to the best of our knowledge, the underlying series themselves haven’t been constructed and plotted before – and certainly not as proxies for capitalized power and systemic fear. So our answer here can only be tentative.

According to Hobbes’ Leviathan (1691, first published in 1651), the relatively equal abilities of human beings breed their uncertainty, insecurity and mutual suspicion, and these forces in turn compel them to try to increase their differential power without end. But then – and this is the crucial qualifier – the more power one possesses, the more one dreads losing it all. The result is an ongoing cycle, with fear stoking a hunger for power, and the amassment of power heightening the very fear that begot that hunger in the first place (for example, pp. 75 and 94).

And if our interpretation here is correct, this is exactly what we see in Figure 2. The greater the power of capitalists relative to workers (i.e., the higher the ratio of stock prices to wages in the chart), the more difficult it will be to increase this power further in the future, and therefore the greater the capitalists’ systemic fear that their relative capitalization will decelerate or stall. In this sense, the greater the capitalized power the direr its potential investment consequences. As differential power continues to increase against mounting opposition, there is a growing risk that this power will be openly challenged and scaled back (through reform and downward redistribution); and if despite these counter-developments capitalized power continues to climb, there arises the possibility – remote as it may be – of capitalized power being overthrown altogether (revolution). For capitalists, then, capitalized power and systemic fear go hand in hand: the greater (lesser) the power, the greater (lesser) the systemic fear of losing it.

Now, the impact of growing fear – and this is a key point – is largely introverted, at least initially: it affects not the level of capitalization, but its temporal basis. When capitalized power is low (like it was, for instance, during the 1970s and 1980s), capitalization relies on and reflects forward-looking earnings expectations (hence the low or even negative price-EPS correlation). But as capitalized power grows (as it has, for example, since the 1990s), capitalists, apprehensive about mounting systemic risks, gradually shift their gaze from the deep future to the most recent past (causing the price-EPS correlation to rise).

- The harder they fall

With this framework in mind, the question of peak earnings becomes crucial. According to Figure 2, the dialectical twins of capitalized power and systemic fear are currently at record highs, which means that the stock market trajectory is now highly dependent on the direction of current profits. And given that according to Figure 1 U.S. and world earnings growth are also near record highs, it seems likely that the U.S. rate will soon flip (as the global one already has), and that when it does, the U.S. stock market, being ultra-sensitive to current earnings, will follow suit.

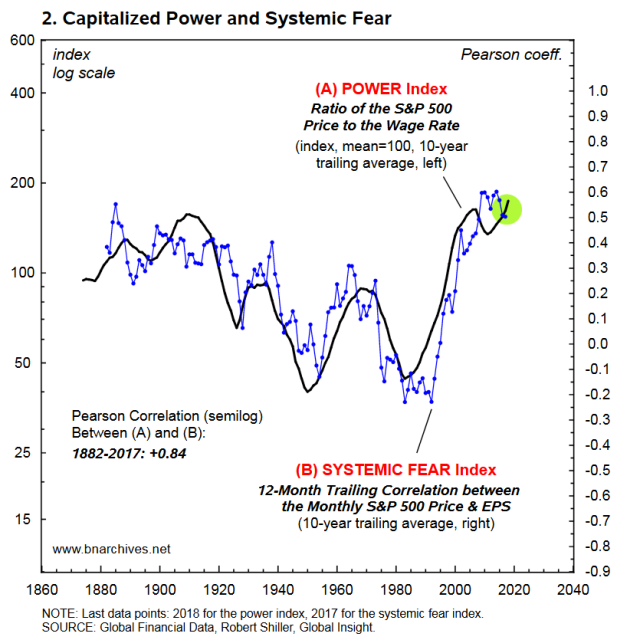

The anticipation of this outcome is revealed, and rather dramatically, by Figure 3. The chart, currently popular among financial fear mongers, juxtaposes the S&P 500 price against the so-called ‘smart money index’. The divergence between the directions of the two series proxies the relative bullishness/bearishness of sophisticated investors (hence the term ‘smart money’). When sophisticated investors are bullish, they ‘buy into weakness’, causing the smart money index to fall by less (or rise by more) than the S&P price. And when they are bearish, they do the opposite – namely, they ‘sell into strength, thus causing the smart market index to rise by less (or fall by more) than the S&P 500 price.

Based on this arithmetic, the huge drop in the smart money index since early 2018 against the backdrop of a rising S&P 500 price suggests that sophisticated investors have grown extremely pessimistic.

All in all, then, it seems that the road for another major bear market, with roller-coaster consequences for the subjects of global capitalism, is now wide open. The only thing missing for the hard fall is a reversal of U.S. current earnings.

Endnotes

[1] The high price-EPS correlation of the late nineteenth and early twentieth centuries was associated, at least in part, with the fact that forward-looking capitalization was only beginning to gain traction in the equity market, and that its birth pangs elicited plenty of uncertainty about and mistrust of future earnings projections. ‘The principle that capitalization should be based on [future] earning capacity rather than on actual cost’, declared one disgruntled observer, ‘is not only unsound in theory but is also vicious in its practical application’ (Bonbright 1921: 482). For more, see Nitzan and Bichler (2009a: 155-158).

- References

Baines, Joseph, and Sandy Brian Hager. 2019. Financial Crisis, Inequality, and Capitalist Diversity: A Critique of the Capital as Power Model of the Stock Market. New Political Economy OnlineFirst (January 9): 1-18.

Bichler, Shimshon, and Jonathan Nitzan. 2010. Systemic Fear, Modern Finance and the Future of Capitalism. Monograph, Jerusalem and Montreal (July), pp. 1-42.

Bichler, Shimshon, and Jonathan Nitzan. 2016. A CasP Model of the Stock Market. Real-World Economic Review (77, December): 119-154.

Bichler, Shimshon, and Jonathan Nitzan. 2018. With Their Back to the Future: Will Past Earnings Trigger the Next Crisis? Real World Economics Review (85, September): 41-56.

Bonbright, James C. 1921. Earning Power as a Basis of Corporate Capitalization. The Quarterly Journal of Economics 35 (3, May): 482-490.

Hobbes, Thomas. 1691, first published in 1651. [2002]. Leviathan. Edited by Aloysius Martinich. Peterborough, Ont.: Broadview Press.

Kliman, Andrew, Shimshon Bichler, and Jonathan Nitzan. 2011. Systemic Crisis, Systemic Fear: An Exchange. Special Issue on ‘Crisis’. Journal of Critical Globalization Studies (4, April): 61-118.

Nitzan, Jonathan. 1992. Inflation as Restructuring. A Theoretical and Empirical Account of the U.S. Experience. Unpublished PhD Dissertation, Department of Economics, McGill University.

Nitzan, Jonathan. 1998. Differential Accumulation: Toward a New Political Economy of Capital. Review of International Political Economy 5 (2): 169-216.

Nitzan, Jonathan, and Shimshon Bichler. 2009a. Capital as Power. A Study of Order and Creorder. RIPE Series in Global Political Economy. New York and London: Routledge.

Nitzan, Jonathan, and Shimshon Bichler. 2009b. Contours of Crisis III: Systemic Fear and Forward-Looking Finance. Dollars & Sense, June 12.

Schulberg, Budd. 1947. The Harder They Fall. New York: Random House.

Zweig, Jason. 2009. Be Inversely Emotional, Not Unemotional. The Wall Street Journal, May 26, pp. 28.