From Nat Dyer

Readers of this blog will be well aware of the myriad problems with the mainstream economics that has dominated university and political life for the past few decades.

As Lars Syll wrote here last month, too much of the profession “has since long given up on the real world” and is happy to investigate the “thought-up worlds” of unrealistic economic models. Too much attention is focused on how the parts of the model fit together, rather than on how well the models fit with reality.

But how can critics communicate these problems effectively? Especially to those who will be intimidated or turned off by a phrase like ‘ontological foundations’?

In my new book Ricardo’s Dream: How Economists Forgot the Real World and Led Us Astray I unpack the problem and suggest an answer. One

Articles by Editor

new issue of RWER

December 4, 2024Real-world economics review

issue no. 109

download whole issue

Culture – the elephant in the roomHardy Hanappi 22

The capitalization of everythingShimshon Bichler and Jonathan Nitzan 18

From the Bretton Woods system to global stagnationLeon Podkaminer 29

The role of internetization in creating sustainable development for the Global SouthConstantine E. Passaris 35

The works of Ha-Joon ChangJunaid B. Jahangir 56

A critique of Saito’s Slow Down; How degrowth communism can save the EarthTed Trainer 84

Causality in economics and Keynes’ General TheoryGeorge H. Blackford 84

End Matter 108

Please click here to support this open-access journal and the WEA

Making America Great Again, 2024

November 11, 2024From Shimshon Bichler & Jonathan Nitzan

In 2019, we published a RWER paper assessing Trump’s promise to ‘Make America Great Again’. https://bnarchives.net/id/eprint/630/

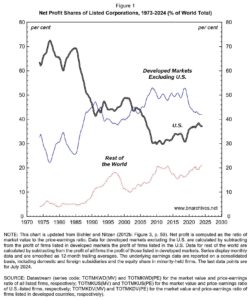

Here are updates of two key charts from this paper.

The first figure depicts the relative global decline of U.S. corporations. It shows that U.S. firms currently accounts for ~1/3rd of global corporate profit, down from 2/3rds half a century ago.

The second figure shows the growing dependence of U.S. firms on foreign operations. Currently, U.S. corporations get roughly 40% of their profits from foreign subsidiaries, compared to 15% half a century ago and slightly over 5% in the 1940s.

Can these trends be reversed by an authoritarian U.S. president? Do Trump’s corporate masters want to reverse these trends in the

Read More »The 2024 economic laureates and more Nobel nonsense

October 28, 2024From Steven Klees

I am quite sure that this year’s three Nobel Laureates in economics — Daron Acemoglu, Simon Johnson and James Robinson – are very competent new institutionalist economists. Lars Syll offers a thoughtful critique of their substantive arguments, but he misses the main point for me. New institutional economics, by and large, is nonsense. We used to have many sensible institutional economists who offered a qualitative, sociological-type analysis of the role of economic institutions. We still have them in the Association of Evolutionary Economics and their Journal of Economic Issues. They have declined in number after their stronghold in labor economics was folded into neoclassical theory by the advent of human capital theory turning Labor into a tractable commodity.

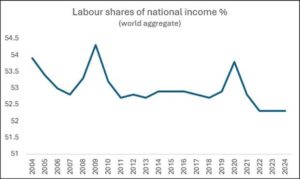

Falling shares of labour income

October 23, 2024From C. P. Chandrasekhar and Jayati Ghosh

The latest World Employment and Social Outlook Report (update for September 2024) from the International Labour Organisation highlights some disturbing trends. Importantly, it identifies a significant decline and then stagnation in the share of labour income in GDP, for the world as a whole, in the past few years. This comes as part of a persistent trend of decline in labour income shares, other than spikes in “crisis years” like 2008-10 and 2020-21. (Note that the IO includes income from self-employment as part of the labour share, which is an important point since self-employment is very important, and indeed often dominated total employment, in poorer countries.)

