PERG economists are developing a macroeconometric model to track the evolution of the US economy over the medium term, which is 3-5 years: KFBM Macroeconomic Outlook Issue 1 February 2016 The model belongs to the family of “financial balances models”, an approach pioneered by Wynne Godley and collaborators at Cambridge University (UK) and then successfully developed by the macroeconomics team of the Levy Institute – led by Godley himself. At its heart, the KFBM (Kingston Financial Balances Model) is characterised by a set of thorough accounting matrices that gather the major stocks and flows of the US economy as well as their links across institutional sectors. This results in three key strengths of the KFBM: The model and its forecasts are always consistent with the identity that the surplus of one sector is the deficit of another sector. Thus potentially overoptimistic assumptions about structural adjustments in the private sector, implicit in other models are ruled out. The focus on financial balances allows to spot structural fragilities early on. A sectoral deficit means accumulation of net liabilities, which proves to be unsustainable if the process persists long enough. Being able to track the financial balances of the core sectors of the economy enables us to easily assess the implications of public sector spending plans and compare it with alternative scenarios.

Topics:

Steve Keen considers the following as important: Debtwatch

This could be interesting, too:

Steve Keen writes Zimpler Casino Utan Svensk Licens ? Utländska Casino Mediterranean Sea Zimpler

Steve Keen writes Login Sowie Spiele Auf Der Offiziellen Seite On The Internet”

Steve Keen writes Login Bei Vulcanvegas De Ebenso Registrierung, Erfahrungen 2025

Steve Keen writes What To Be Able To Wear To The Casino? The Complete Dress Guide

PERG economists are developing a macroeconometric model to track the evolution of the US economy over the medium term, which is 3-5 years:

The model belongs to the family of “financial balances models”, an approach pioneered by Wynne Godley and collaborators at Cambridge University (UK) and then successfully developed by the macroeconomics team of the Levy Institute – led by Godley himself.

At its heart, the KFBM (Kingston Financial Balances Model) is characterised by a set of thorough accounting matrices that gather the major stocks and flows of the US economy as well as their links across institutional sectors. This results in three key strengths of the KFBM:

- The model and its forecasts are always consistent with the identity that the surplus of one sector is the deficit of another sector. Thus potentially overoptimistic assumptions about structural adjustments in the private sector, implicit in other models are ruled out.

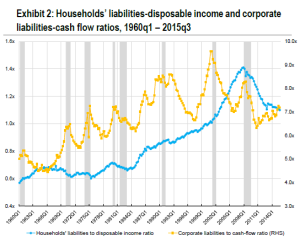

- The focus on financial balances allows to spot structural fragilities early on. A sectoral deficit means accumulation of net liabilities, which proves to be unsustainable if the process persists long enough.

- Being able to track the financial balances of the core sectors of the economy enables us to easily assess the implications of public sector spending plans and compare it with alternative scenarios.

The aim of the model is not to provide short-term economic growth forecasts. Instead the model allows to assess the implications of current economic trends and shed some light on their sustainability. Results are published in economic reports aimed at the general public, at financial practitioners, at investors in general and at policy-makers. Reports are published twice a year.

The model is being developed by the economists Javier López Bernardo and Rafael Wildauer.