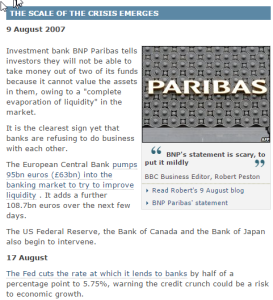

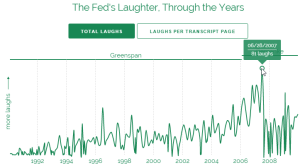

Like many commentators, I regard August 9 2007 as the start of the “Global Financial Crisis“. On that day, BNP Paribas declared that several of its funds were being closed because liquidity in those markets had completely evaporated: So I was particularly amused–in a sick sort of way–to see this brilliant info-graphic on The Fed on Twitter today: it plots the amount of laughter in FOMC meetings between 2000 and 2012. “Peak Laughter” occurred literally days before the crisis began: Laughter, it is often said, is the best medicine. But that’s only when you know what ails you. If you are guided by ignorance, as the Fed was (and still is) by mainstream equilibrium-obsessed, non-monetary economics, laughter is a sign of delusion. The laughs plummeted in the next few days–from eighty on June 28 to forty on August 7, and then just one on August 10, the day after BNP made its statement–as reality punched the FOMC in the guts.

Topics:

Steve Keen considers the following as important: Debtwatch

This could be interesting, too:

Steve Keen writes Zimpler Casino Utan Svensk Licens ? Utländska Casino Mediterranean Sea Zimpler

Steve Keen writes Login Sowie Spiele Auf Der Offiziellen Seite On The Internet”

Steve Keen writes Login Bei Vulcanvegas De Ebenso Registrierung, Erfahrungen 2025

Steve Keen writes What To Be Able To Wear To The Casino? The Complete Dress Guide

Like many commentators, I regard August 9 2007 as the start of the “Global Financial Crisis“. On that day, BNP Paribas declared that several of its funds were being closed because liquidity in those markets had completely evaporated:

So I was particularly amused–in a sick sort of way–to see this brilliant info-graphic on The Fed on Twitter today: it plots the amount of laughter in FOMC meetings between 2000 and 2012. “Peak Laughter” occurred literally days before the crisis began:

Laughter, it is often said, is the best medicine. But that’s only when you know what ails you. If you are guided by ignorance, as the Fed was (and still is) by mainstream equilibrium-obsessed, non-monetary economics, laughter is a sign of delusion.

The laughs plummeted in the next few days–from eighty on June 28 to forty on August 7, and then just one on August 10, the day after BNP made its statement–as reality punched the FOMC in the guts.