Figure 1 shows the trend for the world as a whole, with the share of labour

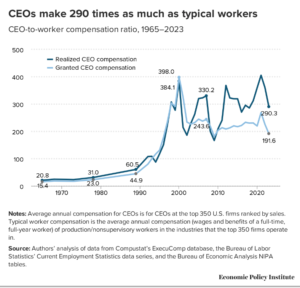

CEO-to-worker compensation ratio, 1965-2023

October 15, 2024“15 Best Economics Book Blogs and Websites in 2024”

October 10, 2024From Feedspot

The best Economics Book blogs from thousands of Book blogs on the web and ranked by traffic, social media followers & freshness.

Economics Book Blogs

Here are 15 Best Economics Book Blogs you should follow in 2024

1. Real-World Economics Review Blog

The Real-World Economics Review blog serves as a critical platform for economists, scholars, and thinkers who challenge mainstream economic theories and advocate for more realistic, socially relevant approaches. It brings together diverse voices that scrutinize conventional economic models, focusing on issues such as inequality, environmental sustainability, and financial instability. The blog encourages deep analysis of economic practices, questioning dominant paradigms while fostering discussions on alternative frameworks

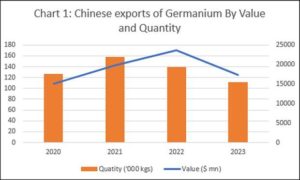

Read More »The Chinese threat in critical minerals

September 8, 2024From C. P. Chandrasekhar and Jayati Ghosh

It is more than a year since China, reportedly in retaliation to US-driven restrictions on exports of advanced semiconductors and related manufacturing equipment, imposed export controls on two crucial materials—germanium and gallium—that enter into the production of semiconductors and military and communications equipment (advanced microprocessors, fibre-optic products and night-vision goggles).

Imposed in the name of safeguarding “national security and interests”, the restrictions on the exports of these materials from China were viewed with alarm. China accounts for 98 per cent of global production of gallium and for two thirds of imported supplies of germanium in the US market. If these restrictions, requiring prior permission for export

The crisis of knowledge and enlightenment’s imitations

August 20, 2024From Asad Zaman and current issue of RWER

Our current environmental predicament is fundamentally a crisis of knowledge, rooted in the Enlightenment’s narrow conceptualization of epistemology. This shift fostered an illusion of objectivity that has since permeated our understanding of the world, particularly in the context of societal dynamics. The Enlightenment’s emphasis on objective knowledge marginalized the subjective realms of emotional intelligence, moral intuition, and diverse lived experiences. This exclusion led to a worldview that erroneously equates scientific rationality with absolute truth, consequently overlooking the multifaceted and nuanced nature of human experience and its interaction with the environment. See Zaman (2015) for a detailed discussion of the deification

Read More »new issue of RWER

August 1, 2024Real-world economics review

Please click here to support this journal and the WEA

Issue no. 108July 2024

download whole issue

The creationist foundations of Herman Daly’s steady state economyJohn Gowdy and Lisi Krall2

Data: a critical perspectiveCarlos Guerrero de Lizardi16

Enlightenment Epistemology and the Climate CrisisAsad Zaman29

Fabulous MacroeconomicsGerald Holtham33

A Tour of the Jevons Paradox. How Energy Efficiency BackfiresBlair Fix40

A Debtor Countries Club? The Cartagena Consensus reloadedJuan Pablo Bohoslavsky and Francisco Cantamutto41

Why Has Growth Theory Been a Failure?Bernard C. Beaudreau63

Socialism, Fascism and Neoliberalism:Karl Polanyi’s Institutionalism and the Democratic Question in the XXI CenturyManuel Ramon Souza Luz, Renan Veronesi Compagnoli

Why do domestic food prices keep going up when global prices fall?

July 25, 2024From C. P. Chandrasekhar and Jayati Ghosh

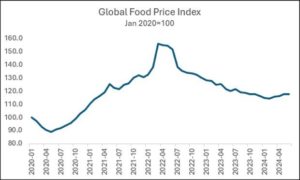

In the past three years, global food prices have been on a roller coaster, rising rapidly especially in the first half of 2022 due to a speculative bubble and then falling from July 2022 onwards (Figure 1). The phase of rising food prices led to increasing food prices around the world, especially in lower income countries—and this was obviously associated with growing hunger. According to the FAO, 122 million more people faced hunger in 2022 than in 2019, before the global pandemic. Around 42 per cent of the world’s population—more than 3.1 billion people—were unable to afford a healthy diet in 2021.

Figure 1.

Source: https://www.fao.org/worldfoodsituation/foodpricesindex/en/

The dramatic rise in global food prices (especially for wheat)

Hudson on Super Imperialism 1

July 18, 2024From Asad Zaman and WEA Pedagogy Blog

In this sequence of posts, I will present the contents of the video podcast entitled “Michael Hudson: Why the US has a unique place in the history of imperialism? ” For me, Hudson’s book Super Imperialism: The Economic Strategy of the American Empire was an amazing eye-opener, essential reading for anyone who want to understand modern real world economics. The podcast provides a summary of his ideas, and these posts break it down further to make it accessible to a broader audience. This first post covers about the first 20 minutes of the video.

Introduction: Michael Hudson, a distinguished economist and professor at the University of Missouri Kansas City, provides a critical analysis of the economic strategies that underpin U.S. global dominance.

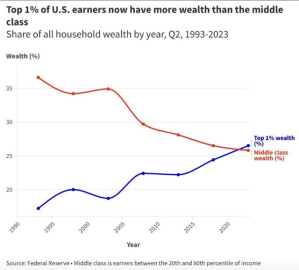

U.S. Top 1% now have more wealth than the middle class

July 15, 2024Weekend read: Theory and reality in economics

July 4, 2024From Lars Syll

So, certainly, both non-theorists and some theorists have little patience for research that displays mathematical ingenuity but has no value as social science. But defining this work exactly is impossible. This sort of work is like pornography quite simple to recognize when one sees it.

Jeffrey Ely

As researchers, we (mostly) want to try to understand and explain reality. How we do this differs between various disciplines and thought traditions. Creating a ‘map’ at a 1:1 scale of reality is of little help. We have to rely on some kind of ‘approximation’ to grasp an often inaccessible reality. Exactly how this approximation is done varies significantly between different research traditions.

In mathematics, by simply defining things clearly and conveniently, some tricky

The ‘Billions to Trillions’ charade

June 3, 2024From Jayati Ghosh

The international-development sector has become fixated on calculating financing gaps. Hardly a day goes by without new estimates of the funds low- and middle-income countries (LMICs) need to meet their climate targets and achieve the United Nations Sustainable Development Goals (SDGs).

The Independent High-Level Expert Group on Climate Finance, for example, estimates that developing and emerging economies (excluding China) need $2.4 trillion annually by 2030 to close the financing gap for investments in mitigation and adaptation. Achieving the SDGs would require an extra $3.5 trillion per year. Similarly, the UN’s 2023 Trade and Development Report suggests that LMICs need roughly $4 trillion per year to meet their climate and development goals.

Such estimates can

Economics — a dismal and harmful science

May 9, 2024From Lars Syll

It’s hard not to agree with DeMartino’s critique of mainstream economics — an unethical, irresponsible, and harmful kind of science where models and procedures become ends in themselves, without consideration of their lack of explanatory value as regards real-world phenomena.

Many mainstream economists working in the field of economic theory think that their task is to give us analytical truths. That is great — from a mathematical and formal logical point of view. In science, however, it is rather uninteresting and totally uninformative! The framework of the analysis is too narrow. Even if economic theory gives us ‘logical’ truths, that is not what we are looking for as scientists. We are interested in finding truths that give us new information and knowledge of the

Real-world economists take note!

May 8, 2024Planet is headed for at least 2.5C of heating with disastrous results for humanity, poll of hundreds of scientists finds

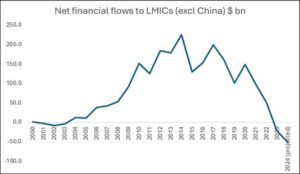

Read More »Water Flowing Upwards: Net financial flows from developing countries

May 1, 2024From C. P. Chandrasekhar and Jayati Ghosh

Once again, low and middle income countries (LMICs) are at the brutal receiving end of the fickle trajectory of international capital flows. As Figure 1 indicates, net financial flows to such countries, which increased rapidly after the Global Financial Crisis that began and was created by advanced economies, peaked in 2014. Thereafter, they have been on a downward trend, which has accelerated dramatically from 2021, to the point that they turned negative in 2023, and are expected to fall further in 2024. In 2023, LMICs as a group (excluding China) sent an estimated $21.4 billion (which they could ill afford to do) outside—and by 2024 that number is expected to more than double, such that these countries will be sending as much as $50.5

In search of radical alternatives

April 22, 2024From Crelis Rammelt and current issue of RWER

Our presumed dominion over nature is an illusion. No matter how clever technological innovations may seem, they remain subject to the laws of thermodynamics. Consequently, a growth-centered capitalist economy finds itself trapped in futile attempts to completely decouple itself from nature – aiming for a 100% circular, service-oriented and zero-waste existence. This obsession stems from an incapacity to imagine an economy that does not grow, where both the quantity and quality of its metabolism remain within secure ecological and planetary boundaries.

Hence, we must seek radically different pathways (the Latin radix means root). One such alternative is degrowth. In the broadest sense, degrowth represents a socio-economic transformation

Chang’s “Edible Economics”

April 15, 2024From Junaid Jahangir and current issue of RWER

[Ha-Joon] Chang’s latest book Edible Economics (2022) crystallizes the narrative that he has developed through his popular books over the years. . . . I have reviewed the salient ideas as follows in a bid to draw out lessons I could share with my ECON 101 students.

. . . the main ideas of Ha-Joon Chang can be distilled in point form as follows.

Neoclassical economics gives precedence to mathematics over real-world issues of inequality and power. It emphasizes markets over democracy.

Culture has elements both conducive and detrimental to development. Policy directs economic development, which then shapes culture.

Free market advocates focus on the economic freedom of consumers and corporations and not the freedom of workers to push for

The increasing collusion between . . . . . .

April 11, 2024From a comment by Ikonoclast

“A truth is permitted only a brief victory celebration between the two long periods where it is first condemned as paradoxical and later disparaged as trivial.” – Arthur Schopenhauer.

As they break new ground, the Capital as Power theoreticians will encounter the “Schopenhauer Effect” over and over. When you point out something clearly for the first time, or even again after a long interregnum when few could see it, then everyone will say, “Oh, we always knew that.”

To widen the focus, I think a big part of what is happening now is the increasing collaboration, or rather collusion, between big government and big capitalism. I think what we have in the modern neoliberal system is a symbiotic relationship between big government and big corporations. It is

Wealth catapulted up

April 10, 2024From Blair Fix and current issue of RWER

Speaking of competition and losers, Ronald Reagan set the tone of the neoliberal era when, in 1981, he fired 11,000 striking air-traffic controllers (Houlihan, 2021). The message? Workers were losers who would be subjected to the discipline of competition. Reagan called it ‘morning in America’. But really, it was ‘morning for American big business’.

Today, we are well into the next-day’s hangover, and we know how the party played out. For workers, it was a disaster. But for the rich, it was an incredible boon. Wealth didn’t trickle down so much as it got catapulted up. The result, as Figure 1A shows, was a relentless rise in the concentration of American wealth.

Figure 1: A neoliberal experiment — rising wealth concentration among Americans,

Read More »The need for a new economic paradigm

April 9, 2024From Giandomenico Scarpelli and current issue of RWER

As documented in the previous paragraph, in recent years it finally seems that most orthodox economists have become more aware of the catastrophic outcomes of climatic disturbances; but at this point the traditional policy they recommend could be insufficient to meet the goals set at international level. In fact, that policy consists mainly of pollution permits and carbon taxes, but if the permits are offered with great generosity and if carbon taxes are low, these policies are ineffective. In order to counter climate change effectively economists should abandon the “… irrational commitment to exponential growth forever on a finite planet subject to the laws of thermodynamics”. This commitment is based on the assumption that GDP

Weekend read – Enlightenment epistemology and the climate crisis

April 5, 2024From Asad Zaman

Introduction

At first glance, it appears that industrialization, with its rampant overproduction and overconsumption, stands as the primary antagonist in our climate crisis narrative. However, this surface-level perception overlooks a more profound shift that lies beneath: an epistemological revolution birthed in the European Enlightenment. This era marked a pivotal transition in our relationship with the planet, from Mother Earth to a dead machine. Turbayne (1962) explores the significance in the change of metaphor in depth. This essay seeks to unravel this transformation in thought and its subsequent paving of the road to our current environmental challenges. Our solution lies not in mere technological or policy changes but in a fundamental revolution in thought—a

new issue of Real-World Economics Review

March 27, 2024Please click here to support this open-access journal and the WEA

real-world economic review

issue no. 106

download whole issue

How entropy drives us towards degrowthCrelis Rammelt2

“It is much too soon to act “ – Economists and the climate changeGiandomenico Scarpelli8

Addressing the climate and inequality crises:An emergency market plan simulationJorge Buzaglo and Leo Buzaglo Olofsgård21

Stocking up on wealth … concentration

Blair Fix

40

Back to the past: income distribution in AmericaAhmad Seyf57

Blinded by science: The empirical case for quantum models in financeDavid Orrell68

Critique of Ayn Rand’s Atlas Shrugged political economy and its place in neoliberalism

Rafael Galvão de Almeida and Leonardo Gomes de Deus

80

Twenty-first century money: Huber and the case for CBDC

Jamie

Long Read – Is Bitcoin more energy intensive than mainstream finance?

March 23, 2024From Blair Fix

When it comes to Bitcoin, there’s one thing that almost everyone agrees on: the network sucks up a tremendous amount of energy. But from there, disagreement is the rule.

For critics, Bitcoin’s thirst for energy is self-evidently bad — the equivalent of pouring gasoline in a hole and setting it on fire. But for Bitcoin advocates, the network’s energy gluttony is the necessary price of having a secure digital currency. When judging Bitcoin’s energy demands, the advocates continue, keep in mind that mainstream finance is itself no model of efficiency.

Here, I think the advocates have a point.

If you want to argue that Bitcoin is an energy hog, you’ve got to do more than just point at its energy budget and say ‘bad’. You’ve got to show that this budget is worse than

Why and how economics must change

March 8, 2024From Jayati Ghosh

Economics needs greater humility, a better sense of history, and more diversity

The need for drastic change in the economics discipline has never been so urgent. Humanity faces existential crises, with planetary health and environmental challenges becoming major concerns. The global economy was already limping and fragile before the pandemic; the subsequent recovery has exposed deep and worsening inequalities not just in incomes and assets but in access to basic human needs. The resulting sociopolitical tensions and geopolitical conflicts are creating societies that may soon be dysfunctional to the point of being unlivable. All this requires transformative economic strategies. Yet the discipline’s mainstream persists in doing business as usual, as if tinkering at the

“The Political Economy of COVID-19”

March 6, 2024New book from WEA Books

At the beginning of 2020, the outbreak of Covid-19 and the lockdown practices imposed worldwide generated a global economic crisis that challenges the traditional explanations of economic downturns . Like the economic crisis of 2008, the Covid-19 pandemic crisis was systemic and global, and this collection of essays examines it in a broad geographical and historical context.

Kindle $6.00 Paperback $14.99Amazon US UK FR DE IN AU CA

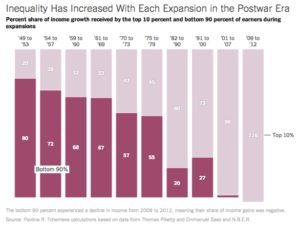

Read More »Income inequality in the USA increased with each expansion

March 3, 2024Pavlina R.Tchemevra is the source of the data for this chart which appeared in September 2014 in the New York Times in an article by Neil Irwin “The Benefits of Economic Expansions Are Increasingly Going to the Richest Americans”. Can anyone source or provide an updated version of this chart?

Read More »Complexity and Econ 100

February 29, 2024From Maria Alejandra Madi and RWER issue 106

Complexity is characteristic of a system that preserves the differentiation among its constituent elements while also preserving their identity. Complexity also implies dynamic systems, that is to say, open totalities of interrelated parts constantly changing in spacetime. The complexity of a system is related to the coexistence of intertwined parts in spacetime and complexity is intrinsic to real-world natural, economic and social processes (Almeida Filho, 1998). If we are to address contemporary problems of the kind referred to in the introduction both the natural world and human society need to be understood as complex systems, where the latter is nested in the former and interdependencies of different kinds arise.

An economy, similar